|

|

|

|

|||||

|

|

As global consumer staples companies navigate a prolonged period of muted demand, Colgate-Palmolive Company CL faces a familiar but increasingly delicate challenge: sustaining growth by balancing pricing discipline with volume recovery. Management made it clear on the latest earnings call that category growth remains structurally lower than historical norms, particularly in developed markets, even as volatility around tariffs, foreign exchange and consumer confidence persists. Against this backdrop, Colgate’s strategy is less about chasing volume at any cost and more about using pricing, mix and innovation to protect value while selectively rebuilding consumption.

The numbers underline this careful trade-off. In the fourth quarter of 2025, Colgate delivered modest volume growth on an underlying basis, excluding the impact of the private-label pet food exit and acquisitions, with underlying organic sales growth above 3%. Management indicated that global category growth has stabilized but remains subdued, running at roughly 1.5% to 2.5%, well below historical averages. For 2026, Colgate is guiding to 1%-4% organic sales growth, with outcomes highly dependent on how pricing and volume evolve across regions. Emerging markets stood out, posting roughly 4.5% organic growth in the fourth quarter with a healthier balance between price and volume, while the United States continued to see category volumes under pressure.

Regionally, the tension between pricing and volume is most evident in North America, where management noted negative category volumes across several core categories for much of the quarter. Consumers remain cautious, trading down, delaying pantry restocking and leaning more heavily on promotions. In response, Colgate is relying on revenue growth management, refined price-pack architecture and targeted promotions to remain competitive, while still pushing premium innovation to support pricing. In contrast, Latin America and parts of Asia showed stronger elasticity, allowing Colgate to take pricing where needed while still growing volumes, supported by brand strength and innovation across multiple price tiers.

Ultimately, Colgate’s ability to balance pricing and volume will hinge on execution rather than macro relief. Management emphasized that pricing remains necessary to offset costs and fund investment but acknowledged that long-term growth requires volume to recover, particularly in mature markets. With a stronger innovation pipeline, expanding premiumization and more data-driven pricing and promotional tools, Colgate believes it can navigate this soft market without eroding brand equity. The path forward may be uneven, but the company’s disciplined approach suggests it is prioritizing sustainable value creation over short-term volume wins.

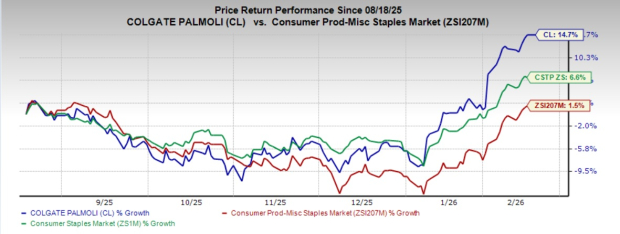

Shares of this Zacks Rank #3 (Hold) company have gained 14.7% in the past three months, outperforming both the industry and the broader Consumer Staples sector, which rose 1.5% and 6.6%, respectively.

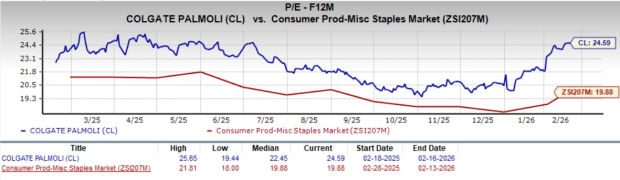

Colgate currently trades at a forward 12-month P/E ratio of 24.59X, which is higher than the industry average of 19.88X and the sector average of 18.24X. This valuation positions the stock at a premium relative to both its sector and industry peers, suggesting that investors may be pricing in stronger growth prospects, brand strength or operational efficiency compared with competitors.

The Hershey Company HSY, a confectionery product and pantry item company, currently sports a Zacks Rank #1 (Strong Buy). HSY delivered a trailing four-quarter earnings surprise of 17.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hershey’s fiscal 2026 sales and earnings suggests growth of 4.4% and 27.1%, respectively, from the year-ago figures.

Medifast, Inc. MED, which is a leading manufacturer and distributor of clinically proven healthy living products and programs, currently carries a Zacks Rank of 2 (Buy). MED missed the average earnings surprise by a sharp margin in the trailing four quarters.

The Zacks Consensus Estimate for Medifast’s current financial-year earnings indicates a decline of 156.5% from the year-ago number.

Ollie's Bargain Outlet Holdings, Inc. OLLI, a value retailer of brand-name merchandise, currently has a Zacks Rank of 2. OLLI delivered a trailing four-quarter earnings surprise of 5.2%, on average.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year earnings implies growth of 17.7% from the previous year’s reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 11 hours | |

| 11 hours | |

| 14 hours | |

| 14 hours | |

| 14 hours | |

| 14 hours | |

| 22 hours | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite