|

|

|

|

|||||

|

|

TransMedics Group, Inc. TMDX is well-poised for growth in the coming quarters, courtesy of its strength in Organ Care System (“OCS”) technology. The optimism, led by solid third-quarter 2025 results, is expected to contribute further. However, concerns due to gross margin pressure persist.

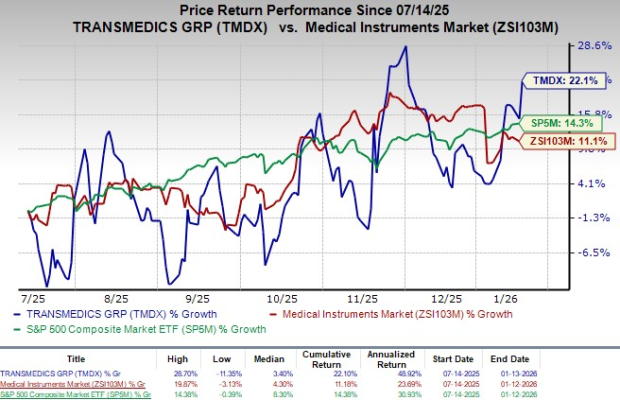

This Zacks Rank #3 (Hold) company has gained 22.1% in the last six-month period compared with 11.1% growth of the industry. The S&P 500 has witnessed 14.3% growth in the said time frame.

The renowned organ transplant therapy provider has a market capitalization of $4.6 billion. TransMedics’ earnings yield of 2.01% compares favorably with the industry’s 0.61%. The company’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 79.25%.

Robust Pipeline Supporting Growth: TransMedics’ third-quarter update underscored meaningful momentum across its clinical pipeline, with next-generation ENHANCE Heart and DENOVO Lung trials set to begin enrolling and generating initial revenues in fourth-quarter 2025 under conditional IDE approvals. Management expects full FDA clearance by early 2026, positioning these studies to accelerate OCS Heart and Lung adoption as they demonstrate the improved performance of the Gen 2 platform.

Alongside these programs, the company advanced its OCS Kidney initiative, with strong preclinical and product development progress and a formal system reveal slated for early 2026. The upcoming kidney trial is expected to be large in scale and revenue-generating, supporting TransMedics’ entry into the biggest organ transplant category beginning in 2027.

The company also highlighted progress on its Gen 3 OCS platform and continued rollout of the NOP Connect digital ecosystem. Gen 3 development is well underway, with additional technical details expected in the second half of 2026. Meanwhile, early feedback on NOP Connect points to efficiency gains that should become more visible as centers deepen integration through 2026. Together, these pipeline and platform initiatives reinforce TransMedics’ long-term innovation strategy aimed at scaling adoption, expanding its addressable market and strengthening operational leverage.

Strength in OCS Technology Driving Adoption: TransMedics’ OCS revolutionizes organ transplantation by replacing passive cold storage with a dynamic, physiologic approach that perfuses donor organs with warm, oxygenated, nutrient-rich blood. This innovation minimizes ischemic injury, allows real-time organ assessment and significantly increases the viability of organs, especially hearts and lungs, donated after circulatory death, that would otherwise go unused.

As the only FDA-approved, portable platform offering warm perfusion for heart, lung and liver transplants, the OCS standardizes care, reduces post-transplant complications and sets a new clinical benchmark in organ preservation. This positions TransMedics as a leader in the multi-billion-dollar transplant market with limited competition.

Solid Q3 Results: TransMedics exited third-quarter 2025 with better-than-expected results. The solid top and bottom-line performances and the uptick in Transplant Logistics services revenues were encouraging. Strength in both revenue sources was also impressive. The expansion of the operating margin bodes well.

The company is preparing large-scale geographic and operational expansion, first by launching its inaugural international NOP program in Italy during the first half of 2026, supported by up to four regional hubs and eventually building a European logistics network similar to the U.S. model. TMDX has raised its aviation capacity to 22 aircraft and plans to pilot “double-shifting” the fleet to improve asset utilization and margins. Management is also finalizing a new global headquarters and manufacturing campus in Somerville to consolidate operations and support future scaling.

Gross Margin Under Pressure: TransMedics’ third-quarter 2025 gross margin came in at roughly 59%, down about 260 basis points sequentially, reflecting typical seasonal transplant softness, lower system utilization and ongoing infrastructure investments that weighed on cost absorption despite healthy year-over-year improvement. Logistics continued to be a major revenue contributor but remained dilutive to blended margins, with volumes also declining sequentially in line with seasonal trends.

Management expects gross margins to hover around the 60% level over the next several years, though short-term fluctuations are likely as international expansion and upfront investments persist. While these pressures should ease as scale improves, the company does not foresee meaningful margin expansion in the near term, leaving the margin profile stable but constrained even alongside strong revenue growth and operating leverage.

TransMedics is witnessing a stable estimate revision trend for 2025. In the past 30 days, the Zacks Consensus Estimate for its earnings has remained stable at $2.61 per share.

The Zacks Consensus Estimate for the company’s fourth-quarter 2025 revenues is pegged at $155.9 million, indicating a 28.2% improvement from the year-ago quarter’s reported number.

Some better-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Boston Scientific BSX and STERIS STE. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for IDEXX’s 2025 earnings per share (EPS) have remained constant at $12.93 in the past 30 days. Shares of the company have risen 12.6% in the past year compared with the industry’s 11.1% growth. IDXX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.1%. In the last reported quarter, it delivered an earnings surprise of 8.3%.

Boston Scientific shares have gained 2.9% in the past year. Estimates for the company’s 2025 EPS have remained constant at $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

STERIS shares have risen 9.1% in the past year. Estimates for the company’s 2025 EPS have increased 2 cents to $10.23 in the past 30 days. STE’s earnings topped estimates in three of the trailing four quarters and matched on one occasion, delivering an average surprise of 2.6%. In the last reported quarter, it posted an earnings surprise of 2.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 8 hours | |

| 10 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite