|

|

|

|

|||||

|

|

UnitedHealth Group Incorporated UNH has endured a bruising market reaction following its fourth-quarter 2025 earnings release, with the stock plunging 21.5% since then. The sharp decline has surprised many investors, given the company delivered a modest earnings beat and outlined an improving margin outlook for 2026. However, beneath the surface, a complex mix of reimbursement pressure, regulatory scrutiny, high medical costs and policy uncertainty continues to weigh heavily on sentiment.

The result is the stock caught between durable long-term strengths and escalating near-term risks.

UnitedHealth reported adjusted earnings per share of $2.11 for the fourth quarter, slightly above the Zacks Consensus Estimate of $2.09, supported by commercial fee-based membership growth and continued momentum at Optum Rx. Despite the beat, earnings fell sharply (69%) from the prior year, reflecting intensifying cost pressures across its insurance operations. Revenue increased 12% to $113.2 billion. Yet the top-line growth narrowly missed expectations, reinforcing concerns about pricing challenges.

The most alarming metric came from medical costs. UnitedHealth’s adjusted medical care ratio (MCR) surged to 91.5%, deteriorating 640 bps from the prior year. The spike was driven by higher utilization, unfavorable pricing trends, and lower Medicare funding.

For further details, see UnitedHealth Q4 Earnings Beat on Strong Optum Rx, Offers 2026 Outlook.

Management’s guidance for 2026 reflects cautious optimism tempered by realism. Revenue is expected to exceed $439 billion, which represents a decline from 2025 levels of $447.6 billion as the company right-sizes operations. Operating cash flow is projected to be above $18 billion, down from the prior year’s $19.7 billion.

On a more encouraging note, UnitedHealth expects adjusted earnings per share to reach at least $17.75 in 2026, up from $16.35 in 2025. Net margins are forecast to recover to roughly 3.6% from 2.7% in 2025, supported by improved cost management and operational efficiencies. The MCR is guided toward 88.8% (± 50 bps), signaling a meaningful improvement from current levels.

The proposed 0.09% increase in 2027 Medicare Advantage payment rates from federal regulators significantly undercut market expectations. Medicare Advantage accounts for nearly half of UnitedHealthcare’s revenue base, making reimbursement rates a crucial earnings driver. A prolonged period of muted payment growth could severely constrain margin recovery and earnings expansion.

Management expects Medicare Advantage membership to be between 7.245 million and 7.295 million in 2026, suggesting a significant decline. With reimbursement pressure from CMS intensifying, the company may increasingly rely on Optum’s diversified services to offset weakness in insurance profitability.

The Zacks Consensus Estimate for 2026 EPS is pegged at $17.66, indicating 8% year-over-year growth. The consensus estimate for revenues is pegged at $439.9 billion, implying a 1.7% decline from a year ago.

For 2027, EPS is projected to grow to $19.91, marking a 12.7% improvement. But it has witnessed one upward estimate revision in the past week, against three downward movements. Revenues are pegged at $465.7 billion, 5.9% growth from a year ago.

Over the past four quarters, the company has missed estimates twice and beat twice, producing an average earnings surprise of negative 2.4%.

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

Regulatory and legal risks further complicate the investment narrative. The Department of Justice continues to examine UnitedHealth’s Medicare billing practices, reimbursement processes, and the competitive conduct of Optum Rx’s pharmacy benefit management business. These probes heighten headline risk and introduce uncertainty around potential penalties, compliance costs and operational restrictions.

Additional concerns stem from ongoing scrutiny of the company’s response to the 2024 Change Healthcare cyberattack, including its handling of emergency financial assistance to healthcare providers. The investigations prolong uncertainty and undermine investor confidence at a time when market patience is already strained.

Operationally, membership softness compounds financial pressure. UnitedHealth expects total medical membership to decline in the range of 46.945-47.495 million in 2026, down from nearly 49.760 million in 2025. The most pronounced declines are anticipated within higher-margin commercial risk plans, Medicare Advantage and Medicaid.

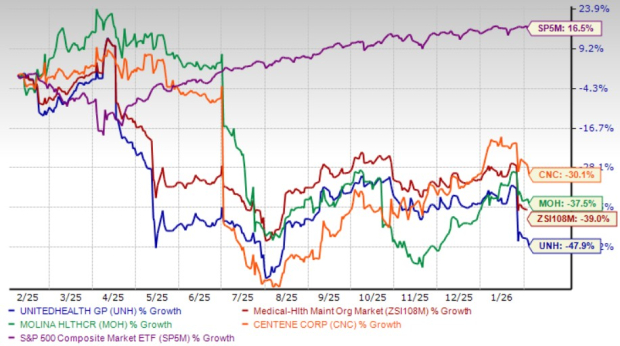

Including its post-earnings decline, UNH shares have plunged 47.9% in the past year, a steeper fall than the industry’s 39% slide. Peers like Molina Healthcare, Inc. MOH and Centene Corporation CNC have shed less value, dipping 37.5% and 30.1%, respectively. The contrast with the broader market is stark: the S&P 500 has gained 16.5% over the same stretch.

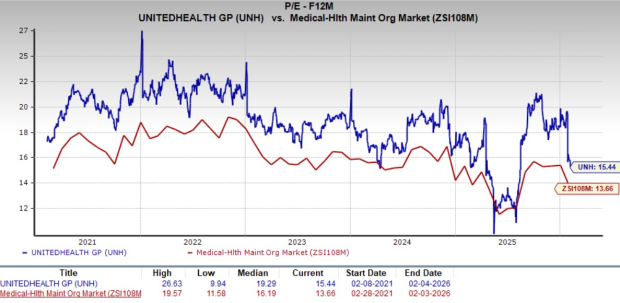

On the flip side, the selloff has driven valuation below historical norms. The stock now trades at a forward price-to-earnings (P/E) ratio of 15.44X, below its five-year median of 19.29X. However, it is still above the industry average of 13.66X. In comparison, Molina and Centene look more attractively priced at 12.63X and 13.72X, respectively.

Despite near-term challenges, UnitedHealth’s long-term investment case remains intact. Its unmatched scale, diversified healthcare platform and deep data capabilities provide strategic advantages few rivals can replicate. Structural tailwinds, including aging population, rising chronic disease prevalence and expanding healthcare utilization, continue to support long-term demand growth.

The company remains disciplined in capital deployment, returning substantial cash to shareholders while preserving financial flexibility. In 2025, UnitedHealth distributed nearly $7.9 billion in dividends and repurchased $5.5 billion of common stock. For 2026, it plans to continue prioritizing shareholder returns with repurchases of $2.5 billion and dividend payments worth $8 billion alongside balance sheet strength.

UnitedHealth’s fourth-quarter beat failed to revive investor confidence because the underlying challenges remain unresolved. Medical cost inflation, reimbursement uncertainty, regulatory scrutiny and membership softness create a difficult operating backdrop. While valuation has become more appealing, relative pricing suggests the stock remains vulnerable if execution falters.

For long-term investors, UnitedHealth’s dominant market position and diversified earnings base offer a solid foundation. However, until clearer evidence emerges of margin stabilization, regulatory clarity, and membership recovery, caution is warranted. The stock is not broken, but its once-defensive profile has weakened. A neutral stance appears justified, as investors await tangible progress that confirms management’s margin recovery narrative. It currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 8 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite