|

|

|

|

|||||

|

|

Badger Meter, Inc. BMI reported earnings per share (EPS) of $1.14 for fourth-quarter 2025, which missed the Zacks Consensus Estimate by 0.9%. However, the bottom line compared favorably with the year-ago quarter’s EPS of $1.04.

Quarterly net sales were $220.7 million, up 7.6% from $205.2 million in the year-ago quarter, driven by higher utility water sales. The Zacks Consensus Estimate was pegged at $230.8 million.

For full-year 2025, the company reported sales of $916.7 million, representing an 11% year-over-year increase. EPS increased approximately 13% in 2025 to $4.79 from $4.23 reported in 2024.

Management highlighted that the company’s performance in 2025 marked double-digit revenue growth, expanded profit margins and record free cash flow conversion. Sustained demand, underpinned by long-term secular trends supporting the adoption of smart water management solutions, continues to drive strong, profitable top-line growth.

The company’s 2025 results marked another year of record sales, profitability and cash flow, supported by sustained demand for its smart water management solutions across the entire BlueEdge portfolio. The successful completion of several AMI projects, along with newly awarded projects scheduled to begin implementation in 2026, underscores the clear value proposition driving adoption of its industry-leading cellular AMI solution.

In early 2025, the company deployed available capital to acquire SmartCover, broadening its portfolio to include enhanced sewer monitoring and stormwater management hardware and software capabilities. The integration of SmartCover into the BlueEdge suite strengthens its position for long-term growth across the entire water cycle.

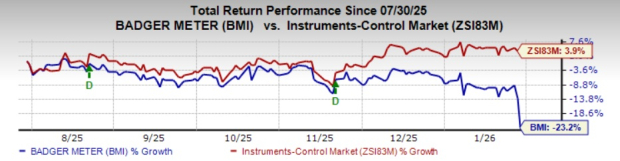

BMI’s shares fell 11% on Wednesday, closing at $146.32 in response to the weaker-than-expected results. In the past six months, shares have lost 23.2% against the Zacks Instruments-Control industry’s growth of 3.9%.

In the quarter under review, utility water sales rose 9% year over year. Even excluding SmartCover, utility water sales were up 2%. The growth was driven by continued customer adoption of digital smart water solutions, including higher sales of ultrasonic meters, ORION Cellular radios, BEACON Software-as-a-Service (SaaS) and water quality offerings.

Flow instrumentation sales were mainly flat year over year, as modest growth in water-focused end markets was offset by declines in de-emphasized applications.

In the fourth quarter, gross profit was $93 million, up from $82.8 million in the prior-year quarter. Gross margin was 42.1%, up 180 basis points (bps) year over year. Gross margin continued to benefit from a favorable structural sales mix, led by above line average contributions from ultrasonic meters, cellular AMI, water quality and SmartCover sales.

Operating earnings jumped around 10% year over year to $43.1 million, while operating margin expanded 40 bps to 19.5% from 19.1%.

Selling, engineering and administration (SEA) expenses rose 14.7% year over year to $49.9 million. This increase was mainly driven by the addition of SmartCover, which included $1.6 million in intangible asset amortization. Base SEA expenses rose 2.9% year over year. Overall, SEA as a percentage of sales rose to 22.6% from 21.2%.

Badger Meter, Inc. price-consensus-eps-surprise-chart | Badger Meter, Inc. Quote

Badger Meter has been selected to help modernize Puerto Rico’s water infrastructure following a rigorous, multi-year competitive pilot conducted by the Puerto Rico Aqueduct and Sewer Authority (PRASA). Under the project, PRASA will deploy Badger Meter’s cellular advanced metering infrastructure (AMI) solution, including E-Series Ultrasonic meters, ORION Cellular endpoints and BEACON SaaS. The initiative is expected to strengthen system resiliency while improving operational efficiency, reducing non-revenue water and streamlining billing for approximately 1.6 million service connections.

In the fourth quarter of 2025, Badger Meter generated $54.8 million of net cash from operating activities compared with $52.1 million a year ago.

As of Dec. 31, 2025, the company had $226 million of cash and cash equivalents and $150.7 million of total current liabilities compared with the respective figures of $201.7 million and $153.4 million as of Sept. 30, 2025.

Management highlighted that the company entered 2026 with strong confidence in its ability to deliver high single-digit sales growth, continued operating margin expansion and free cash flow conversion exceeding 100% of earnings over the next five years. This outlook is supported by growth in its industry-leading cellular AMI installed base, accelerating adoption of BlueEdge technologies and value-accretive international expansion, with the PRASA AMI project exemplifying the scale and quality of opportunities driving our long-term growth.

Base revenue growth in the second half of 2025 was tempered by the completion of several AMI turnkey projects, a dynamic the company expects to continue into the first half of 2026 until newly awarded projects move into multi-year deployment phases. Backed by a proven record of disciplined execution and innovation, management remains well-positioned to capitalize on a strong pipeline of opportunities, deliver differentiated solutions and create long-term value as utilities address increasingly complex water management challenges.

Badger Meter currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Seagate Technology Holdings plc STX reported second-quarter fiscal 2026 non-GAAP earnings of $3.11 per share, beating the Zacks Consensus Estimate of $2.83 and exceeding the high end of management’s guidance of $2.75 per share (+/- 20 cents). The company reported earnings per share (EPS) of $2.03 in the prior-year quarter. The bottom line also expanded 19% quarter over quarter on the back of STX’s strong execution of its strategic objectives and effective use of its technology roadmap to support growing demand. Non-GAAP revenues of $2.83 billion exceeded the Zacks Consensus Estimate by 2.7%. Revenues also surpassed the guidance midpoint, increasing 22% year over year.

Simulations Plus, Inc. SLP reported first-quarter fiscal 2026 adjusted earnings of 13 cents per share, lagging the Zacks Consensus Estimate by 27.8%. The bottom line also compared unfavorably with the prior-year quarter’s 17 cents. Quarterly revenues declined 3% year over year to $18.4 million, reflecting lower software revenue amid strong momentum in services. The top line beat the consensus mark by 2%. Management noted that software softness was expected due to reduced clinical operations and development activity, partially offset by increased demand for discovery-focused solutions.

BlackBerry Limited BB reported third-quarter fiscal 2026 non-GAAP EPS of 5 cents. In the year-ago quarter, it reported non-GAAP EPS of 2 cents. The Zacks Consensus Estimate was pegged at 4 cents per share. BlackBerry reported quarterly revenue of $141.8 million, beating the top end of its guidance ($132-$140 million). The top line, however, dipped 1.3% year over year owing to soft sales across Secure Communications and Licensing arms. The consensus estimate was pinned at $139 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite