|

|

|

|

|||||

|

|

After climbing nearly 70% in 2025 and starting this year on strong footing, it may seem unreasonable to expect gold and gold mining stocks to deliver another year of outsized performance. Yet the evidence continues to point in that direction. While periodic pullbacks are inevitable, the primary forces driving gold’s advance remain firmly in place.

Importantly, this rally is not being fueled by speculative excess or short-term momentum chasing. Instead, it reflects a series of structural shifts in global markets that have created a durable bid for gold. Central banks have returned as meaningful buyers, institutional investors are rebuilding positions after years of underallocation, and rising geopolitical risk, alongside persistent monetary and fiscal concerns has reinforced gold’s role as a strategic asset.

One of the most notable features of this cycle has been the shallow nature of gold’s corrections. Each pullback has been met with aggressive buying, limiting downside and allowing the broader uptrend to reassert itself quickly. Even seasoned bulls have been surprised by how brief these pauses have been following such sustained gains.

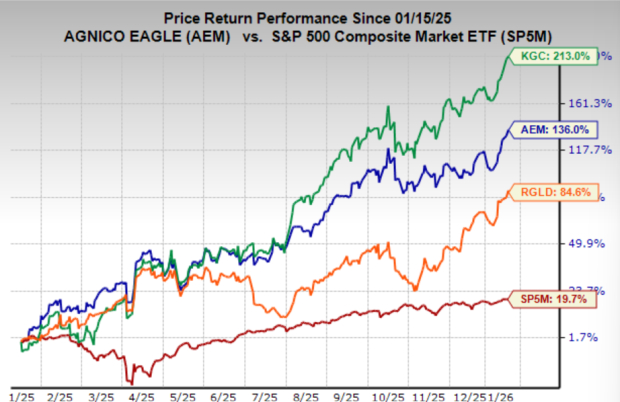

And even if the gold bull market were to pause, select gold mining stocks continue to offer compelling standalone opportunity. Kinross Gold (KGC), Agnico Eagle Mines (AEM), and Royal Gold (RGLD) stand out as some of the strongest names in the space. All carry top Zacks Ranks, trade at reasonable valuations, and combine solid growth outlooks with powerful price momentum.

Image Source: Zacks Investment Research

Gold mining stocks tend to amplify moves in the underlying metal, and that leverage is becoming increasingly attractive as gold prices remain elevated. With costs largely fixed in the near term, incremental gains in gold prices flow disproportionately to miners’ cash flow and earnings. This dynamic is particularly powerful in an environment where gold prices are holding firm rather than surging and collapsing in speculative cycles.

Another important tailwind is balance sheet discipline. Unlike past cycles, many of today’s leading miners have prioritized capital returns, debt reduction, and operational efficiency. That shift has reduced downside risk while preserving upside torque. As a result, gold mining stocks are not acting like purely cyclical trades but increasingly resemble durable growth equities with embedded optionality to higher gold prices.

Against this backdrop, valuation remains reasonable. Despite strong price performance, many miners continue to trade at earnings multiples that do not fully reflect their long-term growth profiles. That disconnect creates an attractive setup for investors seeking both momentum and fundamental support.

Kinross Gold stands out as one of the most compelling risk-reward opportunities in the sector. The company is projected to grow earnings at an annual rate of 36.5% over the next three to five years, yet trades at just 14.5x forward earnings. That combination of high growth and a modest multiple is reflected in its PEG ratio below 1, a hallmark of undervaluation on a growth-adjusted basis.

Operationally, Kinross has benefited from improved asset quality and disciplined capital allocation, which has translated into expanding margins and rising free cash flow. With a Zacks Rank #1 (Strong Buy), the stock continues to see upward revisions to earnings estimates, a key driver of outperformance within the Zacks framework.

Agnico Eagle Mines offers a slightly different profile, pairing strong growth with premium asset quality. Earnings are expected to grow 33.6% annually over the next three to five years, supported by a portfolio of long-life, low-cost mines located primarily in politically stable regions. While its forward earnings multiple of 20.2x is higher than Kinross, it remains reasonable given the company’s consistency, balance sheet strength, and track record of execution. Like Kinross, Agnico’s PEG ratio below 1 suggests a valuation that is cheap when discounted by growth.

Royal Gold provides investors with exposure to gold through a royalty and streaming model rather than direct mining operations. This structure offers several advantages, including lower operating risk, higher margins, and more predictable cash flows. As a result, Royal Gold often commands a valuation premium, reflected in its forward earnings multiple of 23.4x.

That premium appears justified when viewed alongside the company’s projected 30.9% earnings growth rate and its capital-light business model. Royal Gold benefits from rising gold prices without bearing the full cost inflation and operational risks faced by traditional miners. The stock’s Zacks Rank #1 (Strong Buy) underscores improving earnings expectations, while its PEG ratio below 1 suggests that even this higher-quality name remains attractively valued relative to its growth.

With gold prices supported by structural forces and investor demand showing few signs of fatigue, gold mining stocks remain well positioned. Kinross, Agnico Eagle, and Royal Gold each offer a different way to participate in the trend, combining strong earnings growth, reasonable valuations, and favorable Zacks Ranks. For investors seeking exposure to gold with the potential for outsized equity returns, this group continues to stand out.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite