|

|

|

|

|||||

|

|

Comfort Systems USA, Inc. FIX surged 74.6% in the past six months, significantly outperforming the Zacks Building Products - Air Conditioner and Heating industry, the broader Construction sector and the S&P 500 Index.

Amid a favorable infrastructure spending backdrop, FIX is realizing notable benefits through its disciplined bidding approach and solid execution across both mechanical and electrical segments. Apart from gains from the favorable market fundamentals, its margin expansion efforts and ways of ensuring shareholder value uphold optimism regarding the stock. Moreover, the declining Fed interest rate is proving to be an additional catalyst in fostering the upward trends.

However, the company is exposed to several vulnerabilities, such as project delays, labor inflation, increased competition and project execution risks. These factors are liable to hurt margin expansion and reduce profitability prospects.

Robust Project Prospects: Comfort Systems' high concentration of work is tied to hyperscale data centers, AI facilities and advanced manufacturing among U.S. MEP contractors. This attribute is driving the near and long-term growth prospects for the company, given the favorable public spending environment for infrastructure projects. As of the third quarter of 2025, FIX’s backlog of $9.38 billion grew 65% year over year from $5.68 billion and jumped 15.5% sequentially.

Bookings remain exceptionally strong across both traditional construction and modular operations, with modular demand sold out through early 2026, aided by new automation investments and expanded capacity. Moreover, the company’s opportunities in larger and longer-cycle projects, with a disciplined bidding approach, are paving the path for incremental growth prospects and unprecedented visibility heading into 2026.

Focus on Margin Expansion: Margin expansion has become a key focus for the company in a scenario of elevated costs and expenses. It can cater to its target, given its growing exposure to technology and advanced manufacturing projects, which also account for the majority of its backlog. Year to date, the Technology sector accounted for about 42% of revenues, up from 32% reported last year, as hyperscale and AI-driven infrastructure projects continue to scale in size and urgency.

For the first nine months of 2025, its gross margin expanded year over year by 340 basis points (bps) to 23.6%, with the metric increasing 370 bps in the third quarter. A favorable project mix, execution discipline and strong end-market demand have driven the sustained improvement. Management has emphasized disciplined bidding and walking away from low-return work, which has supported higher gross profit per dollar of revenue.

Ensuring Shareholder Value: During the third quarter of 2025, Comfort Systems hiked its quarterly dividend payment by 20% to 60 cents per share (or $2.40 per share annually). This strategic move highlights management’s confidence in the company’s cash flows and long-term demand outlook. The operational momentum, disciplined bidding and favorable project mix continue to fuel growth for FIX. Besides, during the first nine months of 2025, it repurchased 0.3 million shares for approximately $125.4 million under the buyback program.

Comfort Systems generated $717.8 million (up 12.4% year over year) of operating cash flow as of Sept. 30, 2025, with cash and cash equivalents of $860.5 million, which were up 56.5% from the value as of Dec. 31, 2024. Leverage remains minimal, giving the company ample flexibility to fund acquisitions, repurchase shares and continue rewarding shareholders.

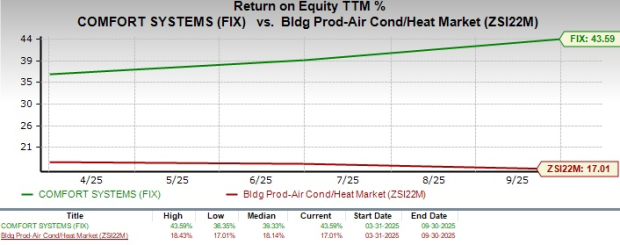

Comfort Systems’ trailing 12-month return on equity (ROE) of 43.6% significantly exceeds the industry’s average, underscoring its efficiency in generating shareholder returns.

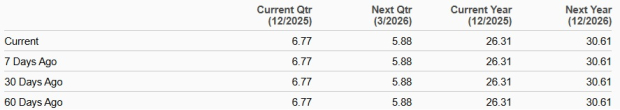

FIX’s 2026 earnings estimate has remained unchanged over the past 60 days at $30.61 per share. However, the estimated figure for 2026 implies year-over-year growth of 16.4%.

Comfort Systems sits at a critical execution layer of the AI-driven data center and technology infrastructure boom, competing with Quanta Services, Inc. PWR, AECOM ACM and Carrier Global Corp. CARR across distinct but overlapping segments.

Quanta mainly focuses on the power generation, transmission and grid infrastructure required to support AI-driven electricity demand. While Quanta captures significant AI-related capital spending, its exposure is upstream from FIX’s core business. Conversely, AECOM competes at a broader level across the entire infrastructure lifecycle, from site selection and design to engineering and project management for hyperscale data centers as well as transportation, water and environmental sectors. AECOM’s deep engineering and digital infrastructure capabilities, including advanced liquid cooling design, align well with AI and HPC buildouts, but its diversified portfolio means data center work is one among many growth vectors.

Carrier Global plays a different role as an equipment and solutions provider, supplying HVAC, thermal management and data center cooling technologies. Carrier Global benefits from rising demand for advanced cooling driven by AI servers, but it does not directly compete with FIX on installation and project execution.

Comfort Systems’ growing exposure to hyperscale data centers is a double-edged sword. Any slowdown in AI-driven capital expenditures, project deferrals by cloud providers or power availability constraints could compress backlog growth and utilization. Moreover, project delays, scope changes, customer funding issues or cancellations, particularly in large and complex projects, could result in backlog conversion failure.

The company is also concerned about shortages of skilled labor and rising wage pressure in the current market dynamics. Besides, exposure to competitive pricing, project mix shifts and normalization from peak conditions could disturb its current margin levels and reduce profitability.

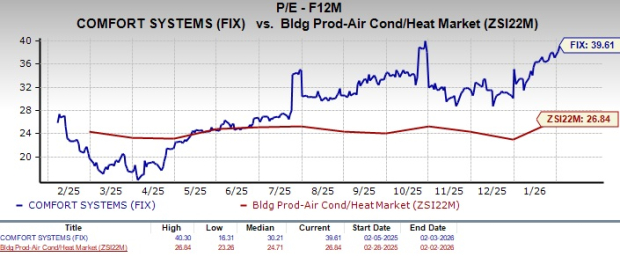

FIX stock is currently trading at a premium compared with the industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 39.61, as evidenced by the chart below.

Comfort Systems reflects a balance between powerful operating momentum and emerging valuation and execution risks. The strong exposure to hyperscale data centers, AI facilities and advanced manufacturing projects, with backlog growth of 65% year over year to $9.38 billion, provides strong revenue visibility into 2026. Also, disciplined bidding and a favorable project mix continue to drive margin expansion.

Robust operating cash flow, minimal leverage, a 20% dividend hike and ongoing share repurchases further reinforce shareholder-friendly capital allocation. The company’s trailing ROE of 43.6% highlights superior profitability compared with peers.

However, a premium valuation and unchanged earnings estimate for 2026 raise concerns amongst investors. Elevated exposure to large, complex data center projects also introduces risks tied to project delays, labor inflation and potential moderation in AI-driven capital spending.

FIX stock still offers long-term structural growth exposure, but near-term upside potential looks more limited at current valuation levels. Thus, it is prudent for existing investors to retain this Zacks Rank #3 (Hold) stock for now. New investors are advised to wait and look for a better entry point when the near-term trends favor FIX stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 hours | |

| 11 hours | |

| 11 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

PWR

Investor's Business Daily

|

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite