|

|

|

|

|||||

|

|

With escalating geopolitical threats worldwide and more nations investing heavily to secure their borders, prominent defense contractors like RTX Corporation RTX and Lockheed Martin LMT are gaining substantially. With global defense budgets on the rise like never before, these two defense giants are well positioned to benefit from the growing demand for advanced, lethal weaponries.

While RTX brings a diversified portfolio to the table, with strengths in aerospace systems, precision weapons and advanced defense electronics, Lockheed, the world’s largest defense contractor, is best known for its flagship platforms such as the F-35 fighter jet as well as its leadership in missile defense and space systems. With both companies boasting strong government contracts and long-term revenue visibility, investors seeking exposure to the defense sector may find themselves weighing the relative advantages of these two industry giants. This article dives into their fundamentals to determine which stock could shine brighter in 2025.

Recent Achievements: RTX registered a solid 8% organic growth in its sales, primarily driven by strength in its commercial aftermarket and defense businesses, in the first quarter of 2025. Looking ahead, we may expect this defense giant to continue to record such solid sales growth due to significant contracts clinched during the first quarter and its defense bookings worth $9 billion.

On the other hand, improving commercial air traffic in recent times has proved to be a key growth catalyst for RTX’s commercial OEM and aftermarket sales. Thanks to the growing demand for new aircraft production and increased aircraft utilization resulting in enhanced aftermarket jet services, RTX recorded a solid backlog of $125 billion as of March 31, 2025, for its commercial business.

Financial Stability: As of March 31, 2025, RTX’s cash and cash equivalents totaled $5.16 billion. Its long-term debt of $38.24 billion as of March 31, 2025, remained well above the cash balance but declined sequentially. However, the current debt value of $3.06 billion remained well below the company’s cash reserve. This reflects a solid solvency position for the stock, at least over the short term. This, in turn, should enable the company to invest in advanced defense products and technologies, further strengthening its value in the defense industry.

Challenges to Note: In February 2025, the U.S. government issued several executive orders imposing tariffs on imports from most countries with which the United States engages in trade (the Tariff EOs). In response to these tariffs, China, the European Union, and Canada have announced, and in some cases imposed, counter tariffs on goods that are imported from the United States.

Since RTX imports goods subject to tariffs from many countries covered by the Tariff Eos, the uncertainties created by these changes in global trade policy and the imposition of tariffs, counter-tariffs and non-tariff countermeasures by countries subject to U.S. tariffs may adversely impact the company’s financial results in the coming quarters. Also, persistent supply-chain issues affecting the aerospace sector continue to pose a risk for RTX.

Recent Achievements: Lockheed registered a solid 4.5% year-over-year improvement in its sales on the back of better-than-expected performance on contract completions at its Aeronautics, Rotary & Missions and Space business segments in the first quarter of 2025. Looking ahead, we may expect this defense contractor to continue to record such solid sales growth due to significant contracts clinched during the first quarter and a solid backlog worth $172.97 billion (as of March 30, 2025).

Moreover, according to Lockheed’s management, the current defense situation worldwide should aid sustained backlog strength for the company with improved U.S. and international budget opportunities. This has made LMT confident about generating stronger sales through 2027. This steady top-line growth, combined with operational improvements, will likely enable LMT to invest more than $10 billion in R&D and capital expenditures and return at least $18 billion to shareholders via dividends and repurchases over the next three years.

Financial Stability: Lockheed’s cash and cash equivalents totaled $1.80 billion as of March 30, 2025, while its long-term debt amounted to $18.66 billion. On the other hand, its current debt totaled $1.64 billion at the end of the first quarter. A comparative analysis of these figures suggests that while Lockheed’s cash position exceeds its current debt, the margin isn’t substantial. This points to a moderate solvency position in the near term, meaning the company could face some pressure in meeting debt obligations if cash flow weakens. This may restrict LMT from carrying out its aforementioned capital deployment plans in the form of dividend pay-outs and share repurchases.

Challenges to Note: The shortage of labor, especially skilled labor, continues to pose a threat for industry players like Lockheed. So, considering the fact that aircraft manufacturers have started to ramp up their production rates following the steady recovery from the impacts of the pandemic, such labor shortages might affect aerospace stocks like Lockheed.

Moreover, in 2024, China specifically banned the export of certain minerals to the United States. If China further restricts the export of certain materials, takes further actions to enforce the existing sanctions on Lockheed, imposes additional sanctions or levies sanctions on its suppliers, teammates or partners, the company’s business could be adversely impacted.

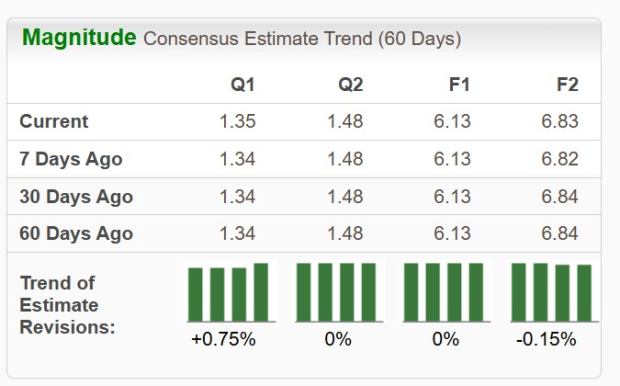

The Zacks Consensus Estimate for RTX’s 2025 sales and earnings per share (EPS) implies an improvement of 4.4% and 7%, respectively, from the year-ago quarter’s reported figures. RTX’s EPS estimates show mixed movement over the past 60 days.

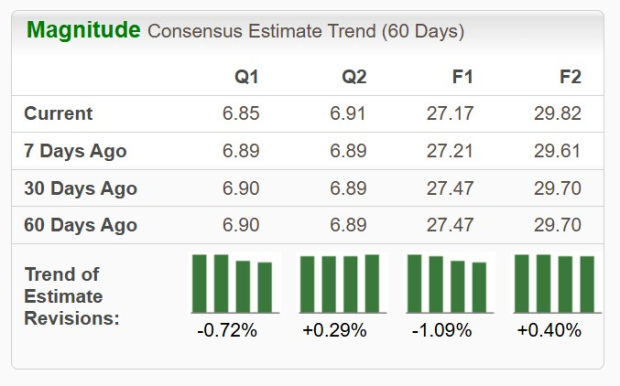

The Zacks Consensus Estimate for Lockheed’s 2025 sales implies a year-over-year improvement of 4.5%, while that for earnings suggests a 4.6% decline. The stock’s EPS estimates show mixed movement over the past 60 days.

RTX (down 9.2%) has underperformed LMT (down 7%) over the past three months. However, in the past year, RTX has outperformed LMT. While RTX’s shares surged 12.2%, LMT inched up 0.5%.

Lockheed is trading at a forward earnings multiple of 16.58X, below RTX’s forward earnings multiple of 17.93X. However, when compared to their respective five-year median, LMT’s forward earnings multiple, unlike that of RTX, looks a bit stretched.

Amid rising global security concerns, both RTX and Lockheed remain solid defense players, backed by strong backlogs and robust government contracts. While RTX offers diversified exposure with strength in both defense and commercial aerospace, it faces near-term challenges from global trade policies and supply-chain risks. Lockheed, on the other hand, stands out with a larger backlog and shareholder-friendly capital return plans, though its moderate solvency position and exposure to labor shortages may limit flexibility.

With both these stocks carrying a Zacks Rank #3 (Hold) at present, investors may stay invested in RTX stock for balanced exposure across segments. Lockheed, on the other hand, could be more appealing to those seeking pure-play defense exposure and attractive valuation.

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Pentagon To Punish Habitually Late Contractors. These Defense Stocks Fall

RTX

Investor's Business Daily

|

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite