|

|

|

|

|||||

|

|

Celestica, Inc. CLS and Corning Incorporated GLW are major players in the tech hardware ecosystem worldwide. With a comprehensive portfolio consisting of cover materials, advanced glass technologies and optical connectivity products, Corning boasts a strong presence in the consumer electronics, AI data center and telecom markets. With its leading-edge electronics manufacturing services and supply chain solutions, Celestica serves original equipment manufacturers across multiple sectors. Its extensive depth and breadth of offerings support a wide variety of customer requirements, from low-volume, high-complexity custom products to high-volume commodity products.

Per a report from Grand View Research, the global AI infrastructure market was valued at $35.42 billion in 2023. It is projected to reach $223.45 billion in 2030 with a compound annual growth rate of 30.4%. The rapid expansion of AI workloads is driving investment in the backend infrastructure needed to support them. This presents a solid growth opportunity for Corning and Celestica.

Celestica is benefiting from healthy traction in the Connectivity & Cloud Solutions (CCS) segment. The 43% uptick in CCS revenues year over year was primarily driven by strength in the hardware platform solutions portfolio consisting of CLS’ leading-edge networking products, including 400G switches and 800G switches. AI investments are driving demand for Celestica’s enterprise-level data communications and information processing infrastructure products, such as routers, switches, data center interconnects, edge solutions, and servers and storage-related products.

The company is expanding its partnership with major industry leaders to augment its portfolio offerings. In 2025, the company announced the launch of SC6110, a 2U dual-node, all-flash 32-drive bay storage controller. Powered by AMD EPYC Embedded 9004 Series processors, the leading-edge solution is ideal to match the requirements of AI infrastructure, high-performance computing, database management, online transaction processing and more. It has collaborated with Broadcom for developing advanced networking switches for data centers.

The data centers are transitioning to 800G switches from 400G to support high bandwidth intensive applications. The surging AI workloads are expected to eventually push customers to opt for 1.6TbE data center switches in coming years. In the recent quarter, the company has introduced two new 1.6TbE data center switches, the DS6000 and DS6001, to support high-bandwidth, AI/ML data center applications. Such innovative product launches augur well for long-term growth.

However, despite its presence in multiple verticals, the company’s growth in the near term is majorly dependent upon AI infrastructure investments. Fluctuation in customer spending behavior induced by macro headwinds and geopolitical issues can lead to lower factory utilization, pricing pressure and increased uncertainty regarding Celestica’s top-line growth. Moreover, it is exposed to significant customer concentration risk. In the third quarter, the company derived 59% of its total revenues from three customers. Given the competitive nature of the industry, any changes in demand or spending by one major customer can significantly impact its top-line growth.

Corning is benefiting from solid traction in the Optical Communications and Specialty Materials segment. The growing usage of mobile and IoT devices, integration of sophisticated AI models and digital transformation are generating a large amount of information. Hyperscalers such as Amazon, Microsoft and Google are rapidly expanding their AI data center footprint to support this surging demand. AI data centers require robust network architecture to facilitate surging AI workloads. Corning offers several products focused on the data center, with a portfolio consisting of optical fiber, hardware, cables and connectors, enabling it to create optical solutions to meet evolving customer needs. This augurs well for its long-term growth.

Moreover, its strong focus on innovation is a positive. Its advanced Gen AI fiber and cable systems that interconnect AI data centers allow for fitting two to four times the fiber in the existing conduit. Such a compact, innovative design enables data centers to increase connectivity capacity without having to make significant changes in their existing infrastructure.

However, the companies’ near-term and long-term growth outlooks are not only reliant on AI data centers. Consumer electronics is another major growth driver. Leading manufacturers such as Apple, Samsung, Motorola, HP and Dell are incorporating Corning’s cover materials across their flagship devices. The company is also expanding into the automotive market. It has collaborated with AUO Corporation to facilitate the development of large-format curved automotive display modules utilizing Corning ColdForm technology. However, weakness in the heavy-duty market in North America remains a concern for this segment.

Some of its businesses stand to benefit from government regulations. For example, the fiber optic business is a direct beneficiary of the government-mandated bridging of the digital divide across the United States. Similarly, proposed regulations by the U.S. EPA will mandate the use of gasoline particulate filters (GPF). This should boost demand for Corning’s industry-leading GPF products.

The company faces competition from Amphenol Corporation APH in the communication components market. The growing use of AI and machine learning applications is driving demand for Amphenol’s high-speed power and fiber optic interconnect solutions. Amphenol recently acquired CommScope to further augment its portfolio offerings. However, Corning’s innovative product launches and diverse product suite expected to give it a competitive edge.

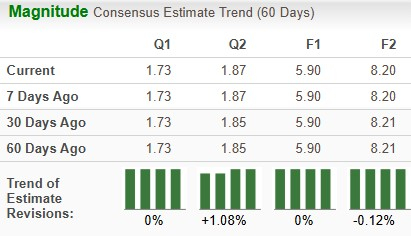

The Zacks Consensus Estimate for Celestica’s 2025 sales and EPS implies year-over-year growth of 26.31% and 52.06%, respectively. The EPS estimates have remained unchanged for 2025 and declined for 2026 over the past 60 days.

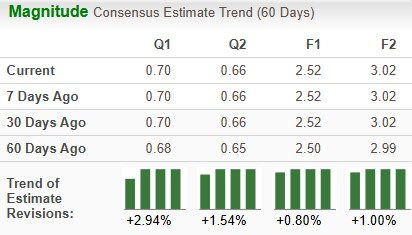

The Zacks Consensus Estimate for Corning’s 2025 sales implies year-over-year growth of 12.99%, while that of EPS is projected at $2.52 per share compared to $1.96 per share a year ago. The EPS estimates for 2025 have increased over the past 60 days.

Over the past year, Celestica has gained 205.3% compared with Corning’s growth of 85.3%.

Corning looks more attractive than Celestica from a valuation standpoint. Going by the price/earnings ratio, Corning’s shares currently trade at 28.96 forward earnings, lower than 37.79 for Celestica.

Celestica carries a Zacks Rank #3 (Hold), while Corning has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both Corning and Celestica are expected to witness solid margin expansion backed by healthy traction in the AI infrastructure domain. Both the company operates at a different spectrum of this domain. Celestica benefits from rising demand for AI servers, rack integration solutions, energy and thermal management solutions. Corning’s AI infrastructure portfolio supports the consistent connectivity requirements for this complex data center infrastructure.

Celestica’s growing prowess in 400G and 800G switches and its collaboration with industry leaders are positive. However, over-reliance on hyperscalers’ AI-related spending and customer concentration risks are major concerns for the company.

Corning’s broader approach reduces its exposure to fluctuations in any single industry. Consumer electronics, the solar market and AI data centers are major drivers for the company. Prospects in the automotive industry are also improving. Strong upward estimate revision shows growing investors’ confidence in Corning’s growth potential. Hence, with a Zacks Rank 2 and attractive valuation, Corning appears to be a better investment option right now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite