|

|

|

|

|||||

|

|

Microsoft MSFT is slated to report second-quarter fiscal 2026 results on Jan. 28.

The Zacks Consensus Estimate for revenues is pegged at $80.23 billion, indicating growth of 15.22% from the figure reported in the year-ago quarter.

The consensus mark for earnings has remained steady at $3.88 per share over the past 30 days, suggesting 20.12% year-over-year growth.

In the last reported quarter, the company delivered an earnings surprise of 13.15%. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 8.53%.

Microsoft Corporation price-eps-surprise | Microsoft Corporation Quote

Our proven model does not conclusively predict an earnings beat for Microsoft this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

MSFT has an Earnings ESP of 0.00% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Microsoft's fiscal second-quarter 2026 results are likely to be supported by accelerated AI agent adoption, strengthened product positioning following Microsoft Ignite 2025, and robust enterprise demand across its cloud and productivity segments during the October-December 2025 period.

Microsoft projected revenues between $33.3 billion and $33.6 billion for Productivity and Business Processes, representing growth of 11% to 12%, with the Zacks Consensus Estimate indicating 13.8% year-over-year growth to $33.4 billion.

Within this segment, Microsoft 365 commercial cloud revenue growth is expected to be between 13% and 14% in constant currency (cc). The segment is expected to have benefited from continued E5 suite adoption and accelerating Copilot deployment.

The landmark Microsoft Ignite 2025 conference held in November represented a pivotal moment for the company's AI strategy. The introduction of Work IQ, the intelligence layer enabling Microsoft 365 Copilot to understand individual users, their roles, and company-specific context, represented a significant advancement in personalization capabilities. Agent Mode launched within Word, Excel, and PowerPoint in November, enabling users to work iteratively with Copilot to create high-quality documents, spreadsheets, and presentations through AI-powered collaboration.

The bundling of Microsoft Security Copilot with Microsoft 365 E5 licenses, which began rolling out on Nov. 18, provided substantial added value to enterprise customers. E5 subscribers received 400 Security Compute Units monthly for every 1,000 user licenses, along with access to 12 new Microsoft-built agents across Defender, Entra, Intune, and Purview.

The launch of Microsoft 365 Copilot Business on Dec. 1 addressed the small and medium business market at $21 per user monthly for companies with fewer than 300 users, with bundled offerings and promotional campaigns potentially stimulating year-end purchasing activity.

The general availability of SQL Server 2025, announced at Ignite and available for Cloud Solution Provider partners beginning Dec. 17, featured near-real-time data mirroring into OneLake and enhanced capabilities, including GitHub Copilot integration within SQL development tools.

LinkedIn revenues are expected to grow approximately 10%, while Dynamics 365 revenue growth is projected to be in the mid to high teens, with continued growth across all workloads.

The Intelligent Cloud segment is likely to have remained capacity-constrained during the quarter despite aggressive data center expansion. Management projected revenues between $30.9 billion and $31.2 billion, representing growth of 25% to 26%, with Azure revenue growth expected to be 36% in cc. The consensus mark for this segment is pegged at $32.4 billion, indicating growth of 26.9% from the figure reported in the year-ago quarter.

The Microsoft Ignite announcements substantially enhanced Azure's enterprise AI positioning. The introduction of Agent 365 provided a control plane for managing and securing AI agents, addressing critical governance requirements. The unveiling of the IQ Stack architecture, including Foundry IQ and Fabric IQ, represented a fundamental advancement in providing AI agents with reliable, permission-aware knowledge and real-time business context.

Azure AI Foundry received substantial enhancements enabling organizations to build, train, deploy, and manage custom agents with enterprise-grade capabilities. The commercial remaining performance obligation of $392 billion reported in the prior quarter continued to provide substantial visibility into future revenue streams.

For the on-premises server business, Microsoft expects revenues to decline in the low to mid-single digits with ongoing customer shift to cloud offerings.

Microsoft projected More Personal Computing revenues between $13.4 billion and $13.8 billion for the quarter, with the Zacks Consensus Estimate indicating a 2.6% year-over-year decline to $14.2 billion.

According to the preliminary results from the International Data Corporation Worldwide Quarterly Personal Computing Device Tracker, fourth-quarter 2025 worldwide PC shipments reached 76.4 million units, up 9.6% year over year. The competitive landscape shows strong results, with Lenovo LNVGY, Hewlett Packard HPE and Dell Technologies DELL achieving 14.4%, 12.1% and 18.2% shipment growth, respectively.

Microsoft’s Windows OEM and Devices revenues are expected to have declined in the mid-single digits percent overall, with Windows OEM revenues specifically expected to decline in the low to mid-single digits.

Gaming faced challenging comparisons, with Xbox content and services revenues expected to decline in the low to mid-single digits against strong prior-year performance. However, platform enhancements, including Gaming Copilot availability on mobile devices in November and Xbox Cloud Gaming expansion into India, strengthened competitive positioning.

Search and news advertising ex-TAC revenues are likely to have grown in the low double digits, with AI-powered capabilities enhancing user engagement and monetization.

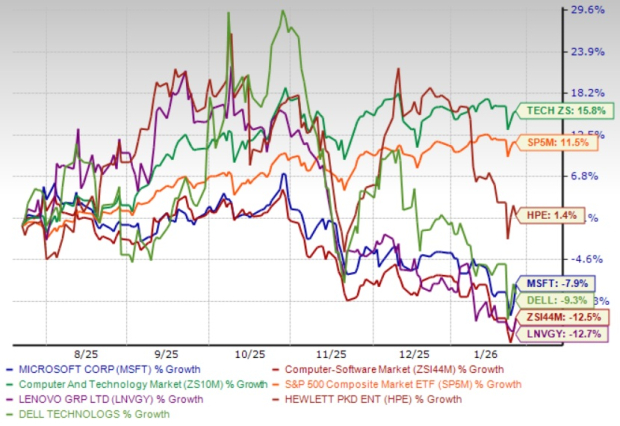

Shares of MSFT have declined 7.9% in the past six-month period compared with the broader Zacks Computer & Technology sector’s growth of 15.8%. Shares of HPE have gained 1.4%, while LNVGY and DELL have lost 12.7% and 9.3%, respectively.

Now, let’s look at the value Microsoft offers investors at current levels. MSFT is trading at a premium with a forward 12-month P/S of 9.84X compared with the Zacks Computer - Software industry’s 8.65X, reflecting a stretched valuation.

Microsoft represents a compelling buy opportunity ahead of fiscal second-quarter 2026 results despite premium valuation, as the company's dominant positioning in enterprise AI transformation justifies current multiples. The landmark Ignite 2025 announcements — Work IQ, Agent 365, and the IQ Stack — positioned Microsoft as the comprehensive platform for agentic business models, driving accelerated adoption across its $392 billion backlog. Expected Azure growth of 36% in cc, sustained Microsoft 365 Copilot momentum enhanced by Security Copilot bundling with E5 licenses, and the Windows 11 upgrade cycle supporting PC market strength create multiple expanding revenue streams. While competition exists, Microsoft's integrated ecosystem spanning productivity, cloud infrastructure, AI development tools, and security capabilities establishes unmatched competitive moats that warrant premium positioning for long-term investors.

Microsoft's fiscal second-quarter 2026 results are positioned to demonstrate AI leadership transformation into financial performance. Accelerating Azure growth, expanding Copilot adoption enhanced by Work IQ and Agent 365, robust enterprise demand, and strengthening competitive moats create compelling upside. Investors may buy shares ahead of earnings, as Microsoft's platform strategy positions the company for sustained growth despite premium valuation and competition.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite