|

|

|

|

|||||

|

|

Inspire Medical Systems, Inc. INSP delivered fourth-quarter 2025 adjusted earnings per share (EPS) of $1.65, up 43.5% year over year. The figure beat the Zacks Consensus Estimate of 69 cents by 139.1%.

Inspire Medical registered revenues of $269.1 million in the fourth quarter, up 10.5% year over year. The figure was in line with the Zacks Consensus Estimate.

Per management, the revenue growth was primarily driven by growth at existing centers and new center additions.

As of Dec. 31, 2025, INSP operated 295 U.S. sales territories and employed 275 field clinical representatives compared with 335 territories and 230 representatives at the end of 2024.

Inspire Medical Systems, Inc. price-consensus-eps-surprise-chart | Inspire Medical Systems, Inc. Quote

In the fourth quarter, Inspire Medical’s gross profit increased 14.4% year over year to $233 million. The gross margin expanded 160 basis points (bps) to 86.6%.

Selling, general and administrative expenses jumped 14.4% year over year to $161.9million. Research and development expenses decreased 17.8% year over year to $24.9million. Operating expenses of $186.9million increased 8.8% year over year.

Operating profit totaled $46.1 million, reflecting a 44.6% plunge from the year-ago quarter’s level. The operating margin expanded almost 380 bps to 17.1%.

Inspire Medical exited fourth-quarter 2025 with cash and cash equivalents and short-term investments of $404.6 million compared with $322.6 million at the end of the third quarter.

Cumulative net cash provided by operating activitiesat the end of fourth-quarter 2025 was $117 million compared with $130.2 million a year ago.

Inspire Medical has updated its revenue outlook for 2026 and issued its EPS outlook.

The company has lowered its revenue guidance to $950 million-$1 billion (representing growth of 4-10%from 2025 levels) from $1,003 million-$1,013 million (previously projected). The Zacks Consensus Estimate is pegged at $1 billion.

INSP expects its adjusted EPS for 2026 to be in the band of $1.85-$2.35.The Zacks Consensus Estimate is pegged at $1.72.

Inspire Medical exited the fourth quarter of 2025 with better-than-expected results. The solid improvement of the top line and improved marginswere impressive. The company’s launch progress with the latest Inspire V models in the United States looks promising as management stated that more than 90% of its centers have implanted the device.

INSP expects the transition to Inspire V from its existing Inspire IV IPG line to be completed later in 2026. The demand for Inspire therapy is also increasing, as the company noted a significant rise in social media activity during the fourth quarter. The recent FDA approval for 3 Tesla MRI compatibility should boost demand further.

However, the lowered revenue outlook for 2026 is disappointing. On its fourth-quarter earnings call, Inspire Medical stated that Inspire V procedures will be reimbursed under CPT code 64582 with a -52 modifier, which may reduce professional fees by 10-50%, potentially leading to a lower number of cases for the latest model.

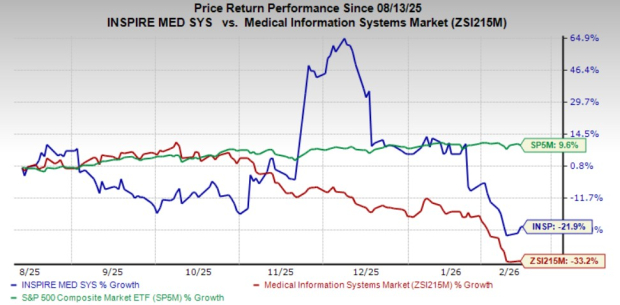

Insipre Medical’s shares fell 8.7% during after-hours trading on Feb. 11, likely due to lowered sales outlook for 2026. The company’s shares have lost 21.9% in the past six months compared with the industry’s 33.2% decline. The S&P 500 Index has gained 9.6% in the same period.

Although the company is focusing on mitigating the reduction in professional fees, sales in first-quarter 2026 are estimated to remain flat year over year. The company expects sequential sales growth thereafter, with the fourth quarter projected to be the strongest quarter of 2026. INSP is also working to establish a new CPT code for Inspire V, although it may take at least two years to take effect. Greater clarity on the actual impact of CPT code 64582 with a -52 modifier on INSP’s sales is expected to emerge as the year progresses.

Insipre Medical will focus on Inspire VI program in 2026 that will include sleep detection and auto activation to maximize therapy adherence.

Inspire Medical currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are DaVita Inc. DVA, Intuitive Surgical ISRG and Cardinal Health, Inc. CAH.

DaVita reported fourth-quarter 2025 adjusted EPS of $3.40, which beat the Zacks Consensus Estimate by 5.1%. Revenues of $3.62 billion surpassed the Zacks Consensus Estimate by 2.7%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has a long-term estimated growth rate of 20.2%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 1.2%.

Intuitive Surgical reported fourth-quarter 2025 adjusted EPS of $2.53, beating the Zacks Consensus Estimate by 12.44%. Revenues of $2.87 billion surpassed the Zacks Consensus Estimate by 4.6%. It currently sports a Zacks Rank of 1.

Intuitive Surgical has a long-term estimated growth rate of 15.7%. ISRG’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.24%.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, reported second-quarter fiscal 2026 adjusted EPS of $2.63, which beat the Zacks Consensus Estimate by 9.9%. Revenues of $65.63 billion topped the consensus mark by 0.9%.

Cardinal Health has a long-term estimated growth rate of 15%. CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 9.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 10 hours | |

| 14 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite