|

|

|

|

|||||

|

|

U.S. stock markets have started 2026 on a positive note. All three major stock indexes are trading in positive territory. This trend is likely to continue in January buoyed by the strong fundamentals of the domestic economy, solid fourth-quarter 2025 earnings projections, the Fed’s accommodative monetary policies and the evaporation of trade and tariff-related issues.

At this stage, we recommend investing in growth stocks to strengthen your portfolio in January. Growth investors are primarily focused on stocks with aggressive earnings or revenue growth, which should propel their stock prices higher in the future.

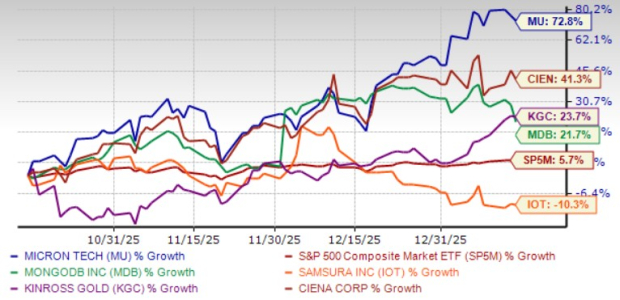

Five such stocks are: Micron Technology Inc. MU, MongoDB Inc. MDB, Samsara Inc. IOT, Ciena Corp. CIEN and Kinross Gold Corp. KGC. Each of our picks sports a Zacks Rank #1 (Strong Buy) and has a Growth Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past three months.

Micron Technology has become a leader in the AI infrastructure boom due to strong demand for its high-bandwidth memory (HBM) solutions. Record sales in the data center end market and accelerating HBM adoption have been driving MU’s Dynamic Access Random Memory (DRAM) revenues higher.

The growing adoption of AI servers is reshaping the DRAM market as these systems require significantly more memory than traditional servers. This is boosting demand for both high-capacity DIMMs (Dual In-line Memory Module) and low-power server DRAM. MU is capitalizing on this trend with its leadership in DRAM technology and a strong product roadmap that includes HBM4, slated for volume production in 2026.

Micron’s diversification strategy is also bearing fruit. MU has created a more stable revenue base by shifting its focus away from the more volatile consumer electronics market toward resilient verticals such as automotive and enterprise IT.

As AI adoption accelerates, the demand for advanced memory solutions, such as DRAM and NAND is soaring. MU’s investments in next-generation DRAM and 3D NAND ensure that it remains competitive in delivering the performance needed for modern computing.

Micron has an expected revenue and earnings growth rate of 89.3% and more than 100%, respectively, for the current year (ending August 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 64.2% over the last 30 days.

MongoDB has scaled its Atlas platform beyond database management into analytics, emphasizing developer-friendly interfaces and distributed architectures. MDB targets agile development and modern workloads to derive benefits from the new generative AI world.

MDB has benefited from continued platform adoption across enterprises and startups. Its upmarket focus with larger enterprises likely supported deal sizes and sales efficiency, while the self-serve channel continued to expand, driving efficient mid-market customer acquisition.

Product initiatives during the period were still in the early stages of rollout. MDB introduced new Voyage AI embedding models and launched the Model Context Protocol Server in public preview, extending integrations with tools such as GitHub Copilot and Anthropic Claude. These moves strengthened MDB’s positioning in AI-driven applications.

MongoDB has an expected revenue and earnings growth rate of 17.5% and 17%, respectively, for the next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 29.6% over the last 60 days.

Samsara provides solutions that connect physical operations data to its connected operations cloud in the United States and internationally. IOT is developing and building sensor systems that utilize wireless sensors with remote networking and cloud-based analytics.

IOT’s Connected Operations Cloud includes Data Platform, which ingests, aggregates, and enriches data from its IoT devices and has embedded capabilities for AI, workflows analytics, alerts, API connections, and data security and privacy.

Samsara has an expected revenue and earnings growth rate of 19.8% and 12.9%, respectively, for the next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 1.8% in the last 60 days.

Ciena’s fiscal fourth-quarter reflected year-over-year 20% top-line gains, 69.5% EPS growth and a record $5 million order backlog, driven by accelerating AI-led demand from cloud and service provider customers. Driven by strong cloud and service provider momentum, CIEN gained 2 points of optical market share year to date and expects further gains in 2026.

Networking Platforms revenue rose 22% to $1.05 billion, driven by 19% Optical growth on a 72% RLS surge and 49% growth in Routing and Switching from DCOM demand. CIEN lifted its fiscal 2026 revenue outlook to $5.7-$6.1 billion, nearly 24% growth at the midpoint, up from the prior 17%, on strong demand from cloud, DCI, and AI infrastructure.

Increased network traffic, higher demand for bandwidth, and adoption of cloud architectures remain the key growth drivers as the company expects to improve its profitability with a balanced mix of new and existing customers. CIEN’s portfolio, including WaveLogic, RLS, Navigator, and Interconnect Solutions, remains a recognized industry standard, with WaveLogic 6 and RLS giving it an 18 - 24 month technology lead and strong positioning to serve global AI network opportunities.

Ciena has an expected revenue and earnings growth rate of 24.2% and more than 100%, respectively, for the current year (ending October 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 19.7%- in the last 30 days.

Kinross Gold has a strong production profile and boasts a promising pipeline of exploration and development projects. These projects are expected to boost production and cash flow and deliver significant value.

KGC is focusing on organic growth through its Tasiast mine, where the Phase One expansion boosted production capacity, and the Tasiast 24K expansion increased throughput and production.

KGC’s Manh Choh project at Fort Knox is expected to extend operations and benefit from higher gold prices. The Great Bear project in Ontario also offers a promising long-term opportunity with substantial gold resources. Higher gold prices should also boost KGC’s profitability and drive cash flow generation.

Kinross Gold has an expected revenue and earnings growth rate of 11% and 35.2%, respectively, for the current year. The Zacks Consensus Estimate for the current year’s earnings has improved 12.9% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

AI Stocks At Crossroads As Nvidia, Snowflake, CoreWeave, Salesforce Step Into Spotlight

CIEN

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite