|

|

|

|

|||||

|

|

Electric vehicle (EV) giant Tesla TSLA is making a major change to how it sells Full Self-Driving (FSD). The company will stop offering FSD as a one-time purchase after Feb. 14, 2026. Instead, FSD will be available only through a monthly subscription after that.

The move reflects Tesla’s evolving strategy around autonomy, revenue stability and long-standing promises for FSD.

FSD has always been a tough sell as an upfront product. At its peak in September 2022, Tesla priced FSD at $15,000. Over time, that price steadily came down, reaching $8,000 in the United States by April 2024. Around the same time, Tesla also cut the FSD subscription price from $199 per month to $99, per Electrek.

At even $8,000, the economics of buying FSD outright stopped making much sense. It would take several years of continuous use to break even versus subscribing. For most buyers, that only worked if they believed FSD would soon become fully autonomous and significantly more valuable.

For many years, Musk has been promising that unsupervised self-driving was just around the corner. Yet FSD today remains a supervised system. Drivers must stay alert and keep their hands ready. This gap between promise and reality created frustration, lawsuits, and regulatory scrutiny.

By ending the one-time purchase option, Tesla removes the “forever promise” problem. When customers paid thousands upfront, they reasonably expected their car to eventually become fully autonomous. With subscriptions, customers are only paying for what FSD can do today. There is no implied guarantee about the future.

This also solves a costly hardware issue for Tesla. Older vehicles may not be able to run future FSD models. Under a purchase model, Tesla faced pressure to upgrade hardware. Under a subscription model, customers can simply stop paying if their vehicle no longer supports the latest version.

The shift to subscriptions also fits better with Tesla’s long-term financial goals. One-time purchases tend to create uneven revenue spikes, often tied to new vehicle sales. Subscriptions, in contrast, will help generate steady cash flow. That is something investors typically value more.

Also, the move aligns closely with Musk’s personal incentives. His massive pay package of around $1 trillion, approved by shareholders in November 2025, is heavily tied to long-term operational milestones, not short-term profits.

One of the most important targets is reaching 10 million active FSD subscriptions over the next decade, not purchases. By removing the one-time option, Tesla is pushing all new FSD users toward subscriptions — a metric that matters for Musk’s compensation.

The performance award also includes ambitious goals beyond FSD. Musk must lead Tesla to 20 million cumulative vehicle deliveries, deploy 1 million Tesla robots and operate 1 million Robotaxis. On top of that, Tesla must reach a market capitalization of $8.5 trillion. If all targets are met, Musk could become the world’s first trillionaire.

From this perspective, the FSD subscription shift looks strategic. It supports recurring revenues, reduces legal risk and directly advances Tesla’s long-term autonomy and software adoption goals. For consumers, the change lowers the entry barrier to FSD and removes uncertainty about future promises. For Tesla, it simplifies its autonomy narrative and strengthens its business model.

Rivian Automotive RIVN is emerging as a direct competitor to Tesla in advanced Level 2 driver assistance. Rivian announced Autonomy+, its in-house alternative to Tesla’s FSD. RIVN is pricing Autonomy+ at $49.99 per month, or $2,500 as a one-time purchase, undercutting Tesla’s pricing. Autonomy+ will enable hands-free driving across more than 3.5 million miles of roadway. Rivian also outlined plans to expand Autonomy+ with continuously improving capabilities starting in early 2026.

NVIDIA NVDA is intensifying competition, making it easier for automakers to offer Tesla-style autonomy on their own. NVIDIA recently launched Alpamayo, a family of open-source AI models designed to handle rare edge cases in autonomous driving. NVIDIA’s Alpamayo 1 uses advanced reasoning to explain driving decisions, not just execute them. Mercedes-Benz will be the first automaker to deploy NVIDIA’s full autonomous driving stack, starting with the 2025 Mercedes-Benz CLA. NVIDIA plans a U.S. launch in early 2026, followed by Europe and Asia.

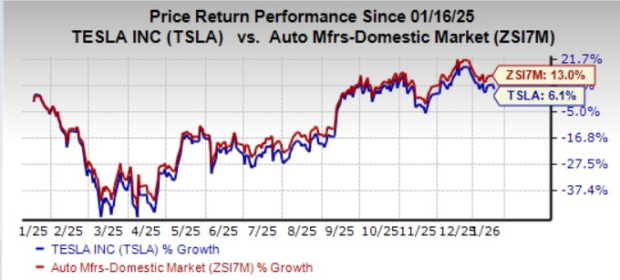

Shares of TSLA have gained 6% over the past year, underperforming the industry.

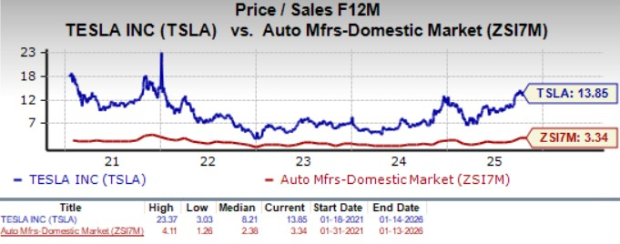

From a valuation standpoint, TSLA trades at a forward price-to-sales ratio of 13.85, above the industry and its own five-year average. It carries a Value Score of F.

See how the Zacks Consensus Estimate for TSLA’s earnings has been revised over the past 90 days.

Tesla stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min | |

| 41 min | |

| 43 min | |

| 1 hour |

Nvidia Partner, IBD Stock Of The Day, Surges To High On S&P 500 News, Trump's Iran War Hopes

NVDA

Investor's Business Daily

|

| 2 hours |

Dow Jones Futures: Trump's Iran Comments Spark Stock Market Reversal As Oil Prices Tumble

NVDA

Investor's Business Daily

|

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite