|

|

|

|

|||||

|

|

We expect Incyte Corporation INCY to surpass estimates when it reports fourth-quarter 2025 earnings on Feb. 10, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s revenues is pegged at $1.35 billion, while the same for earnings is pinned at $1.94 per share.

Let’s see how things might have shaped up before the announcement.

Incyte primarily derives product revenues from the sales of its lead drug, Jakafi (ruxolitinib), in the United States, as well as from the sales of other marketed drugs. Its momentum is likely to have continued on the back of strong Jakafi sales, a first-in-class JAK1/JAK2 inhibitor, in all approved indications (polycythemia vera, myelofibrosis and refractory acute graft-versus-host disease [GvHD]).

The Zacks Consensus Estimate for Jakafi's fourth-quarter sales is pegged at $799.3 million.

Incyte also earns product royalty revenues from Novartis NVS for the commercialization of Jakafi in ex-U.S. markets.

While Incyte markets Jakafi in the United States, Novartis markets the same drug as Jakavi outside the United States. INCY is expected to have received higher royalties from NVS in the to-be-reported quarter due to potentially higher Jakavi sales.

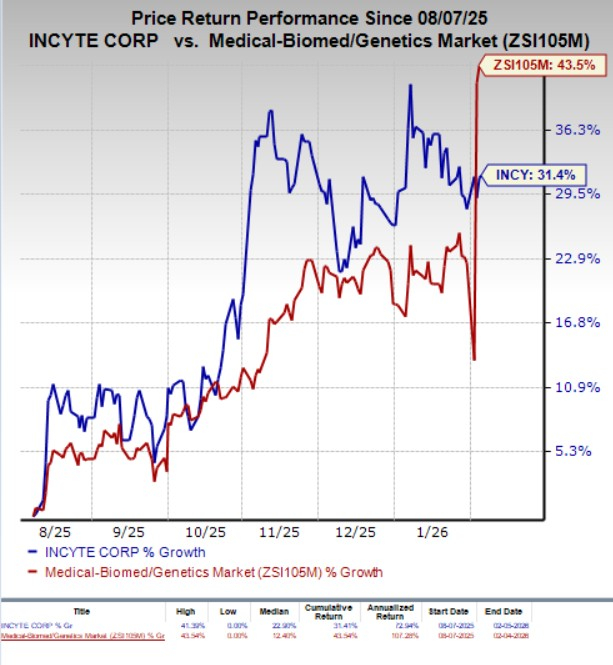

In the past six months, shares of Incyte have risen 31.4% compared with the industry’s 43.5% growth.

Incyte also receives royalties from the sales of Tabrecta (capmatinib), which is approved for treating adult patients with metastatic non-small cell lung cancer. Novartis has exclusive worldwide development and commercialization rights to Tabrecta.

In the to-be-reported quarter, INCY expects growth in Opzelura sales to be driven by continued growth in new patient starts and refills in the United States and increased contribution from the EU.

The Zacks Consensus Estimate for Opzelura’s fourth-quarter sales is pegged at $196.5 million.

While Jakafi’s sales and royalties are the key catalysts for Incyte’s revenue growth, sales of other drugs like Minjuvi, Pemazyre and Iclusig, and Olumiant’s royalties from Eli Lilly LLY are also likely to have contributed to Incyte’s top line. INCY has a collaboration agreement with LLY for Olumiant. The drug is a once-daily oral JAK inhibitor discovered by Incyte and licensed to Eli Lilly. It is approved for several types of autoimmune diseases.

In 2024, the company entered into an asset purchase agreement with MorphoSys AG. This gave Incyte exclusive global rights to tafasitamab, a humanized Fc-modified CD19-targeting immunotherapy marketed in the United States (as Monjuvi) and outside the country (as Minjuvi). In 2025, the FDA approved Monjuvi for a new cancer indication. The regulatory body approved Monjuvi in combination with Rituxan (rituximab) and Revlimid (lenalidomide) for the treatment of adult patients with relapsed or refractory follicular lymphoma, a type of slow-growing blood cancer. The label expansion of the drug is likely to have boosted sales of the drug. During the fourth quarter, the drug was also approved in the EU and Japan for this new cancer indication.

The Zacks Consensus Estimate for Iclusig, Minjuvi/Monjuvi and Pemazyre’s fourth-quarter sales is pegged at $30.8 million, $41.2 million and $22.9 million, respectively. Incremental sales from Zynyz, too, are expected to have boosted Incyte’s revenues in the to-be-reported quarter.

Incyte and partner Syndax Pharmaceuticals obtained FDA approval for axatilimab-csfr, an anti-CSF-1R antibody, for the treatment of GVHD in adult and pediatric patients weighing at least 40 kg who have failed at least two prior lines of systemic therapy. The candidate was approved under the brand name Niktimvo. The drug is Incyte’s second approved treatment for chronic GvHD (third-line) and was launched in the United States in early 2025. Niktimvo recorded $45.8 million in sales in the third quarter of 2025.

Investors will be keen to get further updates on the ongoing launch activities for Niktimvo and its sales performance during the upcoming earnings announcement.

Higher research and development expenses, as well as increased selling and general and administrative costs, are likely to have escalated operating expenses in the fourth quarter.

Incyte has a mixed history of earnings surprises. The company beat earnings estimates in three of the trailing four quarters, while missing the same on the remaining occasion, delivering an average surprise of 14.35%. In the last reported quarter, INCY posted an earnings surprise of 36.14%.

Incyte Corporation price-consensus-eps-surprise-chart | Incyte Corporation Quote

Our proven model predicts an earnings beat for INCY this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is exactly the case here, as you will see below.

INCY’s Earnings ESP: Incyte’s Earnings ESP is +3.69% as the Most Accurate Estimate currently stands at $2.02, higher than the Zacks Consensus Estimate, which is pegged at $1.94. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

INCY’s Zacks Rank: INCY has a Zacks Rank #3 at present.

Here is another stock worth considering from the healthcare space, as our model shows that this also has the right combination of elements to beat on earnings this reporting cycle.

Moderna MRNA has an Earnings ESP of +3.16% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of MRNA have risen 53.6% in the past six months. The company’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 31.45%. Moderna is scheduled to report fourth-quarter results on Feb. 13.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 11 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite