|

|

|

|

|||||

|

|

Ulta Beauty, Inc. ULTA and Bath & Body Works, Inc. BBWI are two leading retailers in the beauty space with loyal customer bases and well-established brand recognition. Ulta Beauty stands out as a full-service beauty destination, offering everything from skincare and cosmetics to haircare and salon services. Meanwhile, Bath & Body Works focuses on a narrower but highly profitable niche — dominating the personal care and fragrance space with a strong brand and high-margin product lines.

As we move through 2025, the retail sector is evolving quickly due to shifting consumer preferences, macroeconomic pressure, rising competition and potential tariff risks. Both ULTA and BBWI are adapting strategies to navigate this changing environment, presenting investors with a unique opportunity to consider quality retail stocks at more attractive valuations.

With both companies showing strengths — and facing challenges — the key question for investors is which stock offers stronger long-term growth potential right now, Ulta Beauty or Bath & Body Works? Let’s dive into the details.

Ulta Beauty continues to distinguish itself as a top performer in the beauty retail industry through a unique and resilient business model. By seamlessly integrating mass, prestige and luxury beauty brands under one roof — and enhancing the in-store experience with salon services — the company creates a compelling and inclusive shopping environment that drives both customer engagement and foot traffic.

Ulta Beauty’s omnichannel retail strategy is further strengthened by its expanding shop-in-shop partnership with Target Corporation TGT and a rapidly growing e-commerce and digital footprint. This agility in adapting to evolving consumer preferences has enabled it to stay ahead of industry trends and foster stronger customer loyalty. The company’s investment in influencer marketing, exclusive brand partnerships and social media engagement has boosted brand visibility, social impressions, and earned media value, reinforcing Ulta Beauty’s position as a go-to destination for beauty consumers.

At the heart of the company’s customer retention strategy is its industry-leading loyalty program, which boasts more than 44.5 million active members. This program acts as a powerful revenue driver, encouraging repeat purchases and increasing average order value, giving it a competitive edge in a saturated beauty market.

Despite its strengths, Ulta Beauty faces several near-term challenges that could impact profitability. The company’s gross margin contracted by 30 basis points in fiscal 2024, primarily due to higher supply-chain costs, increased store occupancy and a shift toward lower-margin products. The company anticipates further margin pressure in fiscal 2025, along with a projected 10% increase in SG&A expenses, as it continues to invest in long-term growth areas such as marketing, staffing and infrastructure.

Intensifying competition in the prestige beauty segment, where over 90% of Ulta Beauty stores have experienced new entrants, could affect customer retention and pricing power. Nevertheless, the company’s strong brand equity, loyal customer base and forward-thinking strategy provide a solid foundation for continued leadership in the beauty space.

Bath & Body Works may not match the product variety of Ulta Beauty, but it continues to dominate in its niche — fragrance, skincare, and home scents. The company has taken smart steps to strengthen its position, including a strategic shift toward off-mall locations and a significant revamp of its digital experience. BBWI’s core strength lies in its ability to drive consistent traffic through seasonal promotions and a deep understanding of its loyal customer base, helping it maintain strong sales across both physical and digital channels.

A major driver of this loyalty is the company’s high-performing rewards program, which now boasts over 38 million active members. This loyalty network generates approximately 80% of U.S. sales, highlighting Bath & Body Works’ strong customer retention and brand affinity. At the same time, the company is making meaningful progress in digital transformation and omnichannel expansion. With Buy Online, Pickup In Store (BOPIS) demand surging 45% in the fourth quarter of fiscal 2024 and accounting for 25% of digital orders, BBWI is creating a seamless and convenient customer journey.

Bath & Body Works is also broadening its product portfolio by expanding into adjacent categories such as men’s personal care, lip care, hair care, and laundry, which now make up about 10% of total sales. These newer segments are gaining strong momentum, driven by consumer demand and innovation. Strategic partnerships with entertainment giants like Disney and Netflix have also fueled brand engagement.

Despite these strengths, Bath & Body Works faces several external challenges that could impact future performance. Rising tariffs on imports from China and persistent inflation pose a threat to profit margins. Additionally, international sales remain weak, representing just 5% of overall revenues and declining over 10% year over year in the fiscal fourth quarter. If international growth continues to lag and macroeconomic pressures persist, Bath & Body Works may struggle to achieve broader revenue diversification and sustained long-term growth.

The Zacks Consensus Estimate for Ulta Beauty's fiscal 2025 earnings per share (EPS) has declined by 3 cents over the past seven days, signaling a projected year-over-year decrease of 9.2%. In contrast, the consensus EPS estimate for BBWI has edged down by a penny during the same period but still points to a promising year-over-year growth of 8.8%. This comparison highlights a more optimistic profitability outlook for BBWI relative to ULTA as we head into fiscal 2025. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Ulta Beauty is currently trading at a forward price-to-earnings (P/E) ratio of 15.18x, which is lower than its three-year median of 17.65x, suggesting the stock may be undervalued relative to its historical norms. Similarly, Bath & Body Works has a forward P/E multiple of 7.76x, also trading below its three-year median of 10.90x, indicating potential value for investors seeking attractive entry points.

Both retailers are trading at discounted valuation levels compared to their historical averages, with BBWI showing deeper relative undervaluation. This could present a compelling opportunity for value-focused investors, particularly if BBWI’s earnings growth trajectory continues to outperform expectations.

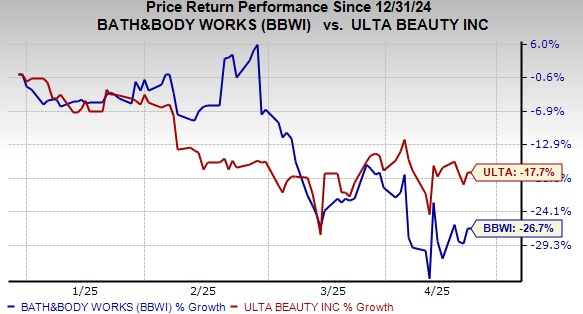

In terms of performance, both stocks have had a tough ride. ULTA has declined 17.7% year to date, while BBWI has plunged 26.7% during this time. Despite a steeper decline, BBWI’s more pronounced undervaluation may deliver outsized returns if its earnings growth materializes as projected.

Ulta Beauty excels with a broader product range and extensive brand partnerships, it faces operational complexities and near-term margin pressures. On the other hand, Bath & Body Works operates within a more focused niche and delivers consistent performance through efficient operations, cost management, and a highly loyal customer base. While both stocks have a Zacks Rank #3 (Hold), Bath & Body Works offers a compelling opportunity for value-driven investors, with a deeper valuation discount and solid earnings growth.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite