|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Chipotle Mexican Grill, Inc. CMG and Sweetgreen, Inc. SG represent two very different ways to play the fast-casual dining theme, making them a compelling head-to-head for investors. CMG brings the heft of a scaled, cash-generating leader with a long track record of traffic resilience and margin discipline, while SG is a newer, growth-oriented concept betting on technology, menu innovation and brand relevance with younger consumers.

As the restaurant industry navigates shifting dining habits and value-conscious customers, along with uneven demand trends, the key question for investors is whether Chipotle's stability and proven execution outweigh Sweetgreen’s longer-term growth potential, or if the latter’s runway justifies the added risk.

Chipotle’s long-term growth story remains anchored in disciplined unit expansion and industry-leading economics. Management reiterated confidence in scaling toward 7,000 restaurants over time, backed by strong new-unit productivity, attractive cash-on-cash returns and minimal cannibalization of existing stores. Even with an aggressive development cadence, new locations are ramping efficiently and recovering quickly, reinforcing Chipotle’s ability to grow its footprint while preserving returns and brand strength.

Another major positive is Chipotle’s renewed focus on operational execution and throughput improvements. The rollout of high-efficiency kitchen equipment is already showing early benefits, including better labor efficiency, faster prep times and improved guest satisfaction. These operational upgrades, combined with retraining efforts and incentive realignment, position the company to handle peak demand more effectively and support higher transaction volumes once consumer pressure eases.

Menu innovation and digital engagement also stand out as key demand drivers. Limited-time offerings such as new sauces and protein additions have demonstrated an ability to spark trial, lift transactions and increase long-term customer value. At the same time, Chipotle’s loyalty initiatives and gamified digital promotions are improving engagement among infrequent users, giving the brand multiple levers to reignite traffic without relying on heavy discounting.

Despite these strengths, near-term performance is being held back by persistent macro-driven traffic softness. Management acknowledged ongoing pressure from lower and middle-income consumers and younger diners, cohorts that make up a meaningful portion of Chipotle’s sales base. With the company choosing not to fully offset rising input costs through pricing, margins are likely to remain under pressure in the near term, creating a temporary trade-off between protecting value perception and delivering earnings leverage.

Sweetgreen’s transformation narrative is gaining structure and discipline, which strengthens its long-term investment appeal. Management has clearly outlined the Sweet Growth Transformation Plan, centered on operational excellence, brand relevance, menu innovation, digital personalization and disciplined capital allocation. Early signs are encouraging; the share of restaurants meeting internal operating standards has improved meaningfully, while initiatives like Project One Best Way and enhanced throughput metrics are beginning to standardize execution across the system. These steps should gradually improve consistency, guest satisfaction and restaurant-level performance as they scale across the fleet.

Another major positive is Sweetgreen’s continued commitment to menu quality and differentiation, which reinforces its brand moat in the fast-casual space. The company is leaning into protein-forward offerings, larger portions and transparent ingredient sourcing to better communicate value to customers. Upcoming innovations, such as a new steak bowl, steak plate and a handheld product test in early 2026, expand the brand’s relevance across more dining occasions. At the same time, management is reassessing menu and pricing architecture to create clearer entry points and trade-up options — an important lever to drive frequency and rebuild traffic without diluting the premium brand image.

Financial flexibility has also improved following the strategic sale of the Spyce automation unit to Wonder. The transaction is expected to add roughly $100 million in liquidity, reduce annual G&A expenses and allow Sweetgreen to continue benefiting from Infinite Kitchen technology without the burden of owning and scaling the platform internally. Importantly, Infinite Kitchen restaurants are already delivering material labor and cost-of-goods advantages, supporting margins and throughput. This move sharpens management’s focus on core restaurant operations while strengthening the balance sheet, positioning the company to pursue profitable growth with greater discipline.

Despite these strategic positives, Sweetgreen’s near-term fundamentals remain pressured. The company reported a sharp same-store sales decline, due to weaker traffic, softer demand among younger consumers and pronounced underperformance in key markets such as the Northeast and Los Angeles. Margin erosion has been significant, with restaurant-level margins and adjusted EBITDA deteriorating year over year due to sales deleverage, higher labor costs and increased food expenses tied to protein portion investments.

While management expects improvement over time, the path to sustained traffic recovery and profitability is still uncertain, leaving SG exposed to ongoing consumer weakness and competitive intensity in the fast-casual landscape.

The Zacks Consensus Estimate for Chipotle’s 2026 sales and earnings per share (EPS) indicates year-over-year increases of 9.8% and 4.2%, respectively. In the past seven days, earnings estimates for 2026 have increased.

The Zacks Consensus Estimate for SG’s 2026 sales and EPS implies year-over-year increases of 9.4% and 13.5%, respectively. In the past seven days, loss estimates for 2026 have widened.

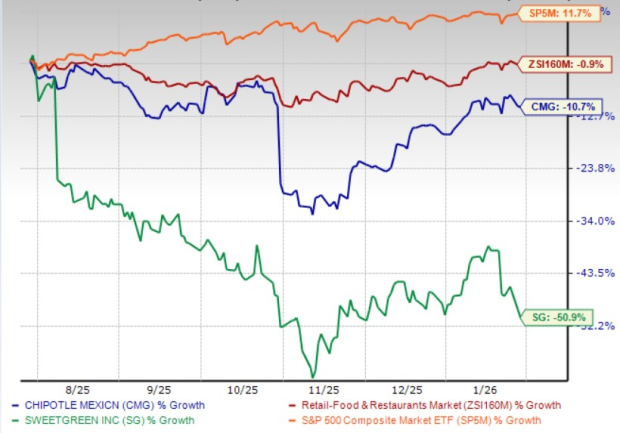

Chipotle’s shares have dropped 10.7% in the past three months. Meanwhile, Sweetgreen stock has tanked 50.9% in the same time frame compared with its industry's decline of 0.9%. The S&P 500 has risen 11.7% in the same period.

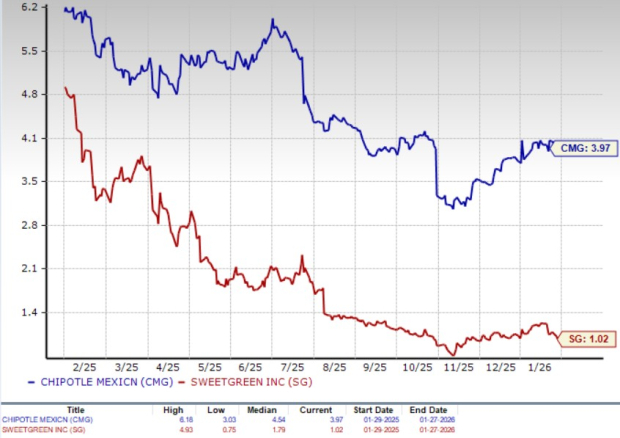

CMG is trading at a forward 12-month price-to-sales (P/S) multiple of 3.97, above the industry average of 3.66 over the last year. SG’s forward 12-month P/S multiple sits at 1.02 over the same time frame.

Taken together, the comparison clearly tilts in favor of Chipotle at this stage of the cycle. While both companies are navigating a cautious consumer backdrop, Chipotle is doing so from a position of strength, with proven unit economics, disciplined expansion and operational improvements that can translate into upside as traffic stabilizes. The company’s ability to protect brand value, invest in efficiency and drive demand through innovation without heavy discounting underscores the durability of its model.

In contrast, Sweetgreen is still in the middle of a multi-year turnaround, facing uneven execution, traffic pressure in key markets and margin volatility that make its recovery less predictable. Even though both stocks carry a Zacks Rank #3 (Hold), Chipotle’s scale, consistency and clearer earnings visibility give it the edge over Sweetgreen for investors seeking a more reliable fast-casual holding right now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite