|

|

|

|

|||||

|

|

Organon & Co. OGN announced the completion of the divestiture of its JADA System to Laborie Medical Technologies Corp. The deal is worth up to $465 million, including $440 million paid at closing and a potential earn-out of up to $25 million tied to the 2026 revenue targets. About 100 employees are expected to move to Laborie as part of the deal.

Per management, the JADA team has helped more than 136,000 women in above 20 countries, making JADA a widely accepted treatment for postpartum hemorrhage. Selling JADA to Laborie, a medical technology company with strong expertise in maternal health, should help expand global access to the product. The divestiture will strengthen Organon’s balance sheet and support its capital allocation strategy for growth opportunities in women’s health biopharmaceuticals.

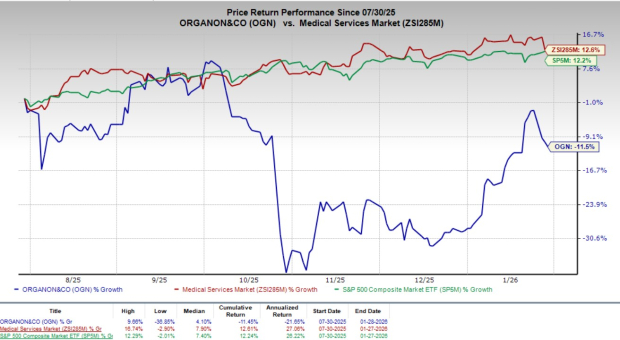

Following the announcement, OGN shares lost 1.2% at yesterday’s closing. Over the past six months, shares of the company have declined 11.5% against the industry’s 12.6% growth and the S&P 500’s 12.2% rise.

The net proceeds are likely to be used toward debt reduction, directly supporting OGN’s stated objective of lowering its net-debt-to-adjusted EBITDA ratio. This could improve capacity for targeted reinvestment or acquisitions in women’s health biopharma. The deal simplifies Organon’s portfolio, enhances capital allocation efficiency, reduces leverage and improves its ability to pursue long-term growth opportunities to drive sustained revenue growth in the women’s health segment.

OGN currently has a market capitalization of $2.34 billion.

In June 2021, Organon acquired the JADA system, a medical device that uses a low-level intrauterine vacuum therapy to manage abnormal postpartum uterine bleeding or hemorrhage when conservative management is warranted. Following the acquisition, Organon established a strong commercial and operational team, creating a solid foundation for Laborie to further scale the product’s adoption and enhance its long-term value.

The transaction implies a multiple of 6.5X JADA’s trailing 12-month revenues, underscoring the product’s strong commercial execution and successful expansion in the United States as a standard of care in postpartum hemorrhage (PPH) management over the last four years. Organon intends to use the net proceeds for debt reduction.

Chris Smith, president and CEO of Laborie, highlighted the clinical importance of the JADA System in supporting timely intervention during childbirth, underscoring the company’s commitment to maternal care. Laborie is proud to support this mission and values the experienced JADA commercial team to help strengthen its position and performance in the obstetrics segment.

Going by data provided by Precedence Research, the PPH treatment market was valued at $1.6 billion in 2025 and is expected to witness a CAGR of 5.3% through 2032. Factors like the rising maternal mortality rates, transfusion-related complications, use of recombinant activated factor VIIa (rFVIIa) in severe PPH cases and standardization of PPH care bundles in hospitals are driving the market’s growth.

Organon announced that the FDA approved a supplemental New Drug Application for NEXPLANON (etonogestrel implant) 68mg Radiopaque, allowing its use for up to five years, extending the previous three-year limit. Clinical trials assessing efficacy and safety during years 4 and 5 with no reported pregnancies and no new safety concerns. The study included women across a wide range of body mass indexes, demonstrating the implant’s continued effectiveness and safety across diverse body types.

The company announced an agreement with Daiichi Sankyo Europe to commercialize Nilemdo (bempedoic acid) in France, Denmark, Iceland, Sweden, Finland and Norway. It is the only therapy of its kind available in these markets, helping healthcare professionals reduce cardiovascular risks in patients who cannot achieve sufficient LDL-C reduction with statins or other lipid-lowering treatments, including those who are statin-intolerant or have contraindications to statin therapy. The collaboration also addresses an important healthcare gap, as women are more likely to experience statin intolerance than men, making alternative therapies like Nilemdo valuable.

Organon & Co. price | Organon & Co. Quote

Currently, Organon carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, AtriCure ATRC and Boston Scientific BSX.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rankstocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.7% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

AtriCure, currently flaunting a Zacks Rank #1, reported a third-quarter 2025 adjusted loss of 1 cent per share, surpassing the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%.

ATRC has an estimated earnings growth rate of 91.7% for 2026 compared with the industry’s 17% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 67.1%.

Boston Scientific, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.1% growth. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 7.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite