|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Ford Motor Company F and Ferrari N.V. RACE are well-recognized automaker brands. Ford manufactures, markets and services cars, trucks, sport utility vehicles, electrified vehicles and Lincoln luxury vehicles while Ferrari designs, manufactures and sells sports cars. Ferrari also produces a limited-edition supercar, the LaFerrari, as well as limited series and one-off cars. Ferrari represents elite performance, speed and exclusivity, whereas Ford stands out for dependable, affordable vehicles with broad market appeal.

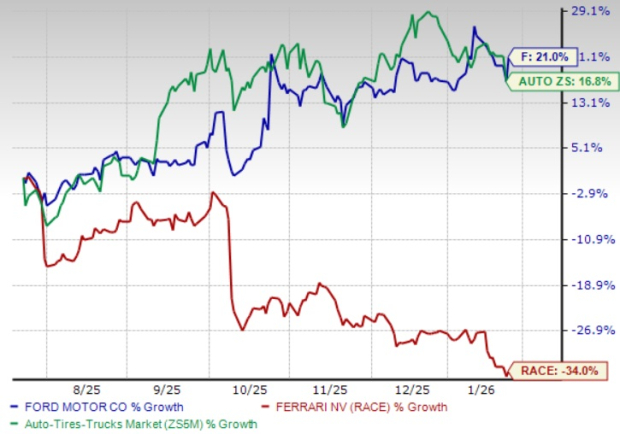

In the last six months, shares of Ferrari have plunged 34%, while Ford shares have risen 21%. F has outperformed the Zacks auto sector, but Ferrari has underperformed the same.

So which stock stands out as the stronger choice now? Let’s examine the fundamentals, growth catalysts and risks to determine which automaker earns a place in your portfolio.

Ford’s consolidated third-quarter revenues came in at $50.5 billion, up 9.3% year over year. The company’s broad lineup, anchored by its F-Series trucks, Maverick pickup and popular SUVs, provides a solid foundation for growth. Its hybrid strategy adds resilience as EV adoption evolves. While the Model e segment faces near-term losses, Ford is positioning for long-term success with its Universal EV Platform, designed for affordable, digitally advanced vehicles starting around $30,000. The company plans to begin equipment installation for UEV production in Louisville and start LFP battery cell production in Michigan later this year, reinforcing its long-term electrification strategy.

Ford Pro remains a key growth engine, supported by strong order books, rising demand for Super Duty trucks, and expanding software and service offerings. The company plans to boost F-150 and Super Duty production by more than 50,000 units in 2026 to meet demand and offset losses from the Novelis fire. Strength across vehicles, software, and physical services underpins the segment’s momentum. Paid subscriptions rose 8% to 818,000 in the third quarter. Partnership with ServiceTitan enhances digital service capabilities, positioning Ford Pro as a major long-term earnings driver for the company.

In December, Ford and Renault Group unveiled a major strategic alliance to expand Ford’s EV lineup in Europe, boosting both companies’ competitiveness in the fast-changing regional auto market. Central to the deal is an agreement to develop two Ford-branded electric models built on Renault’s Ampere platform, tapping the group’s EV expertise and scale. Beyond passenger EVs, the partners also signed a letter of intent to explore jointly developing and producing select Ford- and Renault-branded light commercial vehicles for Europe.

Ford has a high dividend yield of more than 4%, way better than the S&P 500’s yield of 1.1%, on average. The company targets distributions of 40-50% of FCF going forward, demonstrating its commitment to shareholder return.

The Zacks Consensus Estimate for F’s 2026 EPS implies year-over-year growth of 38.1%. EPS estimates for 2025 and 2026 have fallen a penny and risen 3 cents, respectively, in the past seven days.

Ferrari reported net revenues of $2.06 billion in the third quarter of 2025, up 14.2% from the corresponding quarter of 2024. Total shipments slightly rose to 3,401 units from 3,383 vehicles in the third quarter of 2024. However, shipments in Mainland China, Hong Kong and Taiwan unit and Americas unit declined 12% and 2% respectively.

Per Jing Daily, China’s luxury car buyers, particularly younger consumers, are placing greater emphasis on advanced technology, sustainability and digitally integrated lifestyles. Ferrari’s brand, built on heritage and exclusivity, appears misaligned with these evolving preferences. Although personalization is a global strength for the company, it has not been sufficiently tailored to Chinese cultural tastes and local expectations. While the visibility of Formula 1 drivers helps generate attention, it does not translate into consistent, long-term sales momentum. Moreover, Ferrari’s absence in the electric vehicle segment represents a notable weakness in a market where new energy vehicles account for more than 40% of total new car sales.

Moreover, even as Ferrari lifted its long-term revenue ambition to roughly €9 billion ($10.4 billion) by 2030, the company now expects fully electric models to account for just 20% of its portfolio by that time, a reduction from its earlier 40% target. Hybrid vehicles are projected to represent another 40%, while the remaining share will continue to rely on internal combustion engines. Ferrari does not anticipate introducing a second electric model before at least 2028, pointing to limited demand for high-performance EVs.

The Zacks Consensus Estimate for RACE’s 2025 sales and EPS implies year-over-year growth of 14.9% and 14.6%, respectively. EPS estimates for 2025 and 2026 have fallen 13 cents each in the past 30 days.

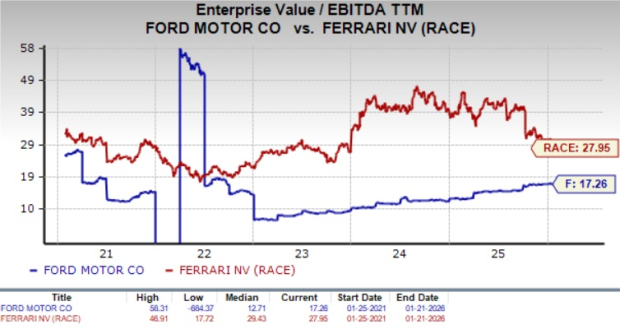

On a valuation basis, F trades at a more attractive EV/EBITDA multiple than RACE. This suggests that, relative to its earnings before interest, taxes, depreciation, and amortization, Ford stock is priced more reasonably.

Overall, Ford appears to be the more compelling investment choice than Ferrari at this stage. Ford offers diversified revenue streams, broad market exposure, and multiple growth levers across trucks, hybrids, EVs, software, and commercial services. Its strong recent stock performance reflects improving investor confidence, supported by solid revenue growth, a resilient product mix, and expanding high-margin businesses like Ford Pro.

Strategic initiatives, such as the Universal EV Platform, battery investments and the partnership with Renault, strengthen Ford’s long-term positioning in both North America and Europe, while its hybrid-first approach reduces risk amid uneven EV adoption. Also, the consensus estimate points to robust earnings growth through 2026, and the stock trades at a more attractive valuation relative to peers.

By contrast, Ferrari’s reliance on exclusivity and limited volumes constrains its growth potential. While the brand remains profitable, recent share price weakness, declining shipments in key regions like China and a cautious stance on electrification raise concerns. Ferrari’s slower EV rollout further clouds its outlook. For investors seeking scalable growth, reasonable valuation and clearer long-term catalysts, Ford stands out as the stronger option. F sports a Zacks Rank #1 (Strong Buy), while RACE has a Zacks Rank #5 (Strong Sell) at present.

You can see the complete list of today’s Zacks Rank #1 stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite