|

|

|

|

|||||

|

|

Micron Technology, Inc. MU and Taiwan Semiconductor Manufacturing Company TSM are key players in the artificial intelligence (AI) semiconductor ecosystem, benefiting from surging demand for data center and AI-driven computing. Micron provides the advanced memory chips that store and move the massive amounts of data required for AI, while Taiwan Semiconductor, based in Taiwan and also known as TSMC, is the largest contract chipmaker globally.

Though the two companies are well-positioned to benefit from the surging demand for AI and high-performance computing, their financial performance, growth strategies and valuations offer different risk-reward profiles for investors considering semiconductor exposure. Let’s see which stock is a better investment option right now.

Micron Technology sits at the heart of several transformative tech trends. Its exposure to AI, high-performance data centers, autonomous vehicles and industrial IoT uniquely positions the company for sustainable long-term growth. As AI adoption accelerates, the demand for advanced memory solutions like DRAM and NAND is soaring. Micron Technology’s investments in next-generation DRAM and 3D NAND ensure it remains competitive in delivering the performance needed for modern computing.

The company’s diversification strategy is also yielding positive results. Micron Technology has created a more stable revenue base by shifting its focus away from the more volatile consumer electronics market and toward resilient verticals, such as automotive and enterprise IT. This balance enhances its ability to weather cyclical downturns, a critical trait in the semiconductor space.

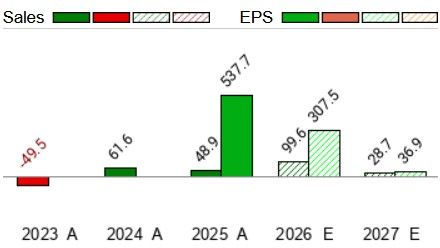

In the first quarter of fiscal 2026, Micron Technology’s revenues jumped 57% year over year to $13.64 billion, while non-GAAP earnings per share (EPS) rose 167% to $4.78. The top and bottom lines surpassed the Zacks Consensus Estimate by 7.26% and 22.25%, respectively.

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

Micron Technology is also riding on a strong wave in high-bandwidth memory (HBM) demand. Its HBM3E products are attracting significant interest for their superior energy efficiency and bandwidth, which are ideal for AI workloads. The company has noted that its supply of HBM3E and next-generation HBM4 chips for the calendar year 2026 has already been sold out.

Micron Technology is a core HBM supplier for NVIDIA’s GeForce RTX 50 Blackwell GPUs, signaling deep integration in the AI supply chain. Its under-construction HBM advanced packaging facility in Singapore, set to launch this year with further expansion in 2027, underscores the company’s commitment to scaling production for AI-driven markets.

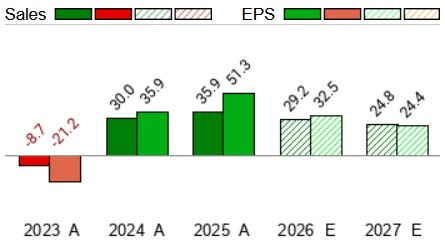

Taiwan Semiconductor continues to lead the global chip foundry market. Its scale and technology make it the first choice for companies driving the AI boom. NVIDIA, Marvell and Broadcom all count on TSMC to build advanced graphics processing units (GPUs) and AI accelerators. TSM’s full-year 2025 results highlight just how dominant the company remains. In 2025, Taiwan Semiconductor’s revenues surged approximately 36% year over year to $122.42 billion, while EPS jumped 51% to $10.65.

Taiwan Semiconductor Manufacturing Company Ltd. price-consensus-eps-surprise-chart | Taiwan Semiconductor Manufacturing Company Ltd. Quote

AI-related chip sales have become a major driver. In 2025, high-performance computing (HPC), which includes AI-related revenues, accounted for 58% of total revenues, up from 51% in 2024. Taiwan Semiconductor’s long-term forecasts depict that the momentum is far from over. Management expects AI revenues to increase at a CAGR of more than 50% in five years from 2024 to 2029. That makes TSMC central to the AI supply chain.

To keep up with the growing demand for AI chips, Taiwan Semiconductor is spending aggressively. The company is set to invest between $52 billion and $56 billion in capital expenditures in 2026, far outpacing its $40.9 billion investment in 2025. The bulk of this spending is focused on advanced manufacturing processes, ensuring TSMC remains ahead of rivals in the chip manufacturing space.

Despite its strengths, Taiwan Semiconductor witnesses near-term hurdles. Escalating geopolitical tensions, particularly U.S.-China relations, pose strategic risks. With significant revenue exposure to China, TSMC is vulnerable to export restrictions, supply-chain disruptions or further regulatory pressure. These uncertainties could weigh on the near-term performance.

The company’s global expansion strategy adds further strain. New fabs in the United States (Arizona), Japan and Germany are vital for geopolitical risk mitigation, but they come with higher costs. These facilities are expected to drag down gross margins by 2-3 percentage points annually over the next three to five years due to higher labor and energy costs, along with lower utilization rates in the early stages.

Both companies will benefit from the surging demand for AI chips, but Micron Technology’s growth profile appears stronger in the near term. The Zacks Consensus Estimate for MU’s current fiscal-year 2026 revenues and EPS indicates a year-over-year surge of 99.7% and 307.5%, respectively. 2026 estimates for Taiwan Semiconductor imply 29.2% revenue growth and a 32.5% EPS increase.

Comparing the two stocks’ price performance, Micron Technology has surged 283.1% over the past year, outperforming Taiwan Semiconductor’s gain of 81.2%.

When comparing valuations, Taiwan Semiconductor currently trades at a higher forward 12-month price-to-earnings (P/E) multiple of 25.00 compared to Micron Technology’s 10.09. This suggests investors are paying a larger premium for TSM stock, even though its forward earnings growth profile is significantly lower than MU’s.

Both Micron Technology and Taiwan Semiconductor are positioned to gain from AI. MU’s higher EPS growth projection and lower valuation P/E multiple than TSM make it a better investment choice right now.

Currently, Micron Technology and Taiwan Semiconductor each sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 30 min | |

| 43 min | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite