|

|

|

|

|||||

|

|

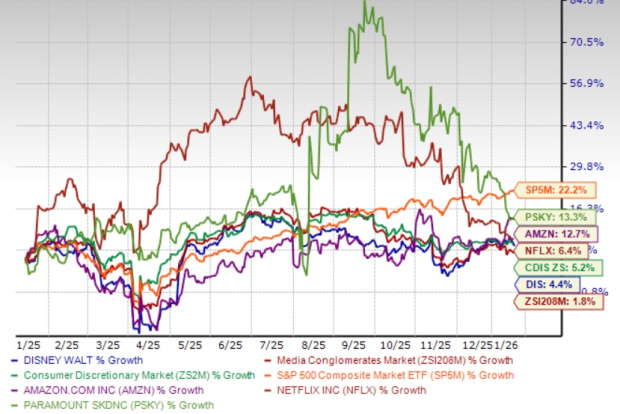

Disney DIS has positioned advertising technology as a cornerstone of its streaming strategy, unveiling a suite of AI-powered tools and measurement capabilities designed to enhance advertiser outcomes across its entertainment portfolio. While the company's shares have gained 4.4% over the past year, this performance trails both the broader S&P 500 and the Zacks Consumer Discretionary sector, prompting investors to evaluate whether recent advertising innovations can catalyze improved returns or whether a more cautious stance remains prudent entering 2026.

At CES 2026, Disney revealed significant enhancements to its advertising infrastructure through its Global Tech & Data Showcase in Las Vegas. The company introduced an AI-powered video generation tool that enables brands to create connected-TV-ready commercials using existing assets and guidelines, with Known and Instinct Pet Food among the first partners testing the technology. This tool considers audience context and placement to optimize creative delivery, addressing advertiser demands for more efficient content production.

Disney expanded its vertical video strategy to Disney+ throughout 2026 in the United States, following the successful launch of "Verts" on the ESPN app in August 2025. The vertical video format aims to boost daily engagement by delivering personalized, mobile-native content across news and entertainment categories. The company also enhanced its Disney Compass platform with a Brand Portal feature that provides unified campaign performance views across all Disney platforms, incorporating category benchmarks and AI-powered summaries. Additionally, Disney launched the Brand Impact Metric, which synthesizes attention, brand health, search, and attribution data to provide advertisers with consolidated measurement insights. These technological advancements reflect Disney's strategy to leverage automation and data-driven solutions, with management targeting 75% automation of its advertising platforms by 2027.

Disney's Direct-to-Consumer advertising revenues demonstrated resilience in the fourth quarter of fiscal 2025, with the segment reporting revenue growth of 8% despite a 2 percentage point adverse impact from the Star India transaction. Direct-to-Consumer operating income increased $99 million to $352 million, driven substantially by advertising tier adoption and price optimization across Disney+ and Hulu's advertising-supported offerings.

Conversely, Disney's Linear Networks segment faced advertising headwinds, with domestic operating income declining due to lower advertising revenues driven by viewership decreases and a $40 million impact from reduced political advertising compared to the prior-year quarter.

Management projects continued advertising revenue momentum in fiscal 2026, though the company anticipates a $140 million year-over-year decline in political advertising revenues in the first quarter of fiscal 2026. The planned $24 billion content investment across entertainment and sports for fiscal 2026 aims to strengthen programming that attracts premium advertising dollars, particularly live sports and tentpole entertainment events, including Bowl games, college football championships, the Grammys, and the Oscars scheduled for early calendar 2026. Disney's advertising strategy emphasizes expanding its automated advertising platforms while leveraging first-party data through the Audience Graph and Disney Select targeting solutions, which are scaling globally across Latin America and EMEA markets to provide advertisers with proprietary audience segments for more precise campaign delivery.

The Zacks Consensus Estimate for fiscal 2026 earnings is pegged at $6.60 per share, indicating 11.3% year-over-year growth.

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Shares of Disney have gained 4.3% over the past year, underperforming both the Zacks Consumer Discretionary sector and its peers. The company faces intensifying competition across the streaming landscape from multiple well-capitalized rivals, including Netflix NFLX, Amazon AMZN-owned Prime Video services and Paramount Skydance PSKY-owned Paramount+.

Netflix maintains global leadership with more than 300 million subscribers and reported third-quarter 2025 revenues of $11.51 billion, representing 17% year-over-year growth. Netflix continues expanding its advertising tier while maintaining strong profitability of $2.55 billion in the third quarter. Amazon Prime Video reaches more than 315 million monthly viewers globally through its advertising-supported tier, with Amazon leveraging Prime Video as part of its broader Prime membership ecosystem. Amazon Prime Video's Thursday Night Football viewership has grown 13% year over year, demonstrating strong engagement with live sports content.

Paramount+ reached 79 million subscribers as of early 2025, adding 1.5 million members in the first quarter. Paramount+ posted a combined streaming profit of $340 million following the Skydance merger, though management expects fourth-quarter losses due to content costs. Paramount+ plans price increases in January 2026 and continues investing several hundred million dollars in film and series content. The competitive intensity among Netflix, Amazon, and Paramount+ necessitates Disney's continued investment in both content quality and advertising technology to maintain differentiation and subscriber growth momentum.

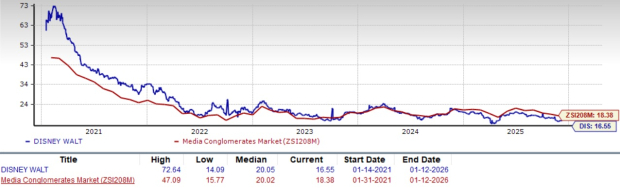

Despite this trailing performance, Disney presents a significantly more attractive valuation profile, trading at a forward price-to-earnings ratio of 16.55 times, representing a substantial discount compared to the Zacks Media Conglomerates industry average.

Disney's advertising technology investments and improving streaming profitability represent meaningful strategic progress, yet near-term uncertainties warrant measured expectations. The combination of double-digit earnings growth guidance, enhanced shareholder returns through increased dividends and buybacks, and expanding automation capabilities across advertising platforms establishes a foundation for potential value creation. However, the company's underperformance relative to broader market indices, alongside anticipated first-quarter fiscal 2026 headwinds from theatrical comparisons and reduced political advertising, suggests prudence. Investors holding Disney shares may consider maintaining positions given the attractive valuation and improving Direct-to-Consumer profitability trajectory. Those seeking new entry points might await greater clarity on fiscal 2026 execution and competitive positioning dynamics before initiating or expanding positions. DIS carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 29 min | |

| 59 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Paramount Stock Up 20% On Warner Deal; Democrats Warn Of 'Vigorous' Investigation

NFLX +13.77%

Investor's Business Daily

|

| 2 hours | |

| 2 hours |

Paramount Stock Up 20% On Warner Deal; Democrats Warn Of 'Vigorous' Investigation

PSKY +20.84%

Investor's Business Daily

|

| 2 hours |

Paramount must convince regulators its deal with Warner will not hurt customers

PSKY +20.84% NFLX +13.77%

Associated Press Finance

|

| 3 hours | |

| 3 hours | |

| 3 hours |

Stock Market Today: Dow Sinks On Hot Inflation; Nvidia Plunges On OpenAI Deal (Live Coverage)

NFLX +13.77%

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite