|

|

|

|

|||||

|

|

West Pharmaceutical Services, Inc. WST is well-positioned for growth, backed by a robust GLP-1-related demand and expansion plans. However, pricing headwinds and tariff risks are concerning.

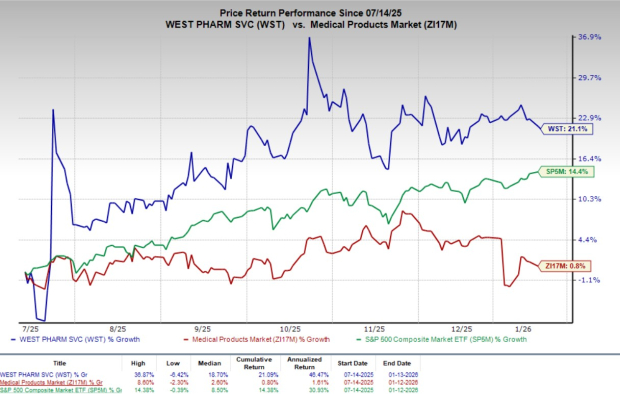

Shares of this Zacks Rank #2 (Buy) company have gained 21.1% so far over the past six months compared with the industry's 0.8% return. The S&P 500 Index has risen 14.4% in the same time frame.

West Pharmaceutical, with a market capitalization of $19.63 billion, is a leading global manufacturer, engaged in the design and production of technologically advanced, high-quality, integrated containment and delivery systems for injectable drugs and healthcare products. Its earnings are anticipated to improve 9.5% over the next five years. The company delivered a trailing four-quarter average earnings surprise of 15.52%.

Sustained Growth in High-Value Product (HVP) Components:WST’s HVP Components business is emerging as the company’s primary growth and profitability engine. In third-quarter 2025, HVP Components delivered 13% organic growth, reflecting strong demand from structurally attractive end markets such as GLP-1 injectable therapies, biologics, biosimilars and Annex 1 regulatory-driven upgrades. These products allow the company to command more than 60% higher margins than standard products.

Management expects HVP Components to sustain multi-year double-digit growth, with Biologics’ demand recovering, WST’s participation in biologics and biosimilars exceeding 90%, and global networking capabilities. By using its existing facilities and expanding HVP capacity, WST improves revenue visibility, protects margins and supports steady long-term earnings growth.

GLP-1 Exposure Is Expanding & Outpacing Market:WST’s exposure to the fast-growing GLP-1 market is expanding rapidly, with GLP-1-related elastomers representing about 9% of the total company revenues. Demand is driven by greater use of vials and related components such as stoppers and seals, increasing clinical trial activity for new GLP-1 molecules, emerging generics activity, and broader adoption across multiple geographies.

As a result, management expects GLP-1-related revenues to continue exhibiting strong growth, even as the business scales, providing a durable and expanding growth tailwind. GLP-1 products within the Contract Manufacturing segment make up about 8% of the total company revenues. The company is steadily increasing the production of delivery devices used in obesity treatments, particularly in Dublin, and validating new equipment to prepare for the commercial launch of its drug handling business in early 2026.

Annex 1 Regulatory Tailwind With Long Runway:Annex 1 regulations are providing a strong and long-lasting growth tailwind for West Pharmaceutical. The company is currently working on 375 active Annex 1 upgrade projects, which involve converting lower-margin standard products into higher-margin HVP components.

Customer adoption is accelerating for HVP components, with management expecting a rising contribution from Annex 1 upgrades.

This opportunity is still in the early stages, with only a small fraction of the estimated six billion addressable components converted, leaving significant room for growth over multiple years. Increasing regulatory scrutiny in Europe is pushing pharmaceutical companies to upgrade quality standards, strengthening West Pharmaceutical’s competitive position and deepening customer reliance on its specialized expertise.

Contract Manufacturing Revenue Headwind:The company is expected to face revenue headwinds from the conclusion of a major Contract Manufacturing agreement in mid-2026, suggesting a $40-million revenue decline in the second half of 2026. Although the company is actively working to replace this business with higher-margin contracts, there is likely to be a temporary gap in revenues during the transition period.

This transition also carries execution risks, as new equipment should be installed and production should be ramped up on schedule. As a result, replacement revenues may not fully offset the lost contract immediately, even if the long-term profitability of the new business is better.

Timing & Visibility Risks in Project Conversions:West Pharmaceutical faces timing and visibility risks due to Annex 1 upgrades and drug launches, where conversion timelines vary widely (three to eight quarters), affecting steady quarterly revenues. In addition, FDA approval timing and customer launch schedules delay HVP adoption.

While management remains confident in the strong long-term demand outlook, it acknowledged that short-term revenue visibility is less stable than in the past, reducing the predictability.

SmartDose 3.5 within the delivery device business is still under margin pressure, even though profitability has been improving. Automation for SmartDose is expected to go live in early 2026 and improve margins. Until then, delivery devices continue to weigh on results within the Proprietary segment.

In addition, some long-term strategic decisions related to this business are still unresolved, adding uncertainty in the near term.

West Pharmaceutical Services, Inc. price | West Pharmaceutical Services, Inc. Quote

WST has been witnessing a positive estimate revision for 2026. In the past 30 days, the Zacks Consensus Estimate for earnings has moved 0.4% north to $7.64 per share, implying a gain of 7.9% from the prior-year reported level. The consensus mark for revenues is pegged at $3.25 billion, indicating a 6.0% increase from the 2025 reported level.

Some other top-ranked stocks from the broader medical space are Phibro Animal Health PAHC, Cardinal Health CAH and The Cooper Companies COO.

Phibro Animal Health, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 73 cents. The metric surpassed the Zacks Consensus Estimate by 23.7%. Revenues of $363.9 million beat the Zacks Consensus Estimate by 2.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

PAHC has an estimated long-term earnings growth rate of 12.8% compared with the industry’s 13.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 20.77%.

Cardinal Health, currently carrying a Zacks Rank #2, reported a first-quarter fiscal 2026 adjusted EPS of $2.55, which surpassed the Zacks Consensus Estimate by 15.4%. Revenues of $64 billion beat the Zacks Consensus Estimate by 8.4%.

CAH has an estimated long-term earnings growth rate of 13.9% for 2025 compared with the industry’s 9.2% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 9.36%.

The Cooper Companies, presently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of $1.15, which surpassed the Zacks Consensus Estimate by 3.6%. Revenues of $1.06 billion beat the Zacks Consensus Estimate by 0.5%.

COO has an estimated long-term earnings growth rate of 7.8% compared with the industry’s 9.2% growth. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 2.41%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 6 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite