|

|

|

|

|||||

|

|

AngioDynamics ANGO has been gaining from its solid prospects with NanoKnife and an increased focus on cancer treatment markets. The optimism, led by a solid second-quarter fiscal 2026 performance, positive ongoing studies and a broad product line, bodes well for the stock.

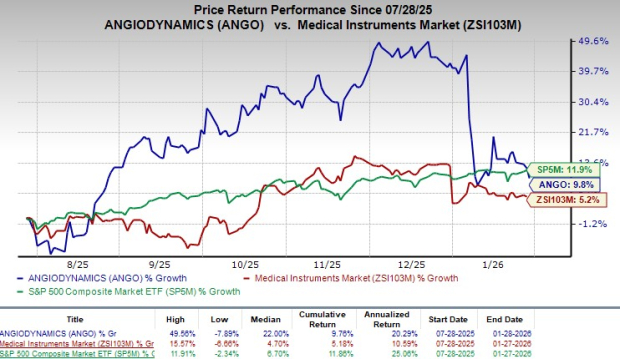

In the last six-month period, the Zacks Rank #1 (Strong Buy) company’s shares have gained 9.8% compared with 5.2% growth of the industry. The S&P 500 has increased 11.9% during the said time frame.

The renowned designer, manufacturer and seller of an extensive range of innovative medical, surgical and diagnostic devices has a market capitalization of $422.1 million. The company projects 51.9% growth over the next year and expects to witness continued improvements in its business. AngioDynamics’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 82.1%.

NanoKnife Driving Growth: During the second quarter of fiscal 2026, management highlighted continued strength in the NanoKnife franchise, with revenue increasing 22.2% year over year and probe sales rising 14.4%, driven primarily by growing adoption in prostate cancer procedures. The quarter marked a record period for prostate procedure volumes, reflecting rising physician interest as the CPT code for prostate ablation became effective on Jan. 1.

Management emphasized that adoption is progressing steadily rather than as an immediate step change, consistent with prior expectations. Capital sales were supported in part by an international distribution transition in France, though leadership stressed that underlying demand is being driven by procedural growth and increasing clinical utilization. Overall, NanoKnife remains well-positioned to benefit from expanding awareness, improving reimbursement clarity and sustained physician engagement in the prostate cancer market.

Broad Product Line: AngioDynamics delivered a strong second-quarter fiscal 2026, with momentum visible across its Med Tech platforms. The Auryon franchise remained the clear highlight, posting $16.3 million in revenues, up 18.6% year over year, and extending its run to 18 consecutive quarters of double-digit growth.

Management pointed to continued share gains in atherectomy, supported by deeper penetration in hospital settings, improving procedure volumes, and more favorable economics. Early international contributions following CE Mark approval further strengthened Auryon’s expanding addressable market and reinforced confidence in its long-term growth trajectory.

The mechanical thrombectomy portfolio also moved forward, with revenue rising 3.9% year over year to $11 million, led by strong execution at AlphaVac, which delivered more than 40% growth as new hospital accounts came online and progressed through value analysis committees. While AngioVac declined year over year due to a tough prior comparison, it remained solidly positive on a year-to-date basis, and management reiterated confidence in its long-term outlook. Importantly, regulatory progress during the quarter, including IDE approvals and expanded FDA clearance, enhanced clinical utility and future adoption prospects, while the Med Device segment provided steady support with 5.6% growth and reliable cash generation.

Solid Q2 Results: AngioDynamics delivered a strong fiscal second-quarter 2026, with revenue rising 8.8% year over year to $79.4 million, reflecting solid execution across both operating segments. Growth was led by the higher-margin Med Tech portfolio, which increased 13% and now accounts for 45% of total revenues, underscoring the company’s ongoing mix shift toward faster-growing platforms. Improved product mix, manufacturing optimization initiatives and pricing actions drove gross margin expansion of 170 basis points to 56.4%.

Macroeconomic Concerns: Per the earnings call, management acknowledged that tariff expense incurred during the second quarter of fiscal 2026 remained in line with expectations, while reiterating its outlook for $4–$6 million in tariff-related costs for the full fiscal year. While these costs were anticipated, they continue to represent a structural margin headwind that management expects to persist through the remainder of the year.

Although gross margin improved year over year, management made clear that this performance relied heavily on pricing actions, accelerated cost-cutting initiatives and a favorable mix shift toward higher-margin Med Tech products, rather than any easing of external pressure.

AngioDynamics has been witnessing a positive estimate revision trend for fiscal 2026. Over the past 30 days, the Zacks Consensus Estimate for loss has narrowed a cent to 27 cents per share.

The Zacks Consensus Estimate for third-quarter fiscal 2026 revenues is pegged at $76.9 million, implying a 6.9% rise from the year-ago reported number. The consensus mark for fiscal third-quarter loss per share is pinned at 10 cents, implying a 433.3% decline year over year.

Some other top-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Boston Scientific BSX and STERIS STE. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for IDEXX’s 2025 earnings per share (EPS) have remained constant at $12.93 in the past 30 days. Shares of the company have risen 12.6% in the past year compared with the industry’s 11.1% growth. IDXX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.1%. In the last reported quarter, it delivered an earnings surprise of 8.3%.

Boston Scientific shares have gained 2.9% in the past year. Estimates for the company’s 2025 EPS have remained constant at $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

STERIS shares have risen 9.1% in the past year. Estimates for the company’s 2025 EPS have increased by 2 cents to $10.23 in the past 30 days. STE’s earnings topped estimates in three of the trailing four quarters and matched on one occasion, delivering an average surprise of 2.6%. In the last reported quarter, it posted an earnings surprise of 2.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite