|

|

|

|

|||||

|

|

Merck MRK will report its first-quarter 2024 earnings on April 24, before market open. The Zacks Consensus Estimate for first-quarter sales and earnings is pegged at $15.48 billion and $2.16 per share, respectively. Earnings estimates for Merck for 2025 have declined from $9.01 to $8.96 per share over the past 30 days. (Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

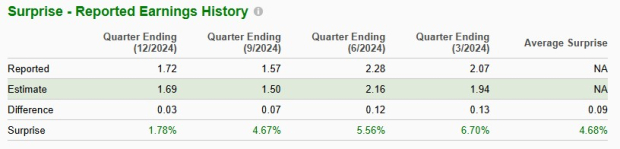

The healthcare bellwether’s performance has been solid, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 4.68%, on average. In the last reported quarter, the company delivered an earnings surprise of 1.78%, as seen in the chart below.

Merck has an Earnings ESP of -2.04% and a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1, #2 (Buy) or #3 have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Merck’s top-line growth in the first quarter is likely to have been driven by cancer drug Keytruda, as in several previous quarters, aided by additional indications and patient demand.

In oncology drugs, Keytruda sales are likely to have been driven by rapid uptake across earlier-stage indications globally, particularly early-stage non-small cell lung cancer. Continued strong momentum in metastatic indications is also likely to have boosted sales growth. The Zacks Consensus Estimate for Keytruda’s sales is $7.55 billion, while our estimate is $7.82 billion.

In the fourth quarter, U.S. sales of Keytruda benefited from approximately $200 million of wholesale inventory buy-in, which is expected to have reversed in the first quarter of 2025.

Higher alliance revenues from Lynparza, driven by increased demand, may have boosted oncology sales. Please note that Merck markets Lynparza in partnership with AstraZeneca AZN.

Merck has a profit-sharing deal with AstraZeneca to co-market Lynparza and Koselugo. AstraZeneca and Merck’s Lynparza is approved for four cancer types, ovarian, breast, prostate and pancreatic. Lynparza is also being evaluated in combination with Keytruda in late-stage studies for lung cancer indications.

Alliance revenues from Lenvima may have also boosted oncology sales.

Sales of new drug Welireg are likely to have benefited from the increased uptake for the additional indication of previously treated advanced renal cell carcinoma in the United States.

With regard to the HPV vaccine, Gardasil, ex-U.S. sales are expected to have been hurt by lower demand in China due to unfavorable economic conditions. Sales are likely to have increased in the United States due to higher pricing and demand. The Zacks Consensus Estimate for Gardasil is $1.33 billion, while our estimate is $1.28 billion.

In the hospital specialty portfolio, generic competition in certain ex-U.S. markets, mainly Europe and the Asia Pacific region, is likely to have hurt sales of neuromuscular blockade medicine — Bridion injection. However, higher demand and pricing are expected to have benefited U.S. sales. The Zacks Consensus Estimate for Bridion is $422.7 million, while our estimate is $410.0 million.

Lower demand and pricing in the United States and generic competition in certain international markets, mainly Europe and Asia Pacific, are likely to have hurt sales of the diabetes franchise (Januvia/Janumet).

New pulmonary arterial hypertension (PAH) drug Winrevair is likely to have contributed to sales growth with most sales coming from the U.S. market as the company is steadily adding new patients. Another new vaccine, Capvaxive, is also off to an encouraging start in the United States. Investors will be keen to know the sales numbers of Capvaxive, which was approved in the European Union toward the end of March.

The Zacks Consensus Estimate for Merck’s Pharmaceutical unit is $13.64 billion, while our estimate is $13.82 billion.

On the fourth-quarter conference call, the company had guided that Medicare Part D redesign is expected to hurt sales of Winrevair and oncology products, including Welireg, Lynparza and Lenvima in 2025. An update is expected on the first-quarter conference call.

In the Animal Health franchise, growth in both companion animal and livestock products driven by higher demand and pricing is likely to have contributed to sales. The Zacks Consensus Estimate for the Animal Health unit is $1.61 billion, while our estimate is $1.58 billion.

Nonetheless, a single quarter’s results are not important for long-term investors. Let's delve deeper to understand whether to buy, sell or hold Merck stock.

Merck’s stock has declined 21.1% so far this year compared with a decrease of 2.4% for the industry. The stock has also underperformed the sector and the S&P 500 Index, as seen in the chart below.

From a valuation standpoint, Merck appears attractive relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 8.44 forward earnings, lower than 15.07 for the industry as well as its 5-year mean of 13.10. Merck’s stock is also cheaper than most other large drugmakers like AbbVie, AstraZeneca, Novo Nordisk and Eli Lilly (LLY).

Merck boasts more than six blockbuster drugs in its portfolio, with the blockbuster PD-L1 inhibitor Keytruda being the key top-line driver. Merck’s animal health and vaccine products are core growth drivers. It has a strong cancer pipeline, including Keytruda. Merck made meaningful regulatory and clinical progress in 2024 across areas like oncology (mainly Keytruda), vaccines and infectious diseases while executing strategic business moves like the acquisitions of Eyebiotech Limited and Harpoon Therapeutics.

However, Merck is heavily reliant on Keytruda. Though Keytruda may be Merck’s biggest strength and a solid reason to own the stock, it can also be argued that the company is excessively dependent on the drug and should look for ways to diversify its product lineup. There are rising concerns about the firm’s ability to grow its non-oncology business ahead of the upcoming loss of exclusivity of Keytruda in 2028.

Also, competitive pressure might increase for Keytruda in the near future. In 2024, Summit Therapeutics SMMT reported positive data from a phase III study (conducted in China by partner Akeso) in patients with locally advanced or metastatic NSCLC, in which its lead pipeline candidate, ivonescimab, a dual PD-1 and VEGF inhibitor, outperformed Keytruda. Summit believes iivonescimab has the potential to replace Keytruda as the next standard of care across multiple NSCLC settings.

The company’s second-largest product, Gardasil, is also seeing grim sales in China. Merck is also seeing weakness in the diabetes franchise and the generic erosion of some drugs.

Merck has one of the world’s best-selling drugs in its portfolio, generating billions of dollars in revenues. Though Keytruda will lose patent exclusivity in 2028, its sales are expected to remain strong until then.

However, the company’s problems are too many at present, including persistent challenges for Gardasil in China, potential competition for Keytruda and a bearish outlook for 2025. All these factors have raised doubts about Merck’s ability to navigate the Keytruda loss of exclusivity period successfully.

No matter how the first-quarter results play out, we suggest that investors with a long-term horizon should stay invested as Merck has strong fundamentals. However, short-term investors should consider selling the stock as the company may take some time to show strong earnings growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 13 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite