|

|

|

|

|||||

|

|

Veeva Systems Inc. VEEV is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism, led by a solid third-quarter fiscal 2026 performance and strategic deals, is expected to contribute further. However, rising operational costs remain a cause for concern.

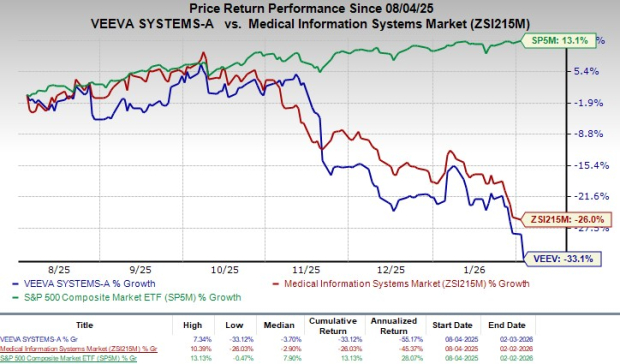

This Zacks Rank #3 (Hold) company’s shares have lost 33.1% in the last six-month period compared with 26% decline of the industry. The S&P 500 Composite has increased 13.1% during the said time frame.

The renowned provider of cloud-based software applications and data solutions for the life sciences industry has a market capitalization of $33.43 billion. The company anticipates 23.8% growth for the next five years and expects to maintain its strong performance in the future. It delivered a trailing four-quarter average earnings surprise of 8.2%.

Strategic Deals: Veeva Systems reported solid progress in the fiscal third quarter, driven by expanding enterprise-wide adoption and partnerships that reinforce its long-term platform vision. Major Global 2000 life sciences customers are increasingly standardizing multiple Veeva Systems’ applications across Commercial, Clinical, Safety, Quality, and Data Cloud functions, reflecting growing trust in the platform’s ability to reliably handle large-scale, mission-critical operations.

Management also underscored the strategic value of its partnership with IQVIA, noting that while revenue contributions build gradually, the collaboration is already enhancing customer confidence, data interoperability and workflow integration, alongside broader partnerships with CROs and systems integrators that reduce implementation friction and enable wider enterprise adoption.

Robust Product Portfolio: Veeva Systems posted a solid fiscal third-quarter performance, with revenue up 16% year over year to $811 million, supported by balanced growth across both its Commercial and R&D Clouds rather than reliance on a single product line. Within Commercial Cloud, Vault CRM continued to anchor the platform with strong penetration among top-20 biopharma customers, though its share of overall revenue declined due to faster growth in Crossix, Data Cloud offerings, and AI-driven solutions, which are enhancing cross-selling opportunities and customer retention.

In R&D, execution in Development Cloud remained consistent, while Quality Cloud gained traction and newer manufacturing-focused products saw early adoption among top-20 customers, further strengthening Veeva Systems enterprise footprint, platform relevance, and long-term revenue visibility.

Strong Q3 Results: Veeva Systems exited the third quarter of fiscal 2026 with better-than-expected results, wherein both earnings and revenues beat their respective Zacks Consensus Estimate. The uptick in both the top and bottom lines and robust performance by the Subscription services segment during the quarter were impressive. The uptick in Professional services and others’ revenues also bodes well.

During the quarter, Veeva Systems also strengthened its leadership position in CRM, driven by expanding adoption and product excellence across global markets. Vault CRM added 23 new customers, bringing the total number of live customers to 115. A major highlight was a large rollout for a top-20 biopharma company in Japan, which showcased the platform’s ability to support complex, multinational deployments.

Rising Costs: Veeva Systems has seen operating expenses trend higher in recent months. In the third quarter of fiscal 2026, general and administrative costs rose sharply, up 56.1% year over year. Management has indicated that sales and marketing expenses will continue to increase in fiscal 2026, largely driven by higher employee-related costs as the company expands headcount to strengthen its sales organization and support a broader portfolio of solutions and greater sales capacity.

Overall operating expenses grew 7.9% year over year in the fiscal third quarter, and Veeva Systems expects further increases in fiscal 2026, primarily tied to compensation and workforce-related expenses.

Veeva Systems is witnessing a stable estimate revision trend for fiscal 2027. In the past 30 days, the Zacks Consensus Estimate for fiscal 2027 earnings per share (EPS) has remained stable at $8.47.

The Zacks Consensus Estimate for fourth-quarter fiscal 2026 revenues is pegged at $808.9 million, indicating a 12.2% improvement from the year-ago quarter’s reported number. The EPS estimate for the fourth quarter of fiscal 2026 is pinned at $1.92, implying a 10.3% improvement year over year.

Some better-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Boston Scientific BSX and STERIS STE. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for IDEXX’s 2025 EPS have remained constant at $12.93 in the past 30 days. Shares of the company have risen 12.6% in the past year compared with the industry’s 11.1% growth. IDXX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.1%. In the last reported quarter, it delivered an earnings surprise of 8.3%.

Boston Scientific shares have gained 2.9% in the past year. Estimates for the company’s 2025 EPS have remained constant at $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

STERIS shares have risen 9.1% in the past year. Estimates for the company’s 2025 EPS have increased by 2 cents to $10.23 in the past 30 days. STE’s earnings topped estimates in three of the trailing four quarters and matched on one occasion, delivering an average surprise of 2.6%. In the last reported quarter, it posted an earnings surprise of 2.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 7 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite