|

|

|

|

|||||

|

|

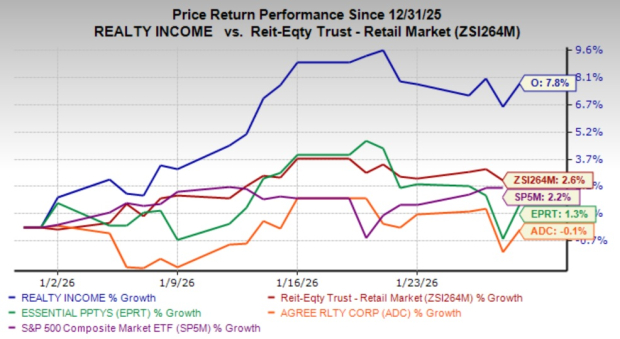

Realty Income O has seen its stock move higher recently, with shares gaining 7.8% over the past month. O stock has not only outpaced its close peers, such as the free-standing REITs, Agree Realty Corporation ADC and Essential Properties Realty Trust, Inc. EPRT, but also outperformed the Zacks REIT and Equity Trust - Retail industry and the S&P 500 composite.

For a REIT best known for steady income rather than sharp price swings, this move has brought renewed attention from investors trying to judge whether the rally is the start of a longer trend or simply a short-term bounce.

The company continues to position itself as a defensive income play, supported by long leases, diversified tenants and consistent dividend growth. Recent announcements around partnerships, capital deployment and international expansion have added to the narrative that Realty Income is adapting well to a changing real estate and capital markets environment.

While the company’s strategic investments augur well for long-term growth and dividend hike gives a boost to investors’ sentiment, its investment thesis presents both compelling growth drivers and legitimate concerns. Let’s explore them to ultimately arrive at the decision of whether to hold the stock for now, buy or sell and book profits.

A key recent development supporting sentiment has been Realty Income’s strategic partnership with GIC. The company established this relationship to expand its access to long-term private capital, complementing the traditional balance-sheet-driven growth model. This brings more than $1.5 billion of joint capital commitments focused on build-to-suit logistics assets leased to investment-grade-equivalent tenants.

The alliance also includes Realty Income’s first foray into the Mexican market through a $200 million industrial portfolio in Mexico City and Guadalajara, pre-leased to Global Fortune 100 companies. The partnership strengthens capital flexibility and supports large-scale transactions without overreliance on public equity issuance, an important consideration in the current rate environment.

Another meaningful catalyst was Realty Income’s announcement of an $800 million preferred equity investment in CityCenter Las Vegas real estate assets. This investment allows the company to deploy capital into a high-quality asset while maintaining downside protection through the preferred structure.

Investment activity remains robust, with Realty Income reporting $1.4 billion of global investments in the third quarter of 2025 at a weighted average initial cash yield of 7.7%, representing a spread of roughly 220 basis points over its short-term cost of capital. Notably, Europe accounted for about $1 billion, or 72%, of quarterly investment volume, with an average yield near 8%. Management emphasized that Europe currently offers more attractive pricing, lower competition and cheaper euro-denominated financing compared with the United States, making it a key growth engine.

Portfolio fundamentals continue to underpin the story. As of the end of the third quarter, Realty Income owned more than 15,500 properties across 92 industries and over 1,600 clients, with portfolio occupancy at 98.7%. Rent recapture on renewed leases stood at 103.5%, generating $71 million in new cash rents. The company also declared the 133rd consecutive monthly dividend increase, reinforcing its income-focused appeal. A strong balance sheet, including net debt to EBITDA of about 5.4x, fixed charge coverage of 4.6x and $3.5 billion of liquidity, supports both growth initiatives and ongoing dividend payments.

Despite these positives, broader macroeconomic risks remain a constraint. Economic softness and uneven consumer behavior can influence tenant performance, particularly across discretionary categories. While Realty Income’s portfolio is largely focused on essential and service-oriented tenants, macro uncertainty continues to shape a cautious outlook for rent growth and capital allocation.

Tariff-related pressures are another emerging consideration. Tariff-driven inflation and higher input costs could affect certain tenants’ operating margins over time. While current credit issues remain manageable, with the credit watch list at 4.6% of annualized base rent, prolonged cost pressures could weigh on tenant health and renewal dynamics, particularly if economic growth slows.

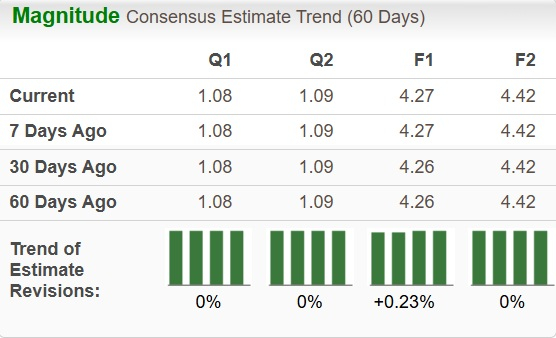

Estimate revisions reflect a somewhat mixed trend. Over the past 30 days, the Zacks Consensus Estimate for 2025 adjusted funds from operations (AFFO) per share has been increased modestly, while the 2026 projection has remained unchanged, indicating a balanced view of growth and cost pressures.

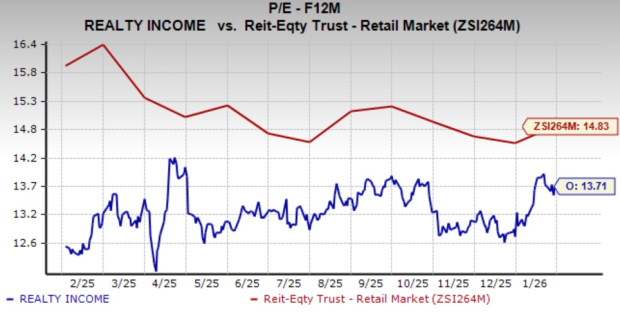

Valuation-wise, Realty Income stock is trading at a forward 12-month price-to-FFO of 13.71X, below the retail REIT industry average of 14.83X but ahead of its three-year median. O stock is also currently trading at a reasonable discount compared with its industry peers, Agree Realty Corporation and Essential Properties Realty Trust. This valuation disparity might not be as favorable as it seems. Agree Realty is trading at a forward 12-month price-to-FFO of 15.83X, while Essential Properties Realty Trust is trading at 14.67X.

However, the Value Score of D suggests that it may not be a bargain at current levels. Still, the company’s strategic investments, consistent dividend growth, underpinned by predictable rental income, keep it appealing for long-term income-oriented investors.

Realty Income’s recent stock gain reflects steady execution, disciplined capital deployment and investor confidence in its income-focused model. Strategic moves such as the GIC partnership and the $800 million CityCenter preferred equity investment, along with growing exposure to Europe, support long-term stability. However, macro uncertainty, tariff-related cost pressures, the stock’s valuation and moderate growth expectations keep it from screening as a compelling buy right now. The stock’s stability also prevents it from being a sell.

Therefore, for investors, Realty Income remains a solid income vehicle, but current conditions suggest a balanced risk-reward profile. A Hold recommendation appears appropriate, allowing investors to benefit from dividends while awaiting a more attractive entry point.

At present, Realty Income carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite