|

|

|

|

|||||

|

|

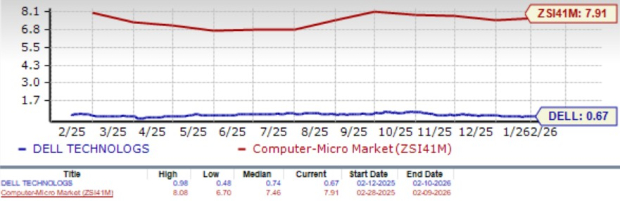

Dell Technologies’ DELL shares are trading at an attractive valuation, as suggested by a Value Score of A. In terms of the 12-month price/sales (P/S), the company is currently trading at 0.67X, significantly lower than the Zacks Computer – Micro Computers industry average of 7.91X and the broader Zacks Computer and Technology sector’s 6.54X.

Dell’s valuation continues to trade at a discount relative to ecosystem partners like NVIDIA NVDA, Advanced Micro Devices AMD and Meta Platforms META. At present, NVIDIA, Advanced Micro Devices and Meta Platforms trade at forward 12-month P/S ratios of 14.58X, 7.43X and 6.74X, respectively.

While Dell's discounted valuation may initially indicate an attractive entry point for investors, a low multiple alone does not guarantee upside. In many cases, compressed valuations reflect market concerns around growth durability, margin pressures or competitive positioning. As a result, Dell’s apparent cheapness could be masking underlying operational and demand-related risks. Let’s take a closer look.

Dell’s consumer PC segment is showing persistent softness compared with its more resilient commercial segment, highlighting structural headwinds. Consumer revenues declined year over year in the fiscal third quarter, contrasting with stable commercial growth. Management has flagged the consumer and education markets as intensely competitive, creating pricing pressure and limiting margin expansion. Because this segment is highly volume- and price-sensitive, incremental demand improvements have not translated into meaningful profitability gains, keeping earnings leverage muted.

Although the overall Client Solutions Group revenues posted modest growth in the fiscal third quarter, contraction in consumer sales weighed on segment performance and operating margins. Profitability remains constrained as the product mix leans toward lower-margin consumer PCs. At the same time, Dell’s broader PC refresh momentum is being driven largely by commercial demand, highlighting persistent softness in the consumer segment. This imbalance limits the segment's continuity and reduces the company's ability to generate meaningful earnings leverage.

Dell’s AI server business is expanding rapidly, yet profitability remains structurally constrained by intense competitive pressures. Even as shipment volumes scale, AI server operating margins are projected to remain in the mid-single-digit range in the fourth quarter of fiscal 2026, underscoring limited pricing power. Large enterprise, sovereign and Neocloud deployments remain highly competitive, forcing disciplined pricing strategies to secure volume without eroding profitability. This signals that growth in AI infrastructure does not automatically translate into high-margin expansion.

Dell is contending with rivals such as Hewlett-Packard, Lenovo and Super Micro Computer, which are rapidly advancing GPU-dense AI server platforms for high-performance and data center workloads. Their comparatively high-performance offerings intensify price competition and narrow differentiation, limiting Dell’s ability to scale profitability and keeping margin expansion a key investor concern.

The Zacks Consensus Estimate for Dell’s fourth-quarter fiscal 2026 earnings is currently pegged at $3.54 per share, down by a couple of cents over the past 30 days. This indicates year-over-year growth of 32.09%.

DELL has shown a mixed earnings surprise record, missing the Zacks Consensus Estimate in one of the trailing four quarters while exceeding it in the other three, with an average surprise of 0.23%.

Dell has delivered an 11.6% return in the trailing 12 months, lagging the Zacks sector’s 23.7% growth and the industry’s 15.3% rise. Key ecosystem partners delivered stronger momentum over the same period, with NVIDIA and Advanced Micro Devices advancing 43.7% and 91.1%, respectively, while Meta Platforms declined 7.6%, highlighting mixed performance trends across the broader AI and infrastructure landscape.

The underperformance can be attributed to elevated memory component pricing, weakness in Dell’s core PC operations and mounting cost pressures, which have collectively weighed on margins.

Dell’s low valuation masks meaningful operational pressures that continue to cloud its near-term outlook. Weak consumer PC demand, margin-limited AI server expansion and competitive pricing dynamics restrict earnings leverage, while mixed estimate revisions signal uncertainty around growth durability. Ongoing cost pressures and recent stock underperformance further highlight execution risks. Together, these factors suggest that the apparent valuation discount is more reflective of structural headwinds than hidden upside. Until Dell demonstrates stronger margin resilience and more balanced demand trends, the stock’s risk-reward profile remains unattractive — reinforcing that this Zacks Rank #4 (Sell) company is not a preferred pick right now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 min | |

| 29 min | |

| 33 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite