|

|

|

|

|||||

|

|

Exxon Mobil Corporation XOM is set to report fourth-quarter 2025 results on Jan. 30, before the opening bell.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.68 per share, implying an improvement of 0.6% from the year-ago reported number. It witnessed one downward estimate movement versus three upward revisions in the past 30 days. The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $83.2 billion, suggesting a 0.3% fall from the year-ago actuals.

XOM beat the consensus estimate for earnings in each of the trailing four quarters, with the average surprise being 5.7%. This is depicted in the graph below:

Our proven model doesn’t predict an earnings beat for XOM this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the chances of an earnings beat. That isn’t the case here.

The leading integrated energy player has an Earnings ESP of -0.25%. XOM currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

In its latest 8-K SEC filings, XOM stated that it is likely to see a sequential decline in the December quarter upstream earnings by $800 million to $1.2 billion, due to a decrease in liquid prices.

To have an idea of how oil prices behaved in the December quarter, let's analyze the commodity prices from the data provided by the U.S. Energy Information Administration (“EIA”). The average Cushing, OK WTI spot prices for October, November and December of this year were $60.89 per barrel, $60.06 per barrel and $57.97 per barrel, respectively, per EIA data. Commodity prices were $68.39 per barrel, $64.86 per barrel and $63.96 per barrel, respectively, in July, August and September, according to the EIA. Investors should note that the weakness in the crude pricing environment is also likely to have hurt the upstream businesses of other integrated giants like BP plc BP and Chevron Corporation CVX.

Coming to the natural gas story, XOM projects a change in gas price to either sequentially increase its upstream earnings by $100 million or decrease the earnings by $300 million.

Soft crude pricing environment in the fourth quarter of 2025 is likely to have aided its refining business. ExxonMobil expects its December quarter earnings from its Energy Products business unit to increase by $300 million to $700 million sequentially.

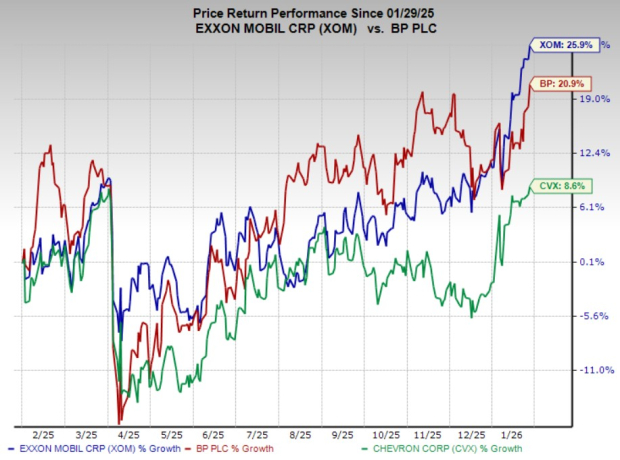

XOM's stock has jumped 25.9% over the past year. BP plc (BP), another integrated energy major, has surged 20.9% over the same time frame, while Chevron Corporation (CVX), in the same space, has gained 8.6%.

One-Year Price Chart

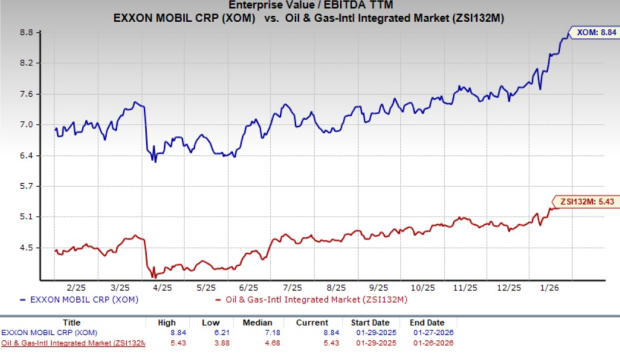

Since the prices of BP and Chevron underperformed ExxonMobil, XOM now appears relatively overvalued. The company's current trailing 12-month enterprise value/earnings before interest, tax, depreciation and amortization (EV/EBITDA) ratio is 8.84, reflecting that it is trading at a premium compared with the industry average of 5.43.

Although the softness in crude prices is likely to have hurt XOM’s upstream business in the fourth quarter, the integrated energy giant’s long-term outlook seems favorable. This is because XOM has a strong footprint in the Permian, the most prolific oil and gas play in the United States, and offshore Guyana. In the Permian, the integrated giant has been employing lightweight proppant technology and hence has been capable of boosting its well recoveries by up to as much as 20%.

In Guyana, XOM has made several oil and gas discoveries, further highlighting its solid production outlook. Notably, record production from both resources has been aiding its top and bottom lines. Importantly, in both resources, the breakeven costs are low, thereby aiding XOM in continuing its upstream business even during a low crude pricing environment. Despite this positive development, the possibility of a relatively lower oil price this year, as forecasted by EIA in its latest short-term energy outlook, will probably hurt XOM’s bottom line, since the integrated energy giant generates the lion's share of its earnings from upstream operations.

Like XOM, Chevron will also report fourth-quarter 2025 earnings on Jan. 30, 2026. CVX currently has an Earnings ESP of -1.45% and a Zacks Rank of 4 (Sell).

Chevron's earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, and missed the same once, with the average surprise being 2.76%.

BP will report fourth-quarter 2025 earnings on Feb. 10, 2026. BP currently has an Earnings ESP of +2.47% and a Zacks Rank of 3.

BP's earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, and missed the same twice, with the average surprise being 5.91%.

Considering the backdrop, it might be wise for investors to wait for a more favorable entry point, as the company is currently somewhat overvalued. Those who own XOM stock may hold on to it to benefit from its long-term growth prospects.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours |

Warren Buffett's company invests in the New York Times six years after he sold all his newspapers

CVX

Associated Press Finance

|

| 2 hours |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

CVX

Investor's Business Daily

|

| 3 hours | |

| 4 hours | |

| 6 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite