|

|

|

|

|||||

|

|

Merit Medical Systems, Inc. MMSI is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism, led by a solid performance in 2025 and its continued spending on research and development (R&D), is expected to contribute further. However, macro headwinds and forex volatility persist.

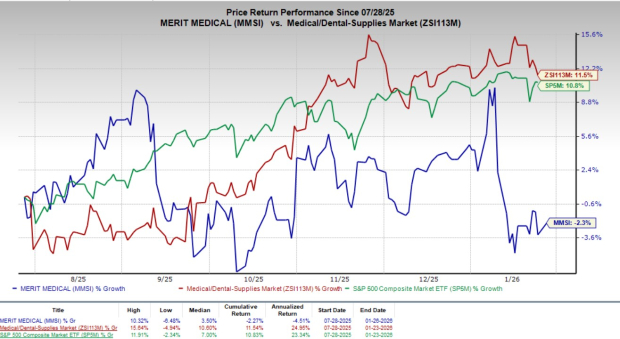

This Zacks Rank #2 (Buy) company’s shares have declined 2.3% over the past six months against the industry’s 11.5% growth. The S&P 500 has climbed 10.8% during the same time frame.

The renowned medical device provider has a market capitalization of $4.8 billion. The company projects 10.3% growth for the next five years and expects to maintain its strong performance going forward. It delivered an average earnings surprise of 14.1% for the past four quarters.

Let’s delve deeper.

WRAPSODY CIE Reimbursement Tailwinds & Portfolio Expansion: WRAPSODY CIE is emerging as a significant growth engine for Merit Medical as the company moves into 2026, supported by favorable reimbursement dynamics and portfolio synergies. Inpatient reimbursement is already in place following the implementation of NTAP on Oct. 1, 2025. Management highlighted encouraging early signs of adoption, including growing physician interest, extensive training efforts and improved hospital access.

The expected initiation of outpatient and ASC reimbursement under Transitional Pass-Through (TPT) as early as January 2026 could expand the addressable market and remove one of the key barriers to broader utilization. With more than 500 physicians already trained, Merit Medical has built a strong foundation for accelerated adoption once reimbursement coverage widens.

WRAPSODY is not being commercialized in isolation; it is driving meaningful pull-through across the broader dialysis portfolio, reinforcing growth in the Renal Therapies segment. As reimbursement friction diminishes across care settings, WRAPSODY is well positioned to transition from early commercialization to scaled utilization in 2026, supporting both top-line growth and favorable product mix-driven margin expansion.

Expanding High-Margin Product Portfolio & Innovation Pipeline: Merit Medical continues to expand its high-margin product portfolio through a steady flow of differentiated and clinically validated innovations, reinforcing its long-term growth outlook. Recent product launches and milestones, such as the Prelude Wave sheath introducer with SnapFix securement technology, the Scout Radar localization platform reaching over 750,000 patients globally, and the CE Mark approval for Embosphere Microspheres in genicular artery embolization, highlight the company’s focus on addressing unmet clinical needs while opening new treatment markets, including nonsurgical solutions for knee osteoarthritis.

The acquisition of the C2 CryoBalloon expands MMSI’s presence in endoscopy, particularly in Barrett’s esophagus and gastrointestinal ablation therapies. These products compete on performance and clinical outcomes rather than price, enabling effective sales force cross-selling and supporting a higher gross margin profile. As MMSI enters 2026, this broader and higher-value product mix is expected to drive sustainable organic growth, enhance pricing power and underpin continued margin expansion, aligning with the company’s long-term CGI objectives.

Margin Expansion & Strong Free Cash Flow Execution: Merit Medical’s strong and growing free cash flow generation will remain a core strategic pillar in 2026, anchored by gross margin expansion, disciplined capital allocation and operational execution under the CGI framework. While 2025 marked an inflection point, the company made it clear that free cash flow strength is expected to continue and scale into 2026 and beyond.

A key long-term target highlighted by management is the CGI goal of generating more than $400 million in cumulative free cash flow through 2026, which reflects confidence in sustained cash generation driven by higher gross margins. The gross margin expansion is the primary driver of free cash flow, supported by favorable product mix, pricing discipline and manufacturing efficiency improvements.

Strong cash flow provides MMSI with the capacity to fund R&D and targeted acquisitions while strengthening balance sheet flexibility and underpinning confidence in delivering its multi-year profitability and cash flow objectives through 2026.

Reimbursement & Policy Uncertainty: Despite the positive momentum around reimbursement, uncertainty remains a key risk factor for Merit Medical going forward. Final confirmation and precise timing of TPT reimbursement for WRAPSODY could still shift due to regulatory review processes or broader government-related delays affecting the pace of adoption outside the inpatient setting.

In addition, tariff risk remains material, with variability depending on future trade policy decisions, which could influence costs and margins. Changes in healthcare policy can impact procedure volumes, pricing dynamics and hospital purchasing behavior, introducing additional variability into demand trends. As a result, MMSI’s growth expectations for WRAPSODY and its margin trajectory are dependent on stable reimbursement and trade conditions — factors that remain outside the company’s direct control and could create near-term volatility if conditions change unfavorably.

Macroeconomic Headwinds and OEM Revenue Volatility: Merit Medical’s exposure to global macro conditions, particularly in China and within its OEM business, represents a challenge that could affect growth consistency. Modest declines in China-related sales are driven by broader macroeconomic weakness, with the impact most visible in OEM demand, which tends to be more sensitive to economic cycles and customer inventory adjustments.

OEM revenues are volatile, with quarter-to-quarter fluctuations influenced by customer ordering patterns rather than underlying end-market demand. Although core China volumes remain healthy, persistent pricing pressure and continued economic uncertainty could extend into 2026. If macro conditions in China remain under pressure or OEM volatility persists, international growth could be muted, and earnings variability may increase, creating headwinds.

Merit Medical Systems, Inc. price | Merit Medical Systems, Inc. Quote

MMSI is witnessing a positive estimate revision trend for 2026. In the past 60 days, the Zacks Consensus Estimate for earnings per share (EPS) has moved north 1.5% to $4.05.

The Zacks Consensus Estimate for the company’s first-quarter 2026 revenues is pegged at $379.6 million, suggesting a 6.8% rise from the year-ago reported number. The consensus mark for EPS is pegged at 89 cents, implying a 3.5% improvement from the prior-year reported figure.

Other top-ranked stocks from the broader medical space are Veracyte VCYT, Cardinal Health CAH and The Cooper Companies COO.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated earnings recession rate of 3% for 2026. VCYT’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 45.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Veracyte’s shares have surged 62.1% compared with the industry’s 4.9% growth over the past six months.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 14.7%. CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 9.4%.

Cardinal Health’s shares have gained 34.9% compared with the industry’s 11.5% growth over the past six months.

The Cooper Companies, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 7.8%. COO’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 2.4%.

The Cooper Companies’ shares have gained 10.9% compared with the industry’s 11.5% growth over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite