|

|

|

|

|||||

|

|

Robinhood shares have soared during the past couple of years.

Its valuation, however, has become more than stretched at a time when its growth may be slowing.

A stock doesn’t have to have millionaire-making potential to be a worthy addition to a portfolio.

What's the secret to finding millionaire-making stocks? A game-changing product or service is a common characteristic. Think Amazon's (NASDAQ: AMZN) e-commerce platform, or Apple's (NASDAQ: AAPL) iPhone.

Not every game-changing company's stock produces huge gains, however, and some enormous gains are dished out by seemingly ordinary companies.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This is the frustration anyone keeping tabs on Robinhood Markets (NASDAQ: HOOD) is likely facing right now. The stock's roughly 200% run-up from April's low certainly suggests there's something special here. The discount online brokerage firm's business, however, doesn't look particularly special. It has been producing growth that will be difficult to sustain given the industry's lack of barriers to entry.

Or maybe Robinhood's continued success won't come from the brokerage side.

Robinhood's commission-free stock-trading app was launched in 2013 in an already-crowded market dominated by players like Schwab (NYSE: SCHW) and E*Trade. It was still unique, though, in that it was built first and foremost to bring no-cost trading to mobile devices. Shortly after it went public in 2021, more than 20 million people were using the app at least once per month.

The brokerage outfit has since stopped reporting its customer metrics by this measure, but as of the third quarter of last year, 26.8 million customer accounts were funded. These customers are also more productive for Robinhood now than ever, driving revenue of $1.27 billion ($191 per user) for the fiscal third quarter. That quarterly top line doubled year over year, extending a long (if somewhat erratic) growth streak that's been in place since the company's inception. This growth has been mirrored by the stock's performance since Robinhood's 2021 initial public offering.

It's a tough act to follow, of course, particularly given that customer growth count has slowed to nearly nil since late last year. The company's top line remains tightly tethered to its customer count and to a market environment that encourages regular stock trading. Robinhood's single biggest source of revenue is the money it collects for directing customer trades to certain market makers, traders who serve as intermediaries between buyers and sellers. And as veteran investors can attest, trading activity can ebb and flow quite dramatically.

Robinhood's got a plan to smooth out its revenue's rough edges, though. It's moving ever deeper into banking services, offers credit cards, and is managing its own take on private equity. It's even getting into the prediction market, competing with the likes of Kalshi, DraftKings, and Polymarket. Although none of these business lines are major profit centers for Robinhood just yet, all of them eventually could be. That's the crux of any millionaire-making argument because the stock-trading business will inevitably reach a plateau.

Image source: Getty Images.

But there's a "but."

Congratulations are in order, to be sure. Robinhood saw an opportunity to build a mobile-specific trading app and then successfully penetrated a crowded market with it. And kudos to the company for now looking beyond its core business to related opportunities. That's the right move. That's why the shares have rallied more than 1,200% from their late-2023 low.

This incredible run-up, however, arguably presents a problem for this particular company in this particular situation.

Although this sort of gain might look like the beginning of prolonged millionaire-creating rally stemming from a whole new kind of product, none of Robinhood's businesses are particularly unique. There are no barriers to entry in any of them, in fact, and the company's still competing with much bigger and deeper-pocketed players on every front. These competitors aren't simply going to let it continue laterally expanding. They will push back.

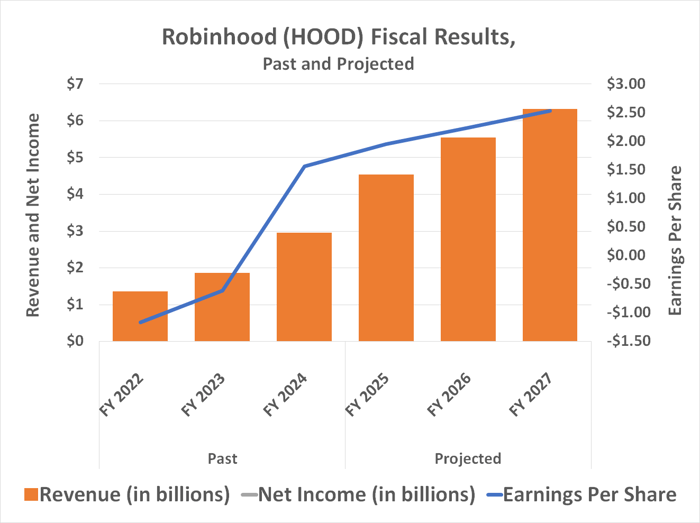

Data source: CFRA. Chart by author.

And that pushback will bring another potential stumbling block into the spotlight. That's Robinhood stock's current valuation.

Although most investors are willing to pay a healthy premium for growth like the 22% top-line improvement that analysts expect in 2026, Robinhood shares are now priced at nearly 50 times this year's average projected per-share earning of $2.44. That may be about as much as the market's willing to value this company at right now, which may explain the stock's weakness since October. That's when much of the growth-driven euphoria began wearing off at the same time that new worries over customer attrition started taking shape. As it turns out, a bunch of Robinhood's retail customers don't stick around when the market suddenly offers fewer profitable short-term swing trading opportunities.

Still, there's at least some growth in Robinhood's foreseeable future.

So is Robinhood stock a millionaire maker?

From here? Probably not -- at least not to the degree that Amazon and Apple have been. What's missing with its growth is the kind of longevity needed to turn a relatively small stake into a seven-figure sum -- the kind of longevity the iPhone or the world's most popular e-commerce marketplace have. Pretty soon, Robinhood's going to bump into a growth ceiling in the form of stiffer competition, not to mention a bear market in which trading slumps.

But that doesn't mean it can't be a solid nearer-term growth holding. You just need to buy into it on a dip, not unlike the one we've seen since October.

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $474,578!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,628!*

Now, it’s worth noting Stock Advisor’s total average return is 955% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 19, 2026.

Charles Schwab is an advertising partner of Motley Fool Money. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Apple. The Motley Fool recommends Charles Schwab and recommends the following options: short March 2026 $100 calls on Charles Schwab. The Motley Fool has a disclosure policy.

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

Apple To Hold Product Event On March 4. Cheaper iPhone Seen But No AI Siri

AAPL

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite