|

|

|

|

|||||

|

|

Archer-Daniels-Midland Company’s ADM Nutrition segment has long been positioned as a key growth pillar, offering diversification beyond the company’s more cyclical agricultural operations. However, shifting demand patterns and near-term pressures are testing whether Nutrition can continue to deliver consistent growth.

The segment, which includes flavors, specialty ingredients, proteins and health-focused solutions, has benefited from long-term trends such as clean-label products, plant-based diets and functional nutrition. These drivers support steady demand from food, beverage and health customers seeking value-added ingredients rather than commodity inputs. In the past few years, Nutrition has helped smooth earnings volatility and lift margin profiles compared with ADM’s traditional Ag Services and Oilseeds businesses. Recent demand softness has weighed on results. Customers have become more cautious amid inflationary pressures, leading to inventory rationalization and delayed purchasing decisions. In fourth-quarter 2025, Nutrition segment revenues were flat at $1.8 billion. Human Nutrition posted 5% growth, while Animal Nutrition declined 4% due to portfolio exits, leading to an 11% decrease in segment operating profit.

Despite these headwinds, Nutrition remains strategically important. ADM has strengthened its core operations through portfolio optimization, disciplined capital allocation, and tighter cost controls. ADM continues to invest in innovation, capacity expansion and product development aimed at higher-margin applications, including flavors, probiotics and specialty proteins. Management has also emphasized disciplined cost control and portfolio optimization to protect profitability during periods of uneven demand. Supported by these initiatives, the Animal Nutrition segment delivered 66% operating profit growth in 2025.

ADM reiterated that its Nutrition segment is expected to sustain a path of stronger organic growth supported by disciplined execution, highlighting management’s confidence in the company’s long-term outlook. The company believes there are significant opportunities ahead, with 2026 and beyond positioned for continued progress, reinforcing Nutrition as a key driver of future growth.

Looking ahead, ADM expects continued momentum in the Nutrition segment, driven by expansion in Flavors, recovery in Specialty Ingredients, and rising Health and Wellness demand. Growth in these areas is expected to benefit from increasing biotech-related consumption and broader customer adoption across end markets. In Animal Nutrition, margin expansion is expected to support operating profit growth as the portfolio shifts toward higher-margin products and the benefits of optimization initiatives begin to materialize.

In the past six-month period, ADM’s shares have gained 13.8% compared with the industry’s growth of 0.2%. ADM presently carries a Zacks Rank #3 (Hold).

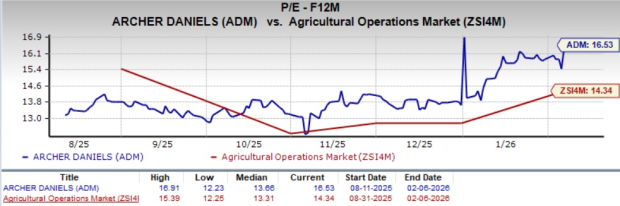

From a valuation standpoint, ADM trades at a forward price-to-earnings ratio of 16.53X, higher than the industry’s average of 14.34X.

The Zacks Consensus Estimate for ADM’s current and next year earnings implies a year-over-year rise of 15.2% and 13.6%, respectively.

The Simply Good Foods Company SMPL, a consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally. SMPL currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Simply Good Foods' current fiscal-year sales implies a decline of 0.3%, and the same for current fiscal-year earnings implies growth of 1.6% from the year-ago reported figures. SMPL delivered a trailing four-quarter earnings surprise of 5.53%, on average.

Kimberly-Clark Corporation KMB manufactures and markets personal care products in the United States. KMB currently carries a Zacks Rank #2 (Buy).

.The Zacks Consensus Estimate for Kimberly-Clark's current fiscal-year sales and earnings implies a decline of 2.1% and 6.2%, respectively, from the year-ago actuals. KMB delivered a trailing four-quarter earnings surprise of 18.9%, on average.

Medifast, Inc. MED operates as a health and wellness company that provides habit-based and coach-guided lifestyle solutions to address obesity and support a healthy life in the United States. MED currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Medifast's current fiscal-year sales and earnings implies a decline of 36.7% and 156.5%, respectively, from the year-ago actuals. MED delivered a trailing four-quarter negative earnings surprise of 640%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite