|

|

|

|

|||||

|

|

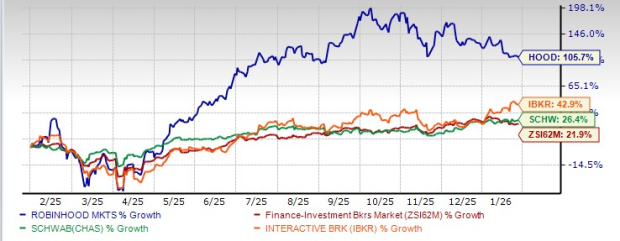

Robinhood Markets HOOD has had an eventful past year, marked by its addition to the S&P 500, a wave of new product launches, a strong crypto cycle and unusually volatile markets. These led to solid performance and resulted in bullish investor sentiments for the stock.

As such, over the past year, shares of HOOD have soared 105.6% compared with 28.1% rally for the industry. In the same time frame, its close peers, Charles Schwab SCHW and Interactive Brokers IBKR have gained 26.4% and 42.9%, respectively.

One-Year Price Performance

The key question is whether this rally can sustain itself or if HOOD has already priced in the upside. Let’s assess the fundamental and market catalysts that may continue to support the stock.

Product Launches & Global Expansion: Robinhood is boosting its growth through aggressive product innovation and global expansion, positioning itself as a next-generation fintech ecosystem.

Major 2025 launches include Robinhood Cortex, an AI assistant that allows users to build custom indicators, analyze markets and access real-time AI-driven news insights. The Legend platform enhances advanced trading with futures access, short selling, simulated options returns and nearly 24/5 index options trading. Robinhood Social introduces a verified trading community for sharing strategies and tracking expert portfolios, with copy trading coming soon.

Further, banking services and a Gold credit card extend Robinhood’s reach into personal finance, aiming to become a digital banking alternative. AI integration and rapid product rollouts are driving engagement and monetization through premium tiers. Social and community features aim to boost retention and virality, while expanded trading tools attract both retail and professional users.

Globally, Robinhood is pioneering tokenized U.S. stocks and ETFs across 31 EU and EEA countries, offering 24/5 commission-free trading and plans to tokenize private companies. Broader crypto services, a proprietary blockchain and future global banking products are underway. With new offices in Toronto and plans for Asia-Pacific growth via acquisitions of Indonesia-based PT Buana Capital Sekuritas and PT Pedagang Aset Kripto, Robinhood seeks to diversify revenues and establish itself as a global fintech leader by blending traditional finance and digital innovation.

Business Diversification Efforts: Robinhood has evolved from a brokerage firm primarily trading in digital assets to a more mature and diversified entity, striving to expand its market reach. Looking at the numbers, in 2021, it mainly relied on transaction-based revenues (almost 75% of total revenues) to generate income. In the first nine months of 2025, this came down to nearly 55%.

HOOD is betting big on the lucrative prediction markets and, in a partnership with Susquehanna International Group, is acquiring a 90% stake in MIAX Derivatives Exchange (a CFTC-licensed derivatives exchange). Through this, the company intends to launch a dedicated futures and derivatives exchange and clearinghouse by 2026.

Robinhood’s other initiatives underscore its ambition to evolve into a full-scale financial services platform. In February, it acquired TradePMR, an assets under administration custodian and portfolio management platform for Registered Investment Advisors, strengthening its credibility in wealth management and positioning it to compete directly with incumbents like Schwab.

Likewise, Interactive Brokers and Schwab have been expanding their product suites aggressively. IBKR has added daily options on European indices and broadened crypto trading capabilities, including stablecoin funding and staking. Interactive Brokers also launched "Connections," a proprietary feature integrating global markets to provide clients access to stocks, options, futures, currencies and bonds across more than 160 markets worldwide.

Meanwhile, Schwab announced a deal to acquire Forge Global Holdings, Inc. for roughly $660 million in cash. This aligns with its strategy to offer private market capabilities to retail and advisor clients, leveraging its comprehensive suite of wealth, advisory and investment management solutions, to address the complex needs of investors.

Focus on Crypto: Robinhood’s focus on the cryptocurrency space, through increased tokenization, enhanced platform capabilities and expansion into EU markets, is expected to drive greater cost efficiency and revenue growth going forward. The company is actively pursuing Markets in Crypto-Assets Regulation (MiCA) licenses, which would enable it to offer crypto services across the European Economic Area, expanding its reach to 27 countries.

The acquisition of Bitstamp (closed in June 2025) and the impending WonderFi deal (expected to close in the first half of 2026) align with this broader strategy. Bitstamp’s core spot exchange, offering more than 85 tradable assets, will significantly strengthen Robinhood’s crypto product suite. Further, WonderFi brings two of Canada’s leading regulated crypto platforms, Bitbuy and Coinsquare, with more than C$2.1 billion in assets under custody. These will enable Robinhood to provide trading, staking and custody services.

As the platform diversifies and enhances its offerings, Robinhood’s cryptocurrency revenues are well-positioned for growth, supported by increasing investor interest in crypto as both a return-generating and diversification tool. Currently, the company supports several major cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, Litecoin, Solana and Toncoin. In the first nine months of 2025, crypto transaction revenues soared 154% year over year to $680 million, driven by impressive trading volume.

With mainstream adoption of cryptos, Robinhood is expected to witness another year of robust revenue growth from it. Also, through this, the company is likely to better cross-sell into subscriptions, cash and other services, which will further drive the top line. Looking ahead, favorable regulatory changes and product updates, including support for tokens, wallet features, staking/earn programs (where permitted) and international availability, are expected to augment transaction-based revenues and user engagement.

Litigation & Probes: Robinhood operates in a heavily regulated space, leaving it vulnerable to fines and oversight actions that can constrain growth. Recent probes underscore this risk: Florida is investigating Robinhood Crypto for deceptive marketing, while Lithuania’s central bank is reviewing its tokenized equity products. Between 2023 and 2025, the company also paid more than $80 million in fines across securities violations, identity-verification failures, crypto withdrawal issues and product-oversight shortcomings. Together, these actions highlight Robinhood’s ongoing compliance challenges.

Dependence on Volatile Revenue Streams: A large portion of HOOD’s business is tied to transaction-driven activity, including options trading, equities turnover and crypto trading. These categories are highly sensitive to market cycles, investor sentiment and shifts in risk appetite. During periods of volatility or bullish momentum, revenues can surge, but they can fall just as quickly when markets cool, trading volumes fall or retail engagement declines. This creates an inherently uneven earnings profile, making Robinhood’s results less predictable and more exposed to macro and sentiment-driven swings than traditional, fee-based financial firms.

On the liquidity front, Robinhood is on solid ground. As of Sept. 30, 2025, it reported cash and cash equivalents of $4.3 billion. In 2024, it announced a share buyback plan (for the first time) to repurchase up to $1 billion of its outstanding common stock. In April 2025, the company increased its existing authorization by $500 million to $1.5 billion. As of Sept. 30, 2025, almost $690 million worth of shares remained available for repurchase. HOOD plans to complete the remainder of its total authorization by 2027.

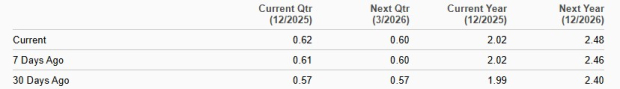

Over the past 30 days, the Zacks Consensus Estimate for 2025 and 2026 has been revised upward to $2.02 and $2.48, respectively. This suggests a bullish sentiment among analysts.

Estimate Revision Trend

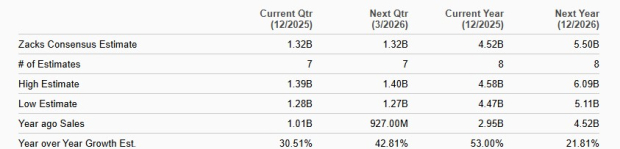

The Zacks Consensus Estimate for HOOD’s earnings implies 85.3% and 22.8% year-over-year growth for 2025 and 2026, respectively. Also, the consensus mark for 2025 and 2026 revenues suggests a year-over-year jump of 53% and 21.8%, respectively.

Sales Estimates

Robinhood’s business transformation is far beyond its brokerage roots. Rapid product innovation continues to deepen client engagement and expand monetization. Global expansion efforts further strengthen its positioning as a next-generation fintech platform.

A sharp reduction in reliance on transaction-based revenues, alongside major moves into prediction markets, wealth management and crypto infrastructure, highlights HOOD’s maturing, diversified business model. Further, surging crypto revenues and strategic acquisitions reinforce growth potential. With a strong balance sheet, buybacks and upwardly trending analyst estimates, Robinhood stock looks like a compelling bet.

Nonetheless, HOOD shares trade at a massive premium to the industry. At present, the company has a price/tangible book (P/TB) of 12.06X for the trailing 12 months compared with the industry average of 3.11X.

Robinhood’s P/TB TTM

Moreover, HOOD stock is expensive compared with Schwab and Interactive Brokers. Schwab and Interactive Brokers have a trailing 12-month P/TB of 7.91X and 1.65X, respectively.

After a 105.6% run in a year, much of Robinhood’s upside — from S&P 500 inclusion, product momentum and the crypto upcycle — looks priced in. The stock also trades at a steep valuation premium versus the industry and peers, limiting near-term upside. Still, current holders can retain it on strong liquidity, buybacks and improving earnings trends.

At present, HOOD carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 7 hours | |

| 15 hours | |

| 18 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

From dabblers to day traders, individual investors' impact on Wall Street grows

HOOD

Associated Press Finance

|

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite