|

|

|

|

|||||

|

|

Baxter International Inc. BAX recently announced the upcoming U.S. launch of its Dynamo Series smart stretcher, expanding its portfolio of connected care solutions for hospital settings. The new stretcher is designed to support care teams in high-pressure environments while improving patient safety, comfort, and overall workflow efficiency.

The launch highlights Baxter’s continued focus on practical innovation in acute care, particularly in areas like emergency departments and perioperative settings. For investors, the Dynamo Series underscores Baxter’s strategy to strengthen its Care & Connectivity segment through differentiated, technology-enabled products that address real clinical pain points.

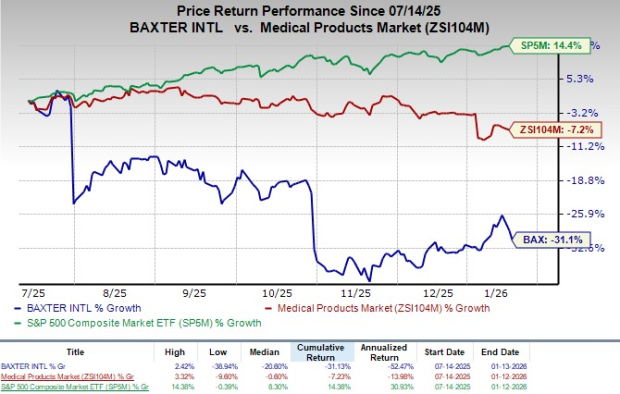

Following the announcement, the company's shares traded flat in yesterday’s after-market session. In the last six-month period, shares have lost 31.1% compared with the industry’s 7.2% decline. The S&P 500 has risen 14.4% over the same period.

Over the long run, the Dynamo Series could strengthen BAX’s growth by deepening its presence in high-use hospital settings and reinforcing its value proposition around connected, workflow-enhancing care solutions. By helping hospitals reduce patient transfers, improve safety and ease staff workload, the stretcher increases switching costs. It supports broader adoption of Baxter’s smart bed ecosystem, which can drive recurring demand and longer customer relationships.

BAX currently has a market capitalization of $10.36 billion.

The Dynamo Series is built to meaningfully improve the day-to-day experience of care teams by reducing unnecessary patient transfers, a common source of physical strain and workflow inefficiency in hospitals. With integrated stirrups and flexible positioning options, clinicians can perform a range of procedures directly in the stretcher, including obstetric and pelvic exams, limiting the need to move patients between equipment. A fully electric design with powered drive and adjustable height, head, and knee positions further simplifies patient handling, while optional wireless connectivity enables select clinical safety and patient data to flow directly into electronic medical records, supporting remote monitoring and more efficient care delivery.

Patient safety is another core focus of the Dynamo Series, particularly around fall prevention, a persistent and costly issue for hospitals. The stretcher incorporates advanced technologies such as Baxter’s SafeView+ system, which projects clear visual cues about safety status, along with a three-mode bed exit alarm that provides real-time alerts and auto-rearm functionality. Optional integration with Baxter’s Voalte Nurse Call and other hospital systems helps ensure faster staff response when risks arise.

Complementing these features, the Dynamo Series offers one of the widest care surfaces in the stretcher category, enhancing stability and comfort across patient sizes, while one-touch positioning, a true chair mode, and built-in USB charging add to patient comfort and independence.

Per a report by Global Market Insights, the global smart hospital beds market was valued at $523.7 million in 2024. The market is expected to reach from $544.8 million in 2025 to $1 billion in 2034, expanding at a CAGR of 7.3% during the forecast period.

Increasing demand for patient-centered care, integration of IoT and AI technologies and growing hospital automation drive smart hospital bed adoption.

In December 2025, BAX shared real-world data highlighting the benefits of integrating smart infusion pumps with hospital electronic medical records (EMRs). The data, developed in collaboration with the University of Texas Medical Branch, analysed more than one million IV infusions using Baxter’s Spectrum IQ large volume infusion pumps.

The findings showed that EMR integration helped reduce patient safety alerts, shortened infusion programming time and improved clinician productivity at the bedside.

Currently, BAX carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Boston Scientific BSX and STERIS STE. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for IDEXX’s 2025 earnings per share (EPS) have remained constant at $12.93 in the past 30 days. Shares of the company have risen 12.6% in the past year compared with the industry’s 11.1% growth. IDXX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.1%. In the last reported quarter, it delivered an earnings surprise of 8.3%.

Boston Scientific shares have gained 2.9% in the past year. Estimates for the company’s 2025 EPS have remained constant at $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

STERIS shares have risen 9.1% in the past year. Estimates for the company’s 2025 EPS have increased by 2 cents to $10.23 in the past 30 days. STE’s earnings topped estimates in three of the trailing four quarters and matched on one occasion, delivering an average surprise of 2.6%. In the last reported quarter, it posted an earnings surprise of 2.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite