|

|

|

|

|||||

|

|

West Pharmaceutical Services WST recently announced the global commercial availability of the West Synchrony S1 prefillable syringe (PFS) system at Pharmapack 2026 in Paris, France. The new system expands the company’s injectable drug administration portfolio and is designed to support a broad range of biologics and vaccine applications. WST will also showcase its leadership, technical expertise and insights into key industry challenges and emerging trends related to packaging and containment systems for injectable medicines.

Per management, the launch is aligned with shifts in the global drug development pipeline, particularly the growing demand for combination products and the continued movement of care from hospital settings to home-based administration, both of which add layers of complexity to regulatory requirements and product development. The accelerating pace of innovation across the pharmaceutical industry underscores the introduction of the West Synchrony S1 prefillable syringe system, as it is designed to address current and future challenges in drug delivery, supporting developers to navigate more complex therapies, regulations and patient-centered care models worldwide.

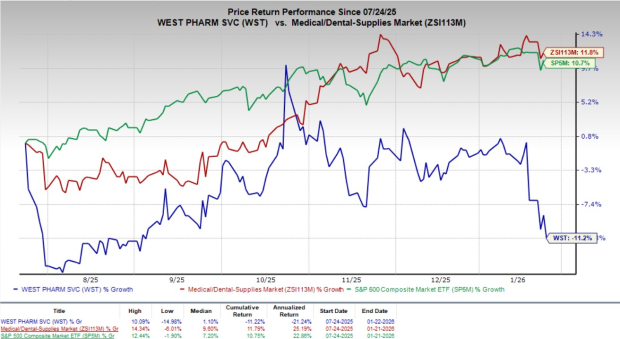

Shares of WST lost 1.1% since the announcement on Tuesday. Over the past six months, shares of the company have declined 11.2% against the industry’s 11.8% growth and the S&P 500’s 10.7% rise.

In the long run, the commercial availability of the Synchrony S1 prefillable syringe system supports WST’s growth strategy by expanding its addressable market in prefillable syringes and reinforcing its leadership in high-value containment and delivery systems. The integrated, system-level platform with pre-generated verification and regulatory data helps customers reduce development time, regulatory complexity and risk.

Its broad portfolio supports both biologics and vaccines, aligning with growing demand for combination products and home-based care. West Pharmaceutical’s ownership of the complete system, supported by comprehensive DMFs across major global markets, enhances customer confidence, accountability and supply reliability. Overall, this innovation is likely to drive revenue growth, reinforce market leadership and support sustained competitive advantage.

WST currently has a market capitalization of $18.36 billion.

The West Synchrony S1 PFS system features a versatile product portfolio designed to address multiple therapeutic applications. It includes 1 mL long and 2.25 mL staked needle systems for biologics, along with 1 mL standard staked needle and Luer lock systems targeted at vaccine delivery. Staked needle systems are offered with either rigid or soft needle shields, while Luer lock systems incorporate an integrated tip cap. The system is further supported by high-performance West NovaPure and FluroTec barrier film plungers, enhancing drug compatibility and overall system performance.

The West Synchrony S1 PFS system includes a pre-generated, system-level verification data package that removes the need for drug-independent device testing, shortening development timelines and enabling earlier design freeze and faster progress to drug-specific and regulatory milestones. The integrated system reduces risks related to order volumes and lead times, ensures clear accountability for quality issues and applies system-level batch testing to verify performance prior to customer inspections.

In addition, WST offers a comprehensive regulatory package with a single DMF covering the full syringe system for the US FDA, Health Canada and China. The package also includes required documentation for European technical file submissions, simplifying global regulatory alignment. By introducing Synchrony S1 at this stage of industry evolution, WST reinforces its role as a long-term partner to drug developers, supporting them through development, regulatory approval and commercialization while driving recurring demand for its proprietary containment and delivery solutions.

Going by data provided by Precedence Research, the prefilled syringes market is anticipated to be valued at $24.13 billion in 2026 and is expected to witness a CAGR of 11.6% through 2035. Factors like rising demand for safe and convenient drug delivery systems, technological advancements, and rising use of biologics, vaccines and injectable therapies, including therapeutic proteins and biosimilars, are driving the market’s growth.

West Pharmaceutical recently announced that it has entered into a definitive agreement to divest all manufacturing and supply rights related to the SmartDose 3.5 mL On-Body Delivery System, along with associated facilities, to AbbVie. The transaction is valued at $112.5 million, subject to customary working capital and other adjustments and is expected to be completed in mid-2026.

West Pharmaceutical Services, Inc. price | West Pharmaceutical Services, Inc. Quote

Currently, WST carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are Veracyte VCYT, Cardinal Health CAH and The Cooper Companies COO.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.6% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Cardinal Health, currently carrying a Zacks Rank #2, reported a first-quarter fiscal 2026 adjusted EPS of $2.55, which surpassed the Zacks Consensus Estimate by 15.4%. Revenues of $64.0 billion beat the Zacks Consensus Estimate by 8.4%.

CAH has an estimated long-term earnings growth rate of 14.7% compared with the industry’s 9.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 9.4%.

The Cooper Companies, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of $1.15, which surpassed the Zacks Consensus Estimate by 3.6%. Revenues of $1.06 billion beat the Zacks Consensus Estimate by 0.5%.

COO has an estimated long-term earnings growth rate of 7.8% compared with the industry’s 9.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 2.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite