|

|

|

|

|||||

|

|

The Estee Lauder Companies EL reported a gross margin of 76.5% in the second quarter of fiscal 2026, up from 76.1% in the prior-year period, reflecting a 40-basis-point increase. The expansion was achieved despite ongoing external pressures, including tariffs and shifts in the product mix.

Management attributed the improvement primarily to benefits from the company’s Profit Recovery and Growth Plan (“PRGP”). Restructuring actions and operational efficiencies generated cost savings during the quarter, while lower excess and obsolescence costs compared with the prior year reflected tighter inventory management. Improved sales leverage also contributed to the stronger gross margin performance.

At the same time, the company continued to invest in its brands. Consumer-facing investments increased 7% year over year, with management indicating that savings from restructuring initiatives helped support these expenditures. This approach allowed Estee Lauder to maintain marketing and innovation efforts while advancing cost discipline.

Tariffs remain a consideration for fiscal 2026. The company expects approximately $100 million in tariff-related impacts for the full year, net of mitigation actions, with a greater portion anticipated in the second half. Management continues to implement mitigation measures aimed at reducing the financial impact while maintaining focus on operational discipline.

For fiscal 2026, Estee Lauder updated its outlook and now projects an adjusted operating margin in the range of 9.8%-10.2%. The revised guidance reflects continued execution of cost initiatives and restructuring programs, as well as expectations for operational improvements over the remainder of the year.

The second-quarter results demonstrate progress under the PRGP and ongoing restructuring efforts. Future performance will depend on sustained cost efficiencies, disciplined inventory management and the company’s ability to navigate external pressures in the operating environment.

Shares of this Zacks Rank #3 (Hold) company have rallied 22.9% in the past three months compared with the broader Consumer-Staples sector and the industry’s growth of 12.9% and 17.1%, respectively. EL has also outperformed the S&P 500 Index’s rise of 3.7% during the same period.

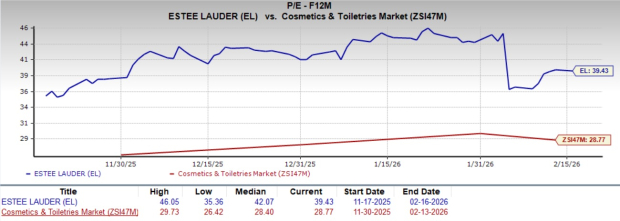

Estee Lauder currently trades at a forward 12-month P/E ratio of 39.43, above the industry average of 28.77 and the sector average of 18.24. This premium valuation reflects investor confidence in the company’s margin recovery and earnings growth potential, pointing to expectations of continued progress in its turnaround efforts.

The Zacks Consensus Estimate for the current fiscal-year earnings per share (EPS) has risen from $2.16 to $2.23 over the past 30 days. The consensus mark for the next fiscal year has also increased 3.1% to $3.04 in the same time frame. We note that the consensus mark for the current and next fiscal EPS suggests year-over-year growth of 47.7% and 36.3%, respectively. The upward estimate revisions reflect improving earnings visibility and strengthening confidence in EL’s recovery trajectory.

Estee Lauder’s improving gross margin, rising earnings estimates and recent share price strength highlight solid execution in its turnaround efforts, though continued cost discipline and tariff management will remain key to sustaining momentum.

Ralph Lauren Corporation RL, which designs, markets and distributes lifestyle products, currently sports a Zacks Rank #1 (Strong Buy). EL delivered a trailing four-quarter earnings surprise of 9.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s current fiscal-year sales and earnings suggests growth of 11.7% and 30.5%, respectively, from the year-ago figures.

European Wax Center EWCZ, a personal care franchise brand, carries a Zacks Rank of 2 (Buy). EWCZ delivered a trailing four-quarter earnings surprise of 170.2%, on average.

The consensus estimate for European Wax Center’s fiscal 2026 sales implies a rise of 1.3%, while that for earnings suggests a 0.8% dip from the year-ago figures.

Columbia Sportswear Company COLM, which designs, develops, markets, and distributes outdoor, active and lifestyle products, has a Zacks Rank #2 at present. COLM delivered a trailing four-quarter earnings surprise of 25.2%, on average.

The Zacks Consensus Estimate for Columbia Sportswear’s current fiscal-year sales calls for growth of 2.1%, while that for earnings suggests a 10.6% decline from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite