|

|

|

|

|||||

|

|

Investors may be wondering if the strong momentum in General Motors GM and Ford F stock will continue this year after impressively outperforming the broader market and most of their auto peers in 2025, including Tesla TSLA.

Defying fears of slower EV growth and higher costs associated with President Trump’s Liberation tariffs, these legacy automakers have been able to post better-than-expected financial results.

GM has also excited investors with its strong cash generation and stock repurchase program, while optimism has grown for Ford’s operational execution as well amid the company’s restructuring and cost-cutting initiatives.

GM stock has spiked 65% in the last year to new all-time highs of over $80 a share, with Ford shares up more than 40% and near a 52-week peak of $14.

It’s noteworthy that EV sales in the U.S. declined broadly during Q4 due to the expiration of the $7,500 federal tax credit for new EV purchases.

Still, GM sold a record 169,887 EVs last year, a 48% increase from 2024. This was despite Q4 2025 EV sales dropping to 25,219 compared to 43,982 in Q4 2024. GM comfortably finished 2025 as the second-best-selling EV maker in the U.S., behind Tesla, led by its Chevy Equinox EV, which is the best-selling non-Tesla EV. Notably, GM’s total vehicle sales were up 5.5% in 2025 to 2.8 million.

As for Ford, it sits in the thrid spot but sold half as many EVs as GM in the U.S. last year, at 84,113. This was a 14% drop from the 98,000 EVs it sold in 2024. Ford’s Q4 EV sales dropped more than 50% to 14,500, but total vehicle sales still increased 6% in 2025 to 2.2 million, its best year since 2019.

In terms of EV sales, the gap comes as Ford only offers three EV models in the U.S. right now: the F-150 Lightning, Mustang Mach-E, and E-Transit. GM, on the other hand, has an EV available for a variety of models across its Chevy, GMC, and Cadillac brands.

Based on Zacks' estimates, GM is thought to have ended fiscal 2025 with annual earnings dipping 2% to $10.33 per share versus record EPS of $10.60 in 2024. That said, FY26 EPS is projected to spike 14% to new peaks of $11.81.

Notably, GM’s FY25 and FY26 EPS estimates have risen 1% and 6% in the last 60 days, respectively, as shown below. GM's annual sales are thought to have dipped 1% for FY25 and are forecasted to slightly contract in FY26 as well, but remain above $184 billion. GM will be reporting Q4 2025 results on Tuesday, January 27th.

Pivoting to Ford, FY25 EPS is now expected at $1.08, a steep drop from $1.84 in 2024, mostly attributed to a $2.5 billion impact from tariffs. Optimistically, Ford's FY26 EPS is projected to rebound to $1.42. FY25 EPS estimates are slightly down in the last two months, although FY26 EPS estimates are modestly higher over the last 60 days, but have dipped from projections of $1.44 a month ago.

Ford’s annual sales are expected to have fallen less than half a percentage point in FY25 and are forecasted to dip another 2% in FY26 to $168.27 billion. Ford’s Q4 2025 report is scheduled for Wednesday, February 4th.

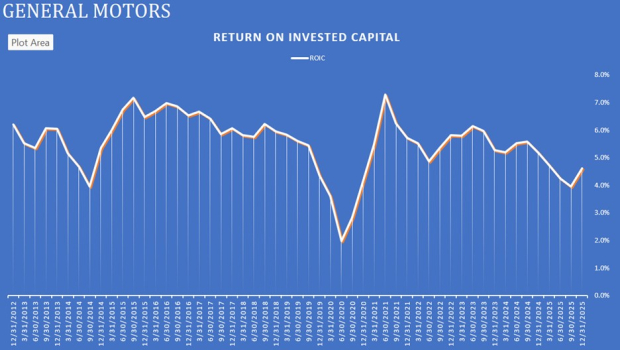

Something to keep an eye on is that automakers have very low return on invested capital (ROIC) as they have capital-intensive business models that require billions in fixed assets for factories, equipment, robotics, and supply chain configuration. Furthermore, GM and Ford are in a long, expensive transition regarding EV investments, while operating in a structurally low-margin environment where the cost of capital is higher than the ROIC.

To that point, EV production is raising their invested capital long before they generate meaningful profits, pulling down ROIC. Although it’s harder and may take longer for automakers to turn capital investments into profits amid their EV expansion, GM does have the edge with an ROIC of 4.6% compared to Ford’s 2.7% with their Zacks Automotive-Domestic Industry average at around 2%.

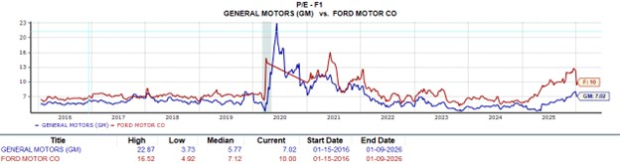

Even with their ROIC being well below the admirable level of 20% or higher, GM and Ford still make the argument for long-term shareholder value with both stocks trading under 11X forward earnings and offering dividends, unlike many of their auto peers.

GM does have the edge in terms of valuation as well though, considering the trend of positive EPS revisions is magnifying its cheaper P/E multiple of 7X, with Ford at 10X and still noticeably beneath the industry average of 14X. Like most of their Zacks Automotive-Domestic Industry peers, GM and Ford stock trade at less than 1X forward sales, with the often preferred price-to-sales ratio being less than 2X.

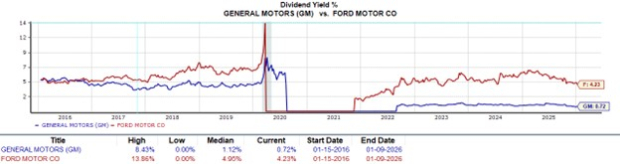

Regarding dividends, Ford’s 4.23% annual dividend yield impressively tops GM’s 0.72%. However, since reinstating their payouts following the pandemic, it's very intriguing that GM’s annual dividend has increased by 20.46% over the last five years compared to Ford’s 8.71%.

GM stock is starting to check more of the boxes that investors look for, including a higher ROIC than Ford and many other automakers. While the inherently low ROIC will be something to keep an eye on for automakers in general, General Motors' earnings momentum lands its stock a Zacks Rank #1 (Strong Buy), with Ford shares landing a Zacks Rank #3 (Hold) at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite