|

|

|

|

|||||

|

|

IonQ Inc (NYSE:IONQ) has not started the new year off on the right foot, with the security losing 30% since the beginning of January. A broader rotation away from the technology sector hasn't helped matters, with IONQ stock losing about 11% during Thursday's afternoon session. Nevertheless, among the equities suffering from the crimson tide, the smart money seems particularly keen on the quantum computing specialist's eventual recovery.

From a reflexive standpoint, it's easy to label any struggling equity as "cheap." However, there's a difference between a security that's cheap versus one that's a discount. Basically, the latter category implies that it's trading below a reasonable valuation benchmark. Of course, "reasonable" in the equities market is a relative, not absolute term. Still, there's a key factor why IONQ stock could be a genuine opportunity — and it has to do with smart money sentiment.

Strong insights hail from volatility skew, a screener that identifies implied volatility (IV) — a stock's potential kinetic output — across the strike price spectrum of a given options chain. For the March 20 expiration date, the skew shows that sophisticated market participants are prioritizing upside convexity while relatively minimizing downside protection.

We can determine this through the surface-level distortion of call IV pricing relative to put IV. On both ends of the strike price spectrum, call IV stands above their put equivalents. Effectively, this structure suggests that the prioritization is for traders to position themselves for upside optionality.

The deeper in-the-money (ITM) calls reflect exposure to IONQ stock through synthetic leverage, which helps in terms of balance-sheet flexibility. On the other end, the out-the-money (OTM) calls imply a non-trivial possibility of strong upswings. Both strategies help smart money traders express optimism without triggering major ripples in the open market, which can easily occur due to IONQ's relatively thinner pool of shares.

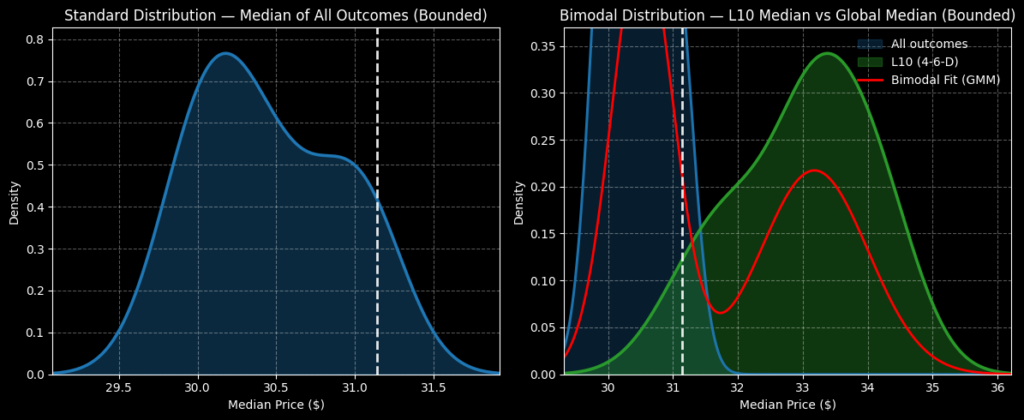

Although we now have a general understanding of the smart money sentiment behind IONQ stock, we're still at a loss as to how this positioning may translate to actual output. For that, we can turn to the Black-Scholes-derived expected move calculator. Wall Street's standard mechanism for pricing options reveals that for the March 20 expiration date, IONQ would be projected to land between $23.61 and $38.79, representing a 24.33% high-low spread from the current spot price.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where IONQ stock may symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration).

The quick cheat sheet is as follows: Black-Scholes is saying that in 68% of cases, we would expect IONQ stock to trade between roughly $24 and $39 when March 20 rolls around. Mathematically, that's a reasonable expectation as it would take an extraordinary catalyst to push a security beyond one standard deviation.

While volatility skew and expected move have delivered strong insights, we have reached the maximum utility of first-order analyses or the methodologies that Wall Street provides to everyone. Yes, this data establishes the likely parameters of the trading battleground for IONQ stock — but looking at the same information that everyone else is does not constitute an edge.

Right now, IONQ stock is a shipwrecked survivor and thanks to the Black-Scholes formula, we have determined that it will likely be found floating somewhere between $24 and $39 (assuming of course that it doesn't drown or get eaten by a shark). But we're talking about a peak-to-trough spread of over 60%. Given limited resources (personnel, equipment, daylight), as a search-and-rescue commander, we need a way to narrow the search radius.

What should we do? There's only one answer and that's to use a mathematical model that incorporates influencing factors like ocean currents and wind speed that can alter survivor drift patterns. This is exactly where the Markov property comes into full view.

Under Markov, the future state of a system depends entirely on the present state. In other words, forward probabilities should not be calculated independently but be assessed under context. In the analogy above, we wouldn't just analyze drift patterns independent of environmental factors. No, we must take into account the scientific fact that different ocean currents will likely lead to different drift patterns.

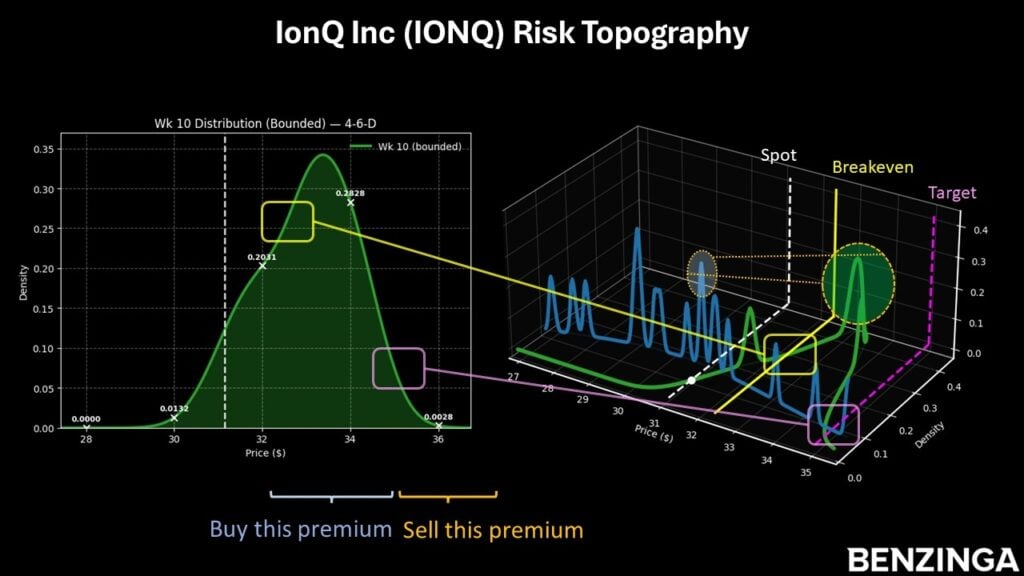

Based on this logic, we can surmise that price action is similar to ocean currents. For example, in the last 10 weeks, IONQ stock printed only four up weeks, leading to an overall downward slope. There's nothing special about this 4-6-D sequence, per se. However, the 4-6-D represents a specific kind of ocean current — and we would thus expect the drift pattern to be different than had any other sequence materialized instead.

Let's pause for a moment. Just like the equities market, the open water is a dynamic and cruel place. Finding shipwrecked survivors is not a perfect science but a probabilistic one. It's the same situation with the market, especially for highly kinetic quantum computing stocks. That said, the theory is that through enumerative induction and Bayesian-inspired inference, a second-order analysis is the best way to narrow uncertainties in a highly variable environment.

With this approach, we can calculate that over the next 10 weeks, IONQ stock will likely range between $29 and $36, with probability density peaking between $33 and $34. This calculation gives us a much tighter range to target.

With that in mind, the one trade that appears most tempting is the 30/35 bull call spread expiring March 20. This wager requires IONQ stock to rise through the $35 strike at expiration, which is an ambitious target. However, if the condition is triggered, the maximum payout stands at over 108%. Further, breakeven lands at $32.40, which helps enhance the trade's probabilistic credibility.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Image: Shutterstock

| 5 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Quantum Computing Stocks: IonQ Earnings, Revenue Beat Amid Acquisitions

IONQ +6.23%

Investor's Business Daily

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite