|

|

|

|

|||||

|

|

Industry Description

The Zacks Medical-Drugs industry comprises small and some medium-sized drug companies that make medicines for both human and veterinary use. We have a separate industry outlook discussion on big drugmakers. Small drugmakers have a limited portfolio of marketed drugs or no commercial-stage drugs at all. Some drugmakers are dependent on just one marketed drug or pipeline candidate. For such companies, upfront or milestone payments from collaboration partners — in most cases, their larger counterparts — are the main sources of revenues. These companies need ample free cash flow to fund their R&D activities.

Factors Shaping the Future of the Medical-Drugs Industry

Pipeline Success: The success or failure of key pipeline candidates in clinical studies can significantly drive the stock price of industry players. Successful innovation and product line extensions in important therapeutic areas and strong clinical study results may act as important catalysts for the stocks.

Strong Collaboration Partners: These companies regularly seek external partners and collaborators for complementary strengths. A partnership deal with a popular drugmaker is a good sign about the potential of small pharma companies, especially when an equity investment is included in the deal. M&A deals are in full swing in the sector, signaling growth.

Investment in Technology for Innovation: For smaller companies, succeeding in a shifting global market and evolving healthcare landscape requires adopting innovative business models, investing in new technologies and increasing investments in personalized medicines. Over the past few years, scientific and technological advancements have made it possible to develop personalized therapies. Other than that, adoption and information exchange through the meaningful use of health IT, development of therapies that improve overall patient outcomes and investment in developing and emerging markets are some of the key priorities for drug companies. Artificial intelligence and machine learning techniques are being used for the rapid advancement of drug discovery and target identification processes.

Pipeline Setbacks: The smaller companies have their share of risk in the form of unstable cash flows. Also, the failure of key pipeline candidates in pivotal studies and regulatory and pipeline delays can be huge setbacks for these smaller companies and significantly hurt their share prices.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks.

The Zacks Medical-Drugs industry currently carries a Zacks Industry Rank #56, which places it in the top 23% of the 246 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present you with a few top-ranked stocks to capitalize on the thriving prospects of the small and medium-sized drugmakers’ space, let’s take a look at the industry’s recent stock-market performance and the valuation picture.

Industry Versus S&P 500 and Sector

The Zacks Medical-Drugs industry is a huge 162-stock group within the broader Medical sector. The industry has outperformed the S&P 500 while slightly underperforming the Zacks Medical sector so far this year.

Stocks in this industry have collectively declined 7.3% year to date compared with the Zacks Medical sector’s decrease of 6.9% and the Zacks S&P 500 composite’s decline of 12.3%.

YTD Price Performance

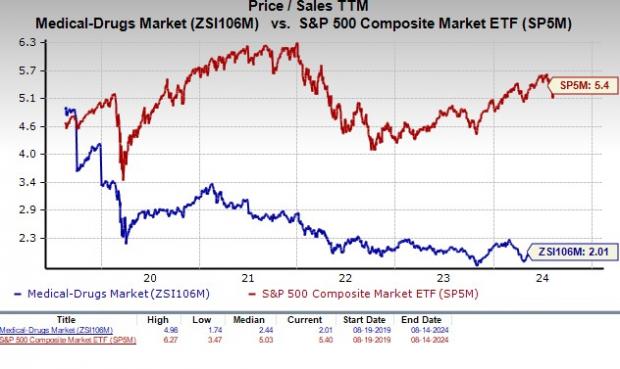

Industry's Current Valuation

Based on the trailing 12 months price-to-sales ratio (P/S TTM), which is a commonly used multiple for valuing these small drugmakers, the industry is currently trading at 1.82, compared with the S&P 500’s 4.79 and the Zacks Medical sector's 2.65

Over the last five years, the industry has traded as high as 3.07, as low as 1.68 and at the median of 2.13, as the chart below shows.

Trailing 12-Month Price-to-Sales (P/S) Ratio

5 Drug Stocks to Bet On

Heron Therapeutics: Redwood City, CA-based Heron Therapeutics’ key marketed drug is Zynrelef, a non-opioid dual-acting local anesthetic for post-operative pain for a wide range of surgical procedures. Zynrelef sales rose 44.1 % in 2024. Heron is optimistic that the drug should record transformational growth in 2025, driven by its expanded label indications, which now cover an estimated 17 million procedures annually. In addition, the launch of Vial Access Needle or VAN, which simplifies the preparation and administration of Zynrelef, and the distributor partnership with CrossLink Life Sciences to expand promotional efforts for Zynrelef should also contribute to Zynrelef sales growth in 2025. Its other commercial products, Aponvie, Cinvanti and Sustol are also generating decent sales. Overall, the company’s revenues and margins are growing.

The stock of Heron Therapeutics has risen 40.5% so far this year. The consensus estimate for 2025 has narrowed from a loss of 5 cents per share to breakeven over the past 60 days. The company has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. .

Price and Consensus: HRTX

Esperion Therapeutics: Ann Arbor, MI-based Esperion Therapeutics has two approved drugs — Nexletol (bempedoic acid) and Nexlizet (bempedoic acid/ezetimibe combination pill) — in its portfolio. Nexletol and Nexlizet have shown promising uptake and prescription trends since their launch in 2020. The drugs’ prescription trends have improved sequentially in recent quarters, with the trend expected to continue. The inclusion of the CLEAR Outcome study data has expanded the drugs’ label, allowing them to cater to a larger patient population. Esperion’s efforts to expand the label of Nexletol and Nexlizet also look promising. Esperion is developing two triple combination products with Nexletol/Nexlizet in combination with either atorvastatin or rosuvastatin.

Esperion Therapeutics’ stock has declined 57.7% in the year-to-date period. The consensus estimate for 2025 loss per share has narrowed from 13 cents to 9 cents over the past 60 days. The company has a Zacks Rank #2 (Buy).

Price and Consensus: ESPR

Pyxis Oncology: Boston, MA-based Pyxis Oncology is a cancer biotech focused on developing next-generation therapeutics to target difficult-to-treat cancers.

In November last year, Pyxis announced preliminary data from a phase I clinical dose escalation study that demonstrated that its lead pipeline candidate, micvotabart pelidotin has a profound monotherapy effect on multiple tumor types with significant tumor regression. Significant clinical responses were observed in patients with recurrent and metastatic head and neck squamous cell carcinoma (R/M HNSCC). The FDA granted Fast Track Designation to micvotabart pelidotin for the treatment of adult patients with R/M HNSCC whose disease progressed following treatment with platinum-based chemotherapy and an anti-PD-(L)1 therapy.

The stock of Pyxis Oncology has declined 34.6% in the year-to-date period. The consensus estimate for 2025 loss per share has narrowed from $1.29 per share to $1.17 per share over the past 60 days. The company has a Zacks Rank #2.

Price and Consensus: PYXS

Plus Therapeutics: Austin, TX-based Plus Therapeutics is a clinical-stage biotech developing targeted radiotherapeutics for difficult-to-treat cancers of the central nervous system (“CNS”).

Plus Therapeutics’ lead pipeline candidate is Reyobiq (previously Rhenium Re186 Obisbemeda), which is designed to treat CNS cancers, including recurrent glioblastoma (“GBM”), leptomeningeal metastases (“LM”), and pediatric brain cancers. Last month, the FDA granted an orphan drug designation (“ODD”) to Reyobiq for treating LM, a rare cancer complication, in patients with lung cancer. PSTV has completed enrollment in a phase I single dose administration study called ReSPECT-LM on Reyobiq in patients with LM and determined the maximum feasible and recommended phase II doses.

The company is also evaluating Reyobiq in the phase I/II study for recurrent GBM and has already received ODD and Fast Track designations from the FDA for this indication.

Plus Therapeutics’ stock has declined 31.5% in the year-to-date period. Loss estimates for 2025 have improved from $1.60 per share to 99 cents per share over the past 60 days. The company has a Zacks Rank #2.

Price and Consensus: PSTV

Aurinia Pharmaceuticals: Canada-based Aurinia Pharmaceuticals makes medicines to treat autoimmune, kidney and rare diseases. It presently markets Lupkynis (voclosporin), an oral therapy for treating active lupus nephritis (LN). The company recorded strong Lupkynis sales growth of 36% in 2024. Lupkynis was approved in Japan in September last year. Aurinia continues to study Lupkynis for use in expanded patient populations.

In 2024, Aurinia initiated a phase I study of AUR200, its potentially best-in-class dual inhibitor of BAFF and APRIL cytokines. It has the potential to treat a wide range of autoimmune diseases. Data from the study is expected in the second quarter of 2025.

Aurinia Pharmaceuticals has a Zacks Rank #2. The consensus estimate for 2025 earnings has declined from 55 cents per share to 47 cents per share over the past 60 days. The company has a Zacks Rank #2. The stock has declined 12.1% so far this year.

Price and Consensus: AUPH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite