|

|

|

|

|||||

|

|

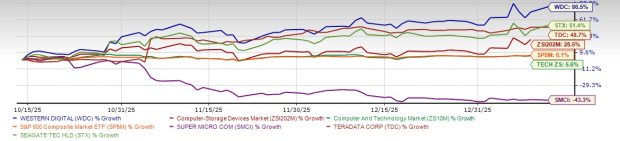

Western Digital Corporation WDC, a prominent name in the data storage industry, has seen its share price jump a whopping 86.5% over the past three months, far outpacing the 28.5% run of the Zacks Computer-Storage Devices industry. The stock has also outperformed the Zacks Computer & Technology sector and the S&P 500’s growth of 5.6% and 6.1%, respectively.

WDC has outgrown its peers from the storage industry, like Super Micro Computer SMCI and Teradata TDC, with TDC climbing 48.7% and SMCI falling 43.3% during the same interval. The company has also outpaced its long-time rival in the HDD market, Seagate Technology Holdings plc STX, which surged 51.4%.

Seagate is a leading data storage company, with hard disk drives as its core product. Super Micro Computer designs and manufactures server and storage systems optimized for data centers, cloud, AI and edge computing. Teradata provides its Vantage hybrid cloud analytics and AI platform, helping enterprises analyze data at scale and drive faster innovation.

WDC has a 52-week high of $221.23. The major driver behind WDC’s rally is explosive demand for data storage driven by AI infrastructure. As organizations build and train larger models and retain massive datasets for analytics, the need for high-capacity storage has surged.

Following a strong rally, investors may wonder whether WDC still has upside or if expectations have outpaced fundamentals. Let’s break down what’s driving the move, the bull and bear cases, and a practical approach to managing risk and position size.

AI workloads generate enormous amounts of data that must be stored cost-effectively over long periods. HDDs, especially nearline, high-capacity drives, remain the most cost-efficient solution. In this environment, Western Digital remains a key part of the world’s data infrastructure, offering exceptional value for mass storage needs. As it provides cutting-edge HDD technology to its customers, it remains committed to innovation, focusing on delivering drives with the highest capacity, better performance, improved energy efficiency and the lowest total cost of ownership.

Rapid AI adoption is boosting demand for high-capacity storage, driving record shipments, expanding margins and long-term customer commitments. Backed by continued ePMR and HAMR innovation and a strong order pipeline through 2027, the company expects sustained revenue growth and improved efficiency. As agentic AI and multimodal LLMs scale, AI use cases are multiplying, further lifting demand for data infrastructure. WDC is expanding ePMR technology, advancing head wafer and media innovations to increase areal density, and boosting manufacturing throughput through automation, AI tools and enhanced testing processes to meet the rapidly growing exabyte demand.

For the second quarter of fiscal 2026, management anticipates ongoing revenue growth, buoyed by strong data center demand and better profitability driven by increased adoption of high-capacity drives.

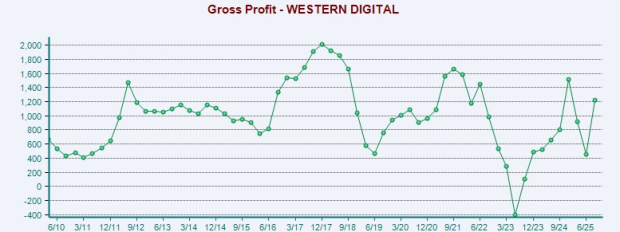

Buoyed by a steady shift to higher-capacity drives and disciplined cost control across manufacturing and the supply chain, WDC continues to expand margins. For the fiscal second quarter, the company expects a non-GAAP gross margin of 44–45%, with operating expenses declining sequentially to $365–$375 million.

Western Digital is also balancing strategic investment with shareholder returns. Reflecting strong momentum, the board approved a 25% dividend increase, supported by rising margins and solid free cash flow. In the fiscal first quarter, the company generated $672 million in operating cash flow, repurchased 6.4 million shares for $553 million and paid $39 million in dividends. Since launching its capital return program in fourth-quarter fiscal 2025, management has returned $785 million to shareholders, underscoring disciplined capital allocation and long-term value creation.

However, macroeconomic volatility, including tariffs and global trade tensions, remains a near-term risk for Western Digital and could drive demand swings across enterprise, distribution and retail markets. At the same time, the AI-led surge in storage demand is adding pressure, as higher-capacity drives increase manufacturing complexity and extend production cycles. A high debt load further limits financial flexibility, potentially constraining accretive acquisitions and other growth initiatives. If competitors like Seagate’s HAMR drives scale faster or prove more reliable, or if flash/NAND becomes cheaper at scale, WDC’s HDD dominance could be pressured.

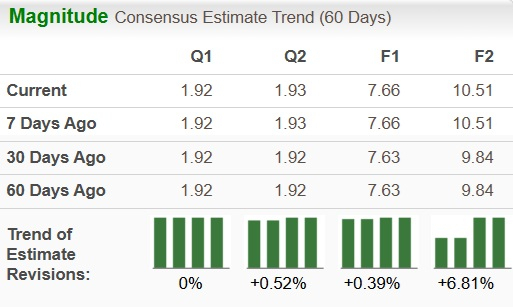

WDC’s estimates revisions are on an upward trajectory currently. The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been marginally revised north 0.4% to $7.66 over the past 60 days, while the same for fiscal 2027 has gone up 6.8% to $10.51.

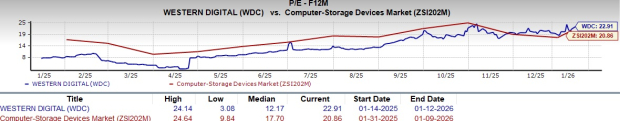

Going by the price/earnings ratio, the company’s shares currently trade at 22.91 forward earnings compared with 20.86 for the industry.

In simple terms, AI is creating data faster than ever, and someone has to store it. WDC is a key beneficiary of this. Next-generation technologies like HAMR will influence WDC’s competitive positions by 2026–27. Successful rollouts could be catalysts while failures could be headwinds. As agentic AI expands across industries, the storage requirement grows exponentially, further underpinning long-term demand. Simultaneously, Western Digital has been executing aggressive share buybacks, signaling confidence in steady future cash flows.

Investors should stay informed and base decisions on both long-term tech trends and near-term market signals. Sporting a Zacks Rank #1 (Strong Buy) at present, WDC seems to be a good bet now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite