|

|

|

|

|||||

|

|

Shares of Sterling Infrastructure, Inc. STRL are currently trading above their 50-day simple moving average (SMA), a key technical indicator that suggests a short-term bullish trend. The 50-day SMA helps smooth out price volatility, making it easier for investors to identify the underlying direction of a stock’s movement. When a stock trades above this level, it’s often seen as a signal of upward momentum and potential continued strength in the near term.

Sterling Price Movement vs. 50-Day Moving Average

This mid-cap company has solid prospects given its E-Infrastructure segment’s resiliency, solid backlog level, shift toward high-margin projects and a focus on operational efficiency. Yet, given ongoing market volatility, driven by trade policy uncertainties, inflationary pressures, and shifting consumer sentiment, could STRL have even more upside ahead?

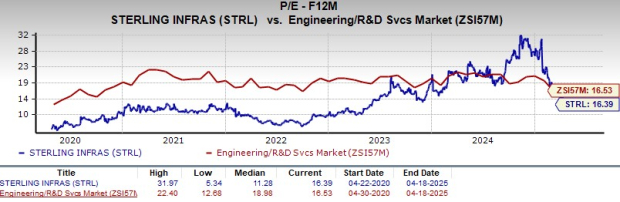

Year to date, Sterling stock has plunged 16.7% but has outpaced the Zacks Engineering - R and D Services industry’s 18.3% decline. Notably, Sterling has rebounded sharply following its fourth-quarter 2024 earnings results, gaining 14.9% since its earnings release on Feb. 26 despite a challenging macroeconomic backdrop. Additionally, the stock outperformed the Zacks Construction sector (down 10.2%) and the Zacks S&P 500 Composite (down 11.4%) during the same period. The STRL stock has a Momentum Score of B.

Precisely, STRL stock also recovered upon the temporary pausing of the reciprocal tariff announced on April 8, 2025. This was notably supported by the temporary tariff exemption on smartphones, computers, and other electronics announced on April 12, 2025, which is expected to have minimal impact on data center capital expenditures.

STRL Vs Industry, Sector & S&P Post Q4 Earnings

E-Infrastructure and Data Center Expansion: Sterling’s E-Infrastructure segment—its largest and most profitable business line, contributing 44% of total revenues in 2024—continues to be the company's standout performer. The segment experienced substantial growth, particularly through large-scale, mission-critical projects. Data centers emerged as the primary growth catalyst, driving a 27% year-over-year increase in E-Infrastructure backlog in 2024. Sterling’s ability to deliver projects ahead of schedule and secure multi-phase contracts has sustained robust demand across this segment.

The rapid advancement of artificial intelligence technologies is fueling the need for high-performance computing infrastructure, leading to increased investments in data centers. The shift toward cloud-based services continues to drive demand for data storage and processing capabilities. According to Grand View Research, the U.S. data center market is expected to grow from approximately $89.9 billion in 2024 to $164.7 billion by 2030, representing a compound annual growth rate (CAGR) of 10.6% during the 2025–2030 period. This development is critical for Sterling’s prospects, given that Amazon AMZN and Meta META are two key customers across STRL's growing exposure to data centers and e-commerce distribution centers.

Emphasis on High-Margin Services: Sterling’s strategic pivot toward higher-margin service offerings has delivered strong results, especially within the transportation solutions segment. While revenues in this area remained flat in the fourth quarter due to a deliberate exit from low-margin contracts in Texas, operating margins improved significantly. Long-term, well-capitalized project wins have insulated the company from concerns over potential federal infrastructure spending reductions. In the fourth quarter, gross profit margins exceeded 21%, while full-year margins reached 20.1%, surpassing previously stated goals. Enhanced project selection and disciplined cost control have underpinned this margin expansion, supporting profitability despite modest revenue growth.

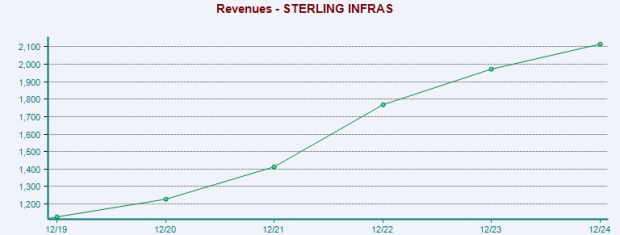

Backlog and Revenue Visibility: Sterling concluded 2024 with a backlog of $1.69 billion, supplemented by $138 million in pending awards. Importantly, this figure excludes nearly $750 million in future-phase projects, underscoring a strong pipeline and supporting long-term revenue growth. Overall, Sterling has posted consistent revenue growth in recent years, driven by strong demand across its key segments, as you can see below.

Sustained Transportation Infrastructure Investment: The transportation sector remained a significant growth driver in 2024, bolstered by the second full year of funding from the Infrastructure Investment and Jobs Act (IIJA). Sterling secured multiple high-value projects in key regions such as the Rocky Mountains and Arizona, resulting in a 24% increase in transportation revenues, which comprised 37% of total revenues.

While IIJA-related funding has begun to level off after its initial surge, Sterling has built a transportation backlog covering more than two years of work, ensuring future growth visibility. The company anticipates continued bidding activity and contract wins in 2025, with a focus on its core regional markets.

Despite broader concerns around potential federal budget adjustments, Sterling's awarded transportation projects remain unaffected. Most are already fully funded and moving forward, providing continued stability in public infrastructure spending and a steady stream of work for the business.

Given that Amazon, Meta, and Walmart WMT are among Sterling’s key clients, any reduction in their capital expenditure guidance could introduce significant volatility to Sterling’s E-Infrastructure Solutions segment, which encompasses data centers, large-scale distribution facilities, and warehouse construction.

Construction costs are anticipated to rise further due to newly imposed tariffs on key building materials such as steel, aluminum, electronics, and other construction inputs.

The company surpassed profit estimates in each of the trailing four quarters, with the average earnings surprise being 16.2%. It is also witnessing northbound estimate revisions for 2025 earnings per share (EPS). The estimated figure indicates 34.6% growth for 2024. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

From a valuation standpoint, the company is currently trading at a discount relative to its industry but at a premium to historical metrics, with its forward 12-month price-to-earnings (P/E) ratio sitting above its five-year average.

Sterling presents a compelling investment opportunity even in the face of broader macroeconomic headwinds. While the stock has faced year-to-date volatility, its resilience—evident in its rebound post fourth-quarter earnings and outperformance relative to the industry and broader indices—signals underlying strength. Technically, the stock trading above its 50-day SMA supports the view of continued bullish momentum.

Key growth drivers include its high-margin E-Infrastructure segment—buoyed by booming data center demand—and a robust backlog offering strong revenue visibility. A strategic focus on operational efficiency and disciplined project selection has driven margin expansion. While tariffs and client capex pose risks, STRL trades at a relative valuation discount with upward EPS revisions. With strong fundamentals and market tailwinds, STRL is well-positioned for upside.

Sterling currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

WMT

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite