|

|

|

|

|||||

|

|

The Home Depot, Inc. HD, a prominent player in the home improvement market, is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 25.23, which positions it at a premium compared to the industry’s average of 23.09 and the S&P 500's 23.28. The stock is also trading above its median P/E level of 23.83, observed over the past year. The valuation does suggest that Home Depot is overvalued.

This valuation positioning becomes clearer when viewed alongside key peers such as Lowe’s Companies Inc. LOW, Williams-Sonoma, Inc. WSM and Floor & Decor Holdings, Inc. FND. While HD trades at a premium to Lowe’s (with a forward 12-month P/E ratio of 21.38) and Williams-Sonoma (23.31), it trades at a discount to Floor & Decor Holdings (35.19).

Despite this premium valuation, Home Depot stock has shown near-term resilience, rising over the past month. This increase reflects investors gravitating toward large-cap stocks, which are often seen as more stable in an uncertain environment. However, the recent momentum seems driven more by positioning than by a significant improvement in underlying fundamentals.

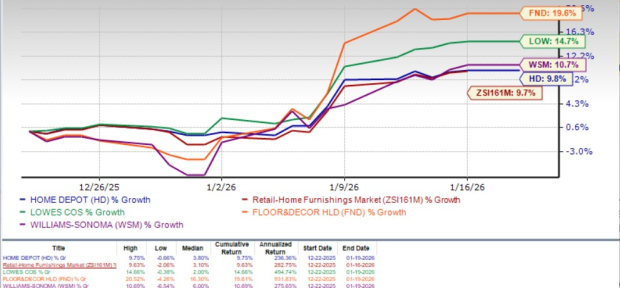

Shares of Home Depot have advanced 9.8% over the past month, slightly outpacing the industry’s 9.7% gain. However, the stock has lagged key peers, with Lowe’s, Williams-Sonoma, and Floor & Decor Holdings posting stronger increases of 14.7%, 10.7% and 19.6%, respectively.

Home Depot’s long-term growth strategy is increasingly shaped by its expanding Pro ecosystem, strengthened through the additions of SRS and GMS. These platforms give the company a deeper reach into specialty building materials and create natural cross-sell pathways between retail and wholesale channels. As SRS demonstrates resilience in challenging categories and GMS broadens access to drywall, ceilings and framing products, the combined network serves as a powerful engine for market-share gains with contractors who prefer a fully integrated supplier.

The company is also enhancing its focus on professional contractors by introducing a new AI-powered tool designed to reshape how Pro customers plan and execute complex projects. The company highlighted that its blueprint takeoffs tool utilizes advanced AI and proprietary algorithms to analyze construction plans and generate material estimates with far greater speed and accuracy than traditional methods. This technology replaces the labor-intensive process that earlier took Pro customers weeks to complete.

By incorporating this advanced technology, Home Depot is reinforcing its position as the go-to destination for all project requirements, from initial planning to material delivery. This development marks a significant step forward in catering to the Pro category. This progress allows Home Depot to differentiate its Pro offerings not only through product assortment but also through digital infrastructure.

Home Depot is facing structural headwinds, muted demand and margin pressure. The softness in housing turnover, a key driver of repair-and-remodel spending, remains a notable drag. With management citing housing activity at nearly 40-year lows and consumer behavior pressured by affordability constraints, the company delivered a modest 0.2% increase in comparable sales in the third quarter, with U.S. comps up only 0.1%, sharply down from 1% and 1.4% increases, respectively, in the preceding quarter. This sluggish growth shows that the expected demand recovery in the second half has not materialized.

High interest rates and affordability concerns have stalled the typical catalysts for home improvement spending, such as home sales and equity-based renovations. While there was an earlier expectation that falling mortgage rates would stimulate activity, this has not yet translated into increased project demand.

Home Depot’s heavy reliance on storm-related sales has emerged as a significant vulnerability, as the lack of seasonal storm activity was cited as the primary reason for missing third-quarter expectations. Categories such as roofing, plywood and power generation faced greater-than-expected pressure. For fiscal 2025, Home Depot anticipates comparable sales growth to be slightly positive, down from its previous forecast of 1% growth.

The high-value Pro customer segment is showing signs of weakness, with management noting reduced backlogs for larger projects. This is compounded by unexpected challenges in the recently acquired SRS business, a crucial part of the company's long-term Pro expansion strategy. Due to a significant lack of storm activity, growth expectations for this acquired asset have been lowered from a mid-single-digit outlook to a low single-digit performance for the full year.

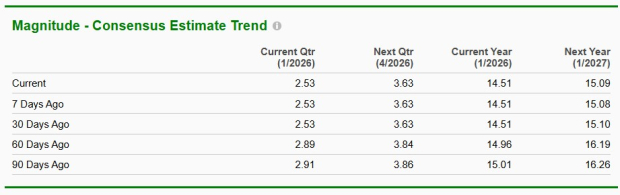

On its last earnings call, Home Depot guided fiscal 2025 adjusted earnings per share to fall about 5% from fiscal 2024 compared with its earlier estimate of a 2% decline. It expects the adjusted operating margin to be 13%, a sharp drop from 13.8% reported last year. As a result, the Zacks Consensus Estimate has witnessed downward revision.

Over the past 60 days, the Zacks Consensus Estimate for the current fiscal year has moved down by 45 cents to $14.51, while the estimate for the next fiscal year has fallen by $1.10 to $15.09.

Home Depot remains a market leader with a strong brand, a scaled Pro ecosystem and long-term strategic initiatives that reinforce its competitive position. However, at the current premium valuation, these strengths appear fully reflected in the stock, while near-term fundamentals face significant pressure from subdued housing activity, cautious consumer behavior and uneven Pro demand. The recent share price resilience seems driven more by sentiment than by a clear improvement in operating momentum. For existing investors, a more cautious approach is warranted, with patience recommended until there are clearer signs of demand recovery or valuation normalization. For potential investors, it may be prudent to wait for a more attractive entry point. Home Depot currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite