|

|

|

|

|||||

|

|

Seagate Technology Holdings plc STX is scheduled to report second-quarter fiscal 2026 earnings on Jan. 27, after the closing bell.

The Zacks Consensus Estimate for earnings is pegged at $2.78 per share, suggesting a rise of 37% year over year. The Zacks Consensus Estimate for revenues is $2.73 billion, indicating a 17.4% uptick from the year-ago actual.

Management anticipates fiscal second-quarter revenues of $2.7 billion (+/- $100 million). At the midpoint, this indicates a 16% year-over-year improvement. Non-GAAP earnings are expected to be $2.75 per share (+/- 20 cents).

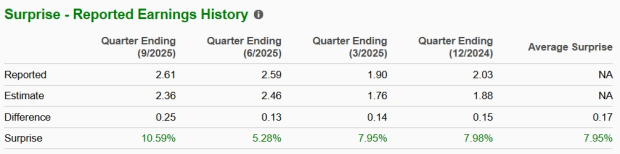

STX’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 8%.

Our proven model predicts an earnings beat for Seagate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is exactly the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Seagate has an Earnings ESP of +2.61% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

One of the strongest secular stories behind Seagate’s fiscal second-quarter performance is the explosive growth in data storage demand, particularly from AI and cloud infrastructure. Starting from the first quarter of fiscal 2026, Seagate reports revenues under two end markets: Data Center, encompassing nearline products and systems sold to cloud, enterprise and VIA customers, and Edge IoT, covering consumer and client-focused segments, including network-attached storage. The structural changes in its business model are poised to generate greater profitability and improve its financial health.

The data center segment accounted for the majority of total revenue in the last reported quarter, at $2.1 billion. Demand from global cloud customers continues to rise, with notable improvement in the enterprise OEM market. These positive trends are expected to continue in the quarter under review, with cloud growth outpacing enterprise demand. High-capacity nearline production remains mostly committed under build-to-order contracts through 2026. STX expects seasonal improvement in Edge IoT revenue in the December quarter, driven by VIA, edge and consumer products.

Amid tight supply conditions, Seagate is working closely with data center customers to accelerate qualification timelines for its high-capacity Mozaic products. Most major global cloud providers are now qualified on Seagate’s HAMR-based Mozaic drives, and production is ramping up to meet strong demand.

Further, STX's areal density roadmap and HAMR-powered Mozaic drives keep HDDs cost-efficient as hyperscalers scale AI storage to 36TB and beyond. Its Mozaic 3+ HAMR-based drives have now been qualified by five of the world’s largest cloud customers, with the company on track to complete qualification with the remaining major global CSPs by mid 2026. At the same time, Mozaic 4+ HAMR-based drives are in qualification with a second global CSP, with an initial volume ramp expected to begin in the second half of fiscal 2026.

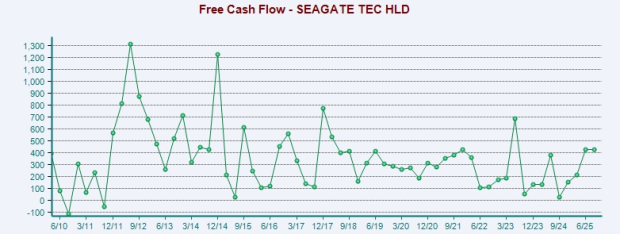

The demand environment remains robust, especially among global cloud data centers. It achieved a record gross margin of 40.1%, up about 680 basis points in the last reported quarter. STX expects margins to expand as customers increasingly adopt its next-generation storage solutions to meet rising demand. At the midpoint of revenue guidance, non-GAAP operating margin is projected to increase to approximately 30%. Moreover, its robust cash flow funds innovation and growth while supporting dividends and buybacks. STX expects free cash flow generation to improve in the to-be-reported quarter and remains committed to returning at least 75% of free cash flow to shareholders over time.

However, Seagate derives a significant portion of its revenue from international markets, making its results sensitive to foreign exchange movements. A weaker euro or British pound versus the U.S. dollar could weigh on reported performance and growth. In addition, the company faces broader macroeconomic headwinds, including tariff-related uncertainty and elevated global debt levels, which could hurt operations.

Nonetheless, looking ahead, STX expects its net leverage ratio to continue declining as profitability improves in the coming quarters. The company is also exploring additional debt reduction opportunities to further support this positive leverage trend.

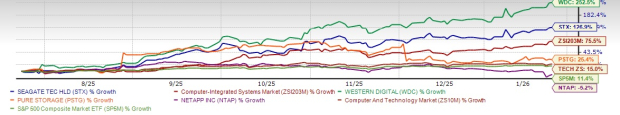

STX shares have surged 126.9% in the past six months, outperforming the Zacks Computer-Integrated Systems industry’s growth of 75.5%. The stock has also outpaced the Zacks Computer & Technology sector and the S&P 500’s growth of 15% and 11.4%, respectively.

The company has outpaced its competitors in the broader storage space, like Pure Storage PSTG and NetApp, Inc. NTAP, while lagging behind its cut-throat rival in the HDD space, Western Digital Corporation WDC. WDC and PSTG have gained 252.5% and 25.4%, respectively, while NTAP has declined 5.2%, during the same time frame.

STX stock is not so cheap, as its Value Style Score of D suggests a stretched valuation at this moment. In terms of forward price/earnings, STX’s shares are trading at 27.39X, higher than the industry’s 18.96X.

WDC, PSTG and NTAP are trading at multiples of 25.96X, 94.87X and 14.45X, respectively, compared with the Zacks Computer-Storage Devices industry’s multiple of 24.37X.

With seismic changes in data demand driven by AI, cloud services and digital transformation, Seagate’s performance is triggered by a strong product roadmap offering enterprise, exabyte-scale storage solutions that help customers maximize the value of their data. This positions Seagate to deliver meaningful value for both customers and shareholders. However, FX swings, macro volatility, debt risks and stiff rivalry loom over STX’s near-term prospects.

Ultimately, investors should combine fundamental analysis, risk tolerance and portfolio allocation discipline to make informed decisions around this. The stock appears to be treading in the middle of the road, and new investors could be better off if they trade with caution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 18 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite