|

|

|

|

|||||

|

|

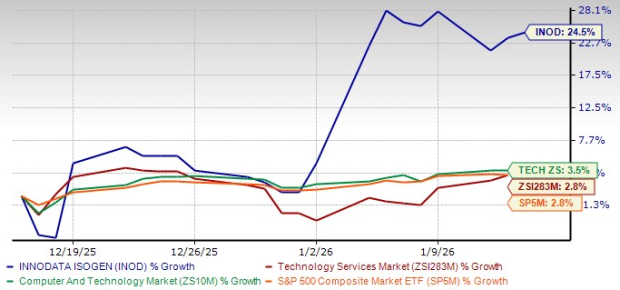

Innodata Inc. INOD has been one of the stronger performers in the small-cap AI services space over the past month. The stock has rallied 24.5%, far outpacing the Zacks Technology Services industry’s 2.8% gain and the S&P 500’s 2.8% increase. Shares recently traded around $63.16 as of Jan. 14, 2026, well off the 52-week high of $93.85 but still sharply above the $26.41 low, underscoring both the stock’s momentum and its volatility.

The recent move has renewed investor focus on whether the rally is backed by fundamentals or whether much of the good news is already priced in. A closer look at the company’s operating performance, growth drivers and valuation provides useful context.

INOD's 1-Month Price Performance

Innodata’s share-price strength follows a period of solid execution. In the third quarter of 2025, the company delivered record revenue of $62.6 million, representing 20% year-over-year organic growth, alongside adjusted EBITDA of $16.2 million, or 26% of revenue, highlighting meaningful operating leverage. Cash and short-term investments climbed to $73.9 million, reflecting strong cash generation and a clean balance sheet with no borrowings under its credit facility.

Management reiterated guidance for 45% or more revenue growth in 2025 and pointed to potentially transformative growth in 2026, supported by expanding relationships with large technology customers and new investment areas coming online. This backdrop helps explain why the stock has attracted renewed buying interest despite broader market volatility.

From a technical standpoint, the recent chart action suggests the longer-term uptrend remains intact even after some near-term consolidation. The stock is trading above both its 50-day simple moving average (around $57.6) and its 200-day moving average (near $52.2), indicating that medium- and long-term momentum remains positive. The sharp advance into late 2025 was followed by a pullback from the highs, but prices have so far held above these key support levels.

Innodata’s growth story is closely tied to its role as a “picks-and-shovels” provider to the generative AI ecosystem. During 2025, the company broadened its exposure across the AI lifecycle, from pre-training and post-training data to evaluation, agentic AI, and model safety. Management disclosed that early investments in high-quality pre-training data have already resulted in signed and expected contracts representing up to $68 million in potential revenue, with the bulk expected to flow through 2026.

Another notable catalyst is the launch of Innodata Federal, a dedicated government-focused unit. The company has already secured an initial project with a high-profile customer that management expects could generate approximately $25 million in revenue, mostly in 2026, with additional opportunities under discussion. Alongside this, growing interest from sovereign AI initiatives and expanding enterprise AI services adds further optionality beyond the core big-tech customer base.

These initiatives, combined with Innodata’s history of scaling complex data programs for large customers, support expectations for 24.1% revenue growth in 2026, according to the current Zacks Consensus Estimate.

Despite the favorable growth narrative, several risks warrant caution. Innodata remains exposed to customer concentration, with a significant portion of revenue tied to a limited number of large technology clients. Project-based work and at-will contracts mean spending levels can fluctuate if customer priorities shift.

The company is also investing ahead of growth, with management having planned roughly $9.5 million in capability-building investments for 2025, which could pressure margins if anticipated revenue ramps are delayed. In addition, competition in AI data services continues to intensify as both specialized firms and larger IT services players target the same budgets.

Finally, valuation is no longer forgiving. Innodata trades at 52.49X forward 12-month earnings, well above the industry average of 26.61X, leaving the stock vulnerable to pullbacks if execution falters or growth expectations are tempered.

INOD's Valuation

Competition in AI data engineering and services is intensifying as enterprises and hyperscalers scale generative AI deployments. EXLService Holdings, Inc. EXLS is a notable competitor with strong capabilities in data analytics, digital operations and AI-led business transformation. EXLService has been expanding its analytics-driven services for regulated industries such as insurance, healthcare and financial services. While EXLService operates at a broader enterprise-services level, EXLService increasingly overlaps with Innodata in AI-enabled data preparation, model governance and workflow automation, especially as clients push for end-to-end solutions.

Genpact Limited G is another important competitor. Genpact has been investing heavily in AI, machine learning and digital process automation, leveraging its long-standing enterprise relationships. Genpact’s scale, global delivery footprint and consulting-led model allow Genpact to compete aggressively for large AI transformation contracts, including data engineering and model optimization work that overlaps with Innodata’s offerings.

Accenture plc ACN represents competition from the large-cap end of the market. Accenture’s deep consulting ties, broad AI stack capabilities and financial strength often set high benchmarks for execution and compliance. While Accenture’s size differs significantly, its presence shapes pricing, delivery standards and customer expectations across the AI services landscape.

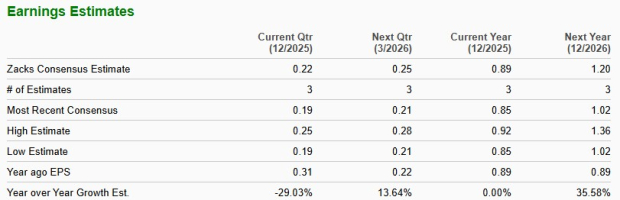

From an earnings standpoint, the Zacks Consensus Estimate for 2026 earnings per share remains unchanged at $1.20 over the past 30 days, indicating 35.6% growth from expected 2025 levels. Stable estimates suggest analysts are comfortable with current forecasts but are not yet revising numbers higher following the recent stock run.

At the same time, the premium valuation reflects confidence in Innodata’s ability to convert its expanding pipeline into sustained earnings growth.

Innodata’s recent 24.5% surge appears grounded in real operating momentum, expanding AI use cases and a strong balance sheet. The technical trend remains constructive, and long-term growth drivers tied to generative AI, federal contracts, and enterprise adoption are compelling.

However, the stock’s rich valuation, customer concentration risk and lack of recent upward estimate revisions argue for caution after the rally. With the stock carrying a Zacks Rank #3 (Hold), the current setup points to a balanced risk-reward profile. For investors already holding shares, it allows participation in longer-term upside while recognizing near-term volatility. New investors may want to wait for a more attractive entry point before committing fresh capital. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 6 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Accenture Stock Jumps After Firm Partners With Mistral in European AI Push

ACN +8.29%

The Wall Street Journal

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite