|

|

|

|

|||||

|

|

Alphabet GOOGL is set to report fourth-quarter 2025 results on Feb. 4.

For fourth-quarter 2025, the Zacks Consensus Estimate for earnings is pegged at $2.58 per share, down by a penny over the past 30 days, and indicates 20% year-over-year growth.

The consensus mark for fourth-quarter revenues is pegged at $94.7 billion, indicating growth of 16.02% from the year-ago quarter’s reported figure.

Alphabet has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 18.74%.

Alphabet Inc. price-eps-surprise | Alphabet Inc. Quote

Let’s see how things have shaped up for the upcoming announcement:

GOOGL’s Search business is benefiting from AI infusion. Alphabet has been actively embedding AI, especially within Search, to enhance user experience, provide better AI-focused features, and consequently improve ad performance.

AI-powered Search features, like AI Overviews and AI Mode, are transforming the way users interact with Google Search, offering more intuitive and personalized experiences. AI Overviews, which are now scaled to more than 2 billion users, are driving meaningful query growth, particularly among younger users. AI Mode has been rolled out globally across 40 languages, attracting over 75 million daily active users and doubling queries over the last quarter. AI Max and Search are already used by hundreds of thousands of advertisers, making it the fastest-growing AI-powered search ads product.

Alphabet’s continued growth and expansion in AI and Search technologies is expected to have benefited the company’s performance in the to-be-reported quarter. The Zacks Consensus Estimate for fourth-quarter 2025 Search and other revenues is pegged at $61.27 billion, indicating 13.39% growth over the figure reported in the year-ago quarter.

Alphabet has been rapidly growing in the booming cloud computing market. Google Cloud is experiencing high demand for its enterprise AI products, including its custom TPUs, GPUs, and industry-leading AI models like Gemini 2.5. This demand is expected to have driven further growth in the to-be-reported quarter.

In third-quarter 2025, revenues from products built on Alphabet’s generative AI models (Gemini, Imagen, Veo, Chirp, and Lyria) grew more than 200% year over year, reflecting accelerating adoption. Over the past 12 months, each of roughly 150 Google Cloud customers has processed approximately 1 trillion tokens with Alphabet’s models for a wide range of applications. Google Cloud signed more billion-dollar deals in the first nine months of 2025 than in the previous two years combined, highlighting its ability to attract large-scale enterprise customers. This momentum is expected to drive Alphabet’s fourth-quarter performance as demand for Google Cloud’s AI infrastructure and solutions continues to grow.

The cloud backlog increased by $49 billion sequentially in the third quarter of 2025, reaching $155 billion. This indicates strong demand for Google Cloud services, which is expected to have continued in the fourth quarter of 2025 as well.

The consensus mark for fourth-quarter 2025 Google Cloud revenues is pegged at $16.25 billion, indicating 35.9% growth over the figure reported in the year-ago quarter.

Despite strong demand for Google Cloud products, the company expects to remain in a tight demand-supply environment in the fourth quarter of 2025 and into 2026, which could limit its ability to fully meet customer demand.

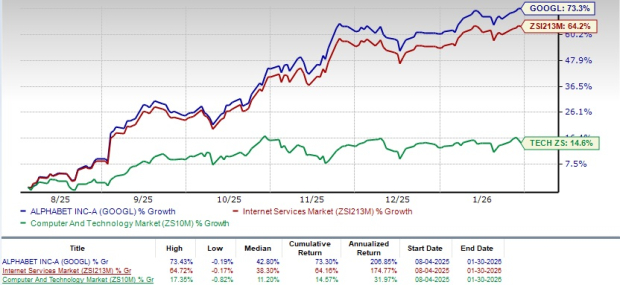

Alphabet’s shares have surged 73.3% in the trailing six-month period, outperforming the Zacks Internet Services industry and the Zacks Computer & Technology sector. Over the same time frame, the sector and industry have increased 14.6% and 64.2%, respectively.

GOOGL shares are overvalued, as suggested by Value Score D.

Currently, GOOGL is trading at a premium, with a forward 12-month price/sales of 10.15X compared with the Internet Services industry’s 7.85X.

Google Cloud’s expanding clientele is expected to boost Alphabet’s top line. Its partnership with companies like Palo Alto PANW has been noteworthy. In December 2025, Alphabet and Palo Alto Networks announced an expanded collaboration that combines Google Cloud’s AI and infrastructure capabilities with Prisma AIRS, Palo Alto Networks’ comprehensive AI security platform, to secure the next generation of digital business.

Google Cloud is also benefiting from its partnership with NVIDIA NVDA. It was the first cloud provider to offer NVIDIA’s B200 and GB200 Blackwell GPUs and will be offering its next-generation Vera Rubin GPUs.

Despite an expanding portfolio and clientele, Alphabet’s to-be-reported quarter’s performance is expected to have suffered from year-over-year comparisons in advertising revenue that will be negatively impacted by the strong spending on U.S. elections during the fourth quarter of 2024, particularly affecting YouTube’s advertising performance.

At current spot rates, Alphabet anticipates a favorable impact on revenues due to foreign exchange tailwinds in the to-be-reported quarter, although this could be affected by exchange rate volatility. Sales and marketing costs are also expected to have risen in the to-be-reported quarter to support product launches and holiday season campaigns, adding pressure to the company’s expenses.

Alphabet is facing stiff competition in the cloud computing and generative AI space from the likes of Amazon AMZN and Microsoft. Amazon has been dominating the cloud market on the back of Amazon Web Services (AWS) momentum. As far as generative AI is concerned, both Microsoft and Amazon are making concerted efforts to bring advancement into OpenAI’s ChatGPT and Amazon Bedrock, respectively.

Alphabet’s dominant position in the Search market, thanks to AI infusion, is a strong growth driver. Expanding cloud footprint is noteworthy. However, a stretched valuation, rising costs, and stiff competition in the cloud space make GOOGL shares risky for investors ahead of fourth-quarter 2025 results.

Alphabet currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| 42 min | |

| 47 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite