|

|

|

|

|||||

|

|

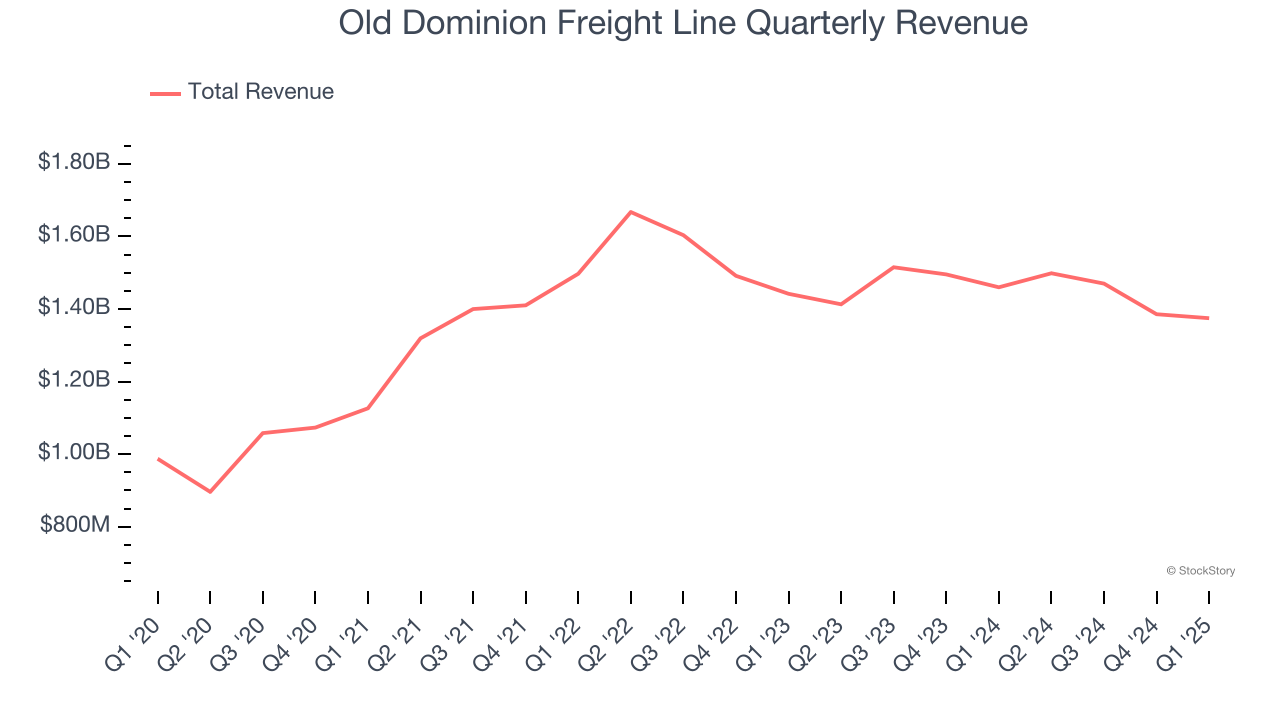

Freight carrier Old Dominion (NASDAQ:ODFL) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 5.8% year on year to $1.37 billion. Its GAAP profit of $1.19 per share was 4.1% above analysts’ consensus estimates.

Is now the time to buy Old Dominion Freight Line? Find out by accessing our full research report, it’s free.

Marty Freeman, President and Chief Executive Officer of Old Dominion, commented, “Old Dominion’s financial results for the first quarter reflect the ongoing softness in the domestic economy. While we were encouraged to see signs of improving demand during the first quarter, there continues to be uncertainty with the economy. We intend to continue to execute on the core elements of our long-term strategic plan, despite this uncertainty, and our team remains committed to delivering superior service at a fair price to our customers. This focus on delivering value has allowed us to strengthen our customer relationships and win market share over the long term.

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ:ODFL) delivers less-than-truckload (LTL) and full-container load freight.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

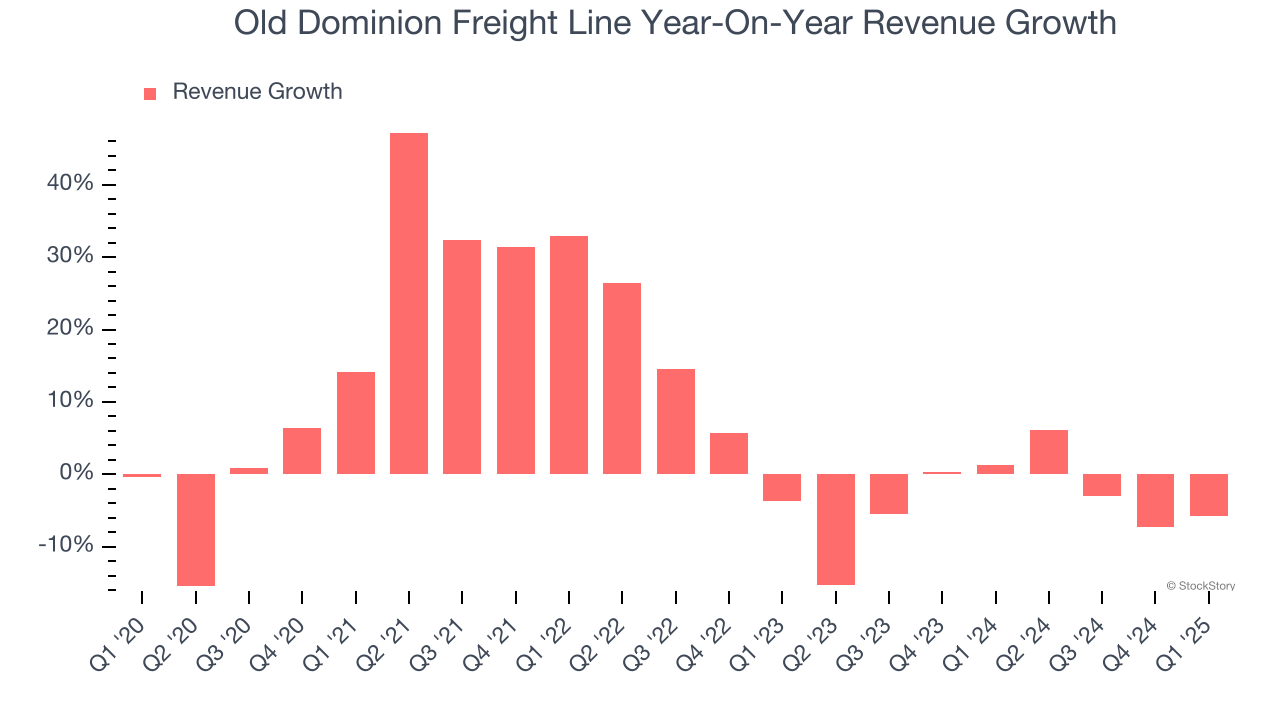

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Old Dominion Freight Line’s sales grew at a mediocre 6.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Old Dominion Freight Line’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.9% annually. Old Dominion Freight Line isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

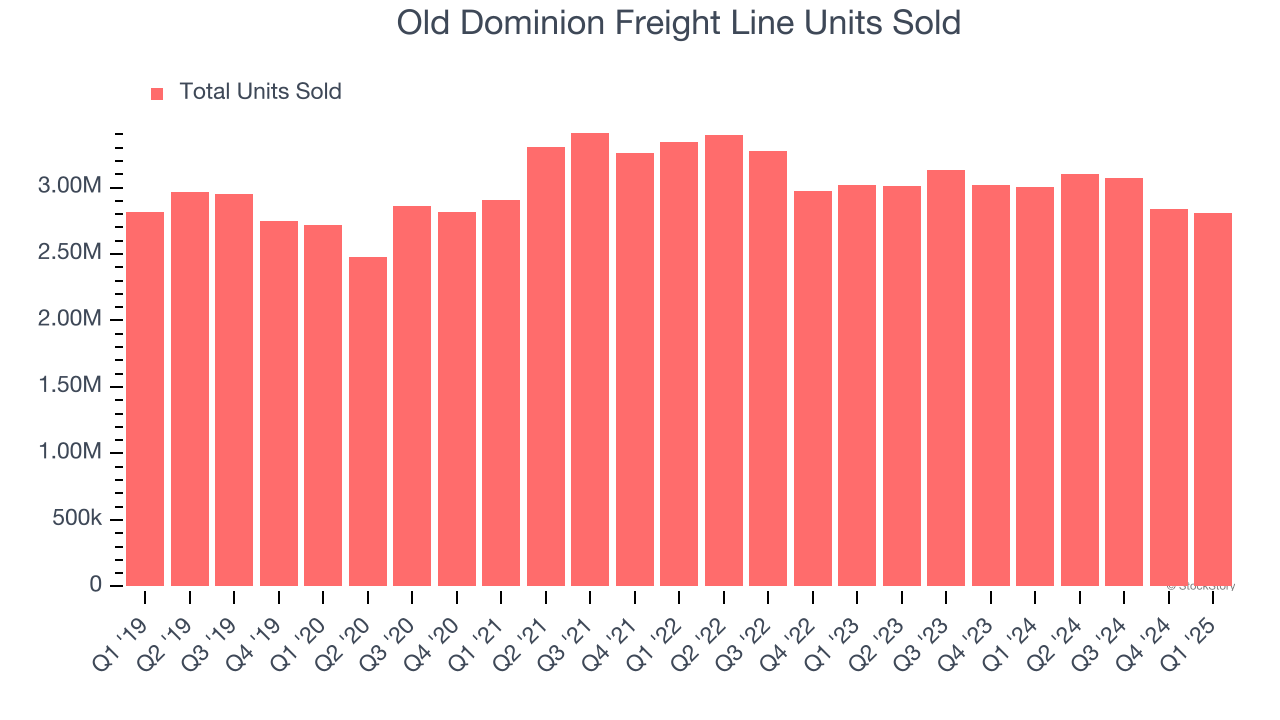

Old Dominion Freight Line also reports its number of units sold, which reached 2.81 million in the latest quarter. Over the last two years, Old Dominion Freight Line’s units sold averaged 3.3% year-on-year declines. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, Old Dominion Freight Line reported a rather uninspiring 5.8% year-on-year revenue decline to $1.37 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

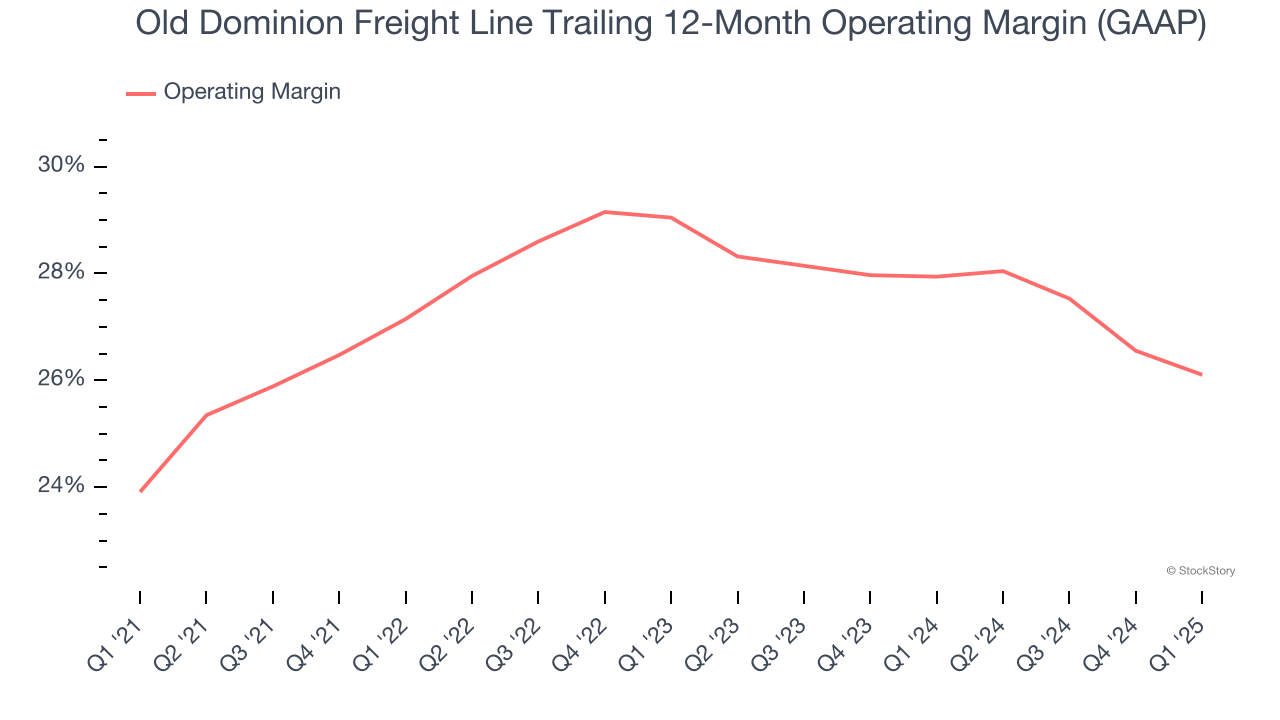

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Old Dominion Freight Line has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Old Dominion Freight Line’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Old Dominion Freight Line generated an operating profit margin of 24.6%, down 1.9 percentage points year on year. Since Old Dominion Freight Line’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

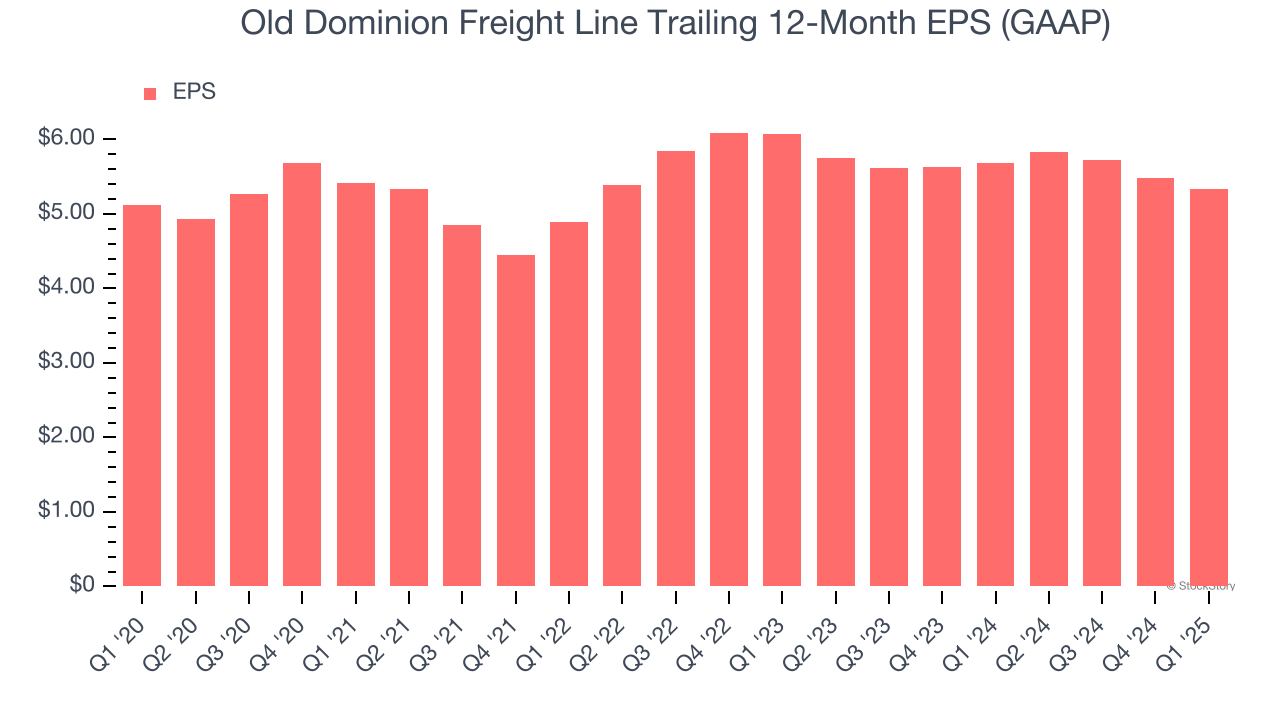

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Old Dominion Freight Line’s flat EPS over the last five years was below its 6.9% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually grew its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Old Dominion Freight Line’s two-year annual EPS declines of 6.3% were bad and lower than its two-year revenue performance.

In Q1, Old Dominion Freight Line reported EPS at $1.19, down from $1.34 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.1%. Over the next 12 months, Wall Street expects Old Dominion Freight Line’s full-year EPS of $5.33 to grow 4.5%.

It was encouraging to see Old Dominion Freight Line beat analysts’ EBITDA expectations this quarter. We were also happy its sales volume narrowly outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 3.4% to $157.38 immediately following the results.

Old Dominion Freight Line may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-17 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite