|

|

|

|

|||||

|

|

Teva Pharmaceutical Industries TEVA reported fourth-quarter 2025 adjusted earnings of 96 cents per share, which comprehensively beat the Zacks Consensus Estimate of 65 cents. Adjusted earnings rose 35.2% year over year, driven by higher gross profit and tax benefits.

Revenues for the fourth quarter were $4.71 billion, which also beat the Zacks Consensus Estimate of $4.34 billion. Total revenues rose 11% from the year-ago quarter on a reported basis and 9% on a constant currency basis.

TEVA’s top line in the fourth quarter was primarily driven by a $500 million milestone payment received from partner Sanofi SNY related to the development of duvakitug as well as continued strong momentum in branded drugs, Austedo, Ajovy and Uzedy. Revenues were partially offset by lower revenues in the International Markets segments.

TEVA recently initiated phase III studies on its anti-TL1A therapy, duvakitug, for treating ulcerative colitis (UC) and Crohn’s disease (CD). The company has partnered with Sanofi for duvakitug to maximize the value of the asset.

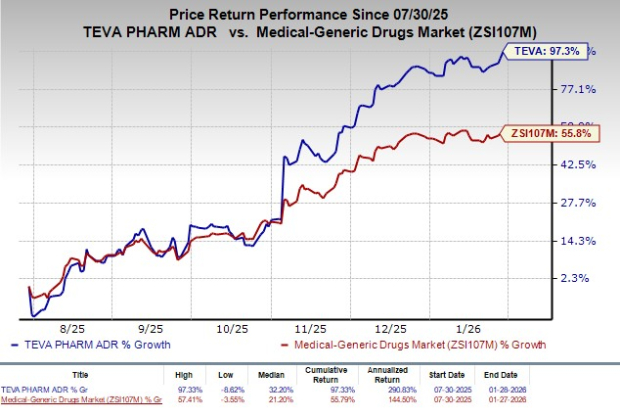

In the past six months, Teva stock has surged 97.3% compared with the industry’s rise of 55.8%.

Sales in the United States segment were $2.64 billion, up 34% year over year, driven by higher revenues from Austedo and a milestone payment from Sanofi related to the duvakitug program. The segment’s sales beat the Zacks Consensus Estimate of $2.14 billion.

Generic/biosimilar product revenues were flat year over year at $673 million in the United States.

Huntington's disease drug, Austedo, recorded sales of $725 million in the United States, up 40% year over year. Sales were mainly driven by volume growth as prescription trends continued to grow. Austedo sales comprehensively beat the Zacks Consensus Estimate of $585 million.

The Austedo franchise got a boost from the launch of Austedo XR, a new once-daily formulation of Austedo.

Ajovy recorded sales of $105 million in the quarter, up 68% year over year, driven by volume growth. Ajovy sales surpassed the Zacks Consensus Estimate of $71 million.

Uzedy (risperidone), a long-acting subcutaneous atypical antipsychotic injection for the treatment of schizophrenia, generated sales of $55 million in the fourth quarter, up 28% year over year, mainly driven by volume growth.

Copaxone recorded sales of $77 million in the United States, up 22% year over year, mainly due to a reduction in sales allowances, partially offset by lower volumes. Copaxone sales beat the Zacks Consensus Estimate of $29.01 million.

The Europe segment recorded revenues of $1.31 billion, down 3% year over year on a reported basis. Sales declined 10% on a constant currency basis, mainly due to lower proceeds from the sale of certain product rights, and lower revenues from generic and OTC products and Copaxone, partially offset by higher revenues from Ajovy. Teva launched Austedo in European markets earlier this month. Europe revenues slightly missed the Zacks Consensus Estimate of $1.32 billion.

The International Markets segment recorded revenues of $528 million, down 20% year over year, both on a reported basis and in constant currency terms. The decrease was mainly due to the divestment of Teva’s business venture in Japan. International Markets revenues missed the Zacks Consensus Estimate of $625 million.

The Other segment (comprising the sales of active pharmaceutical ingredients to third parties and certain contract manufacturing services) recorded revenues of $226 million, down 6% year over year on a reported basis and 9% year over year on a constant currency basis.

Adjusted gross margin was 60.3% in the quarter, up 550 basis points (bps) year over year. The rise was mainly driven by the development milestone from SNY and higher Austedo revenues.

Adjusted research & development expenses increased 8% year over year to $267 million. Selling and marketing expenditure increased 16% year over year to $753 million. General and administrative expenses increased 22% from the prior-year level to $367 million.

Adjusted operating income rose 31% year over year in the fourth quarter to $1.53 billion. Adjusted operating margin increased 490 bps to 32.5% in the quarter, mainly due to higher gross profit margin.

Teva expects an adjusted operating margin of 30% by 2027 to be achieved through cost savings and the continued growth of its branded drugs.

Revenues in 2025 came in at $17.3 billion, representing a 4% year-over-year increase on a reported basis and a 3% increase on a constant currency basis compared with 2024 results. Sales came in ahead of the guided range of $16.8-$17.0 billion.

Adjusted earnings per share (EPS) for the full year were $2.93, which also came in ahead of management’s guided range of $2.55-$2.65 per share.

Teva expects total revenues in the range of $16.4-$16.8 billion for the full year of 2026. The Zacks Consensus Estimate for total sales in 2026 is $16.98 billion.

Per management, the guidance reflects continued strong momentum in TEVA’s innovative portfolio, particularly Austedo, Ajovy, and Uzedy, alongside low single-digit growth in the global generics business.

Teva expects Austedo sales to be in the $2.40-$2.55 billion band and Ajovy sales of approximately $750-$790 million in 2026. TEVA anticipates Uzedy sales to be in the range of $250-280 million in 2026.

The company expects adjusted EPS to be in the range of $2.57-$2.77 in 2026. The Zacks Consensus Estimate for the metric stands at $2.76 per share. The adjusted tax rate is expected to be in the range of 16-19%.

Teva expects adjusted operating income in the band of $4.55-$4.8 billion in 2026. The company expects adjusted EBITDA in the range of $5.0-$5.3 billion. Free cash flow is expected to be in the range of $2.0-$2.4 billion and capital expenditures are expected to be $500 million in 2026.

Teva Pharmaceutical Industries Ltd. price-consensus-eps-surprise-chart | Teva Pharmaceutical Industries Ltd. Quote

Teva currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Alkermes ALKS and Immunocore IMCR, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, estimates for Alkermes’ 2026 earnings per share (EPS) have increased from $1.54 to $1.91. Shares of ALKS have gained 25.6% over the past six months.

Alkermes’ earnings beat estimates in three of the trailing four quarters, while missing the same on the remaining occasion, with the average surprise being 4.58%.

Over the past 60 days, Immunocore’s loss per share estimates for 2026 have decreased from 97 cents to 90 cents. Shares of IMCR have lost 2.3% over the past six months.

Immunocore’s earnings beat estimates in three of the trailing four quarters, while missing the same on the remaining occasion, with the average surprise being 53.96%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 2 hours | |

| 4 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite