|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The global payments landscape continues to expand as digital transactions displace cash and cross-border commerce grows. Two industry titans, Mastercard Incorporated MA and American Express Company AXP, remain central to that transformation, yet their business models differ in important ways. Mastercard operates a vast global card network, while American Express combines payments with direct lending to consumers and businesses.

Both companies benefit from strong brand equity, network effect and rising electronic payment penetration. However, the macro backdrop in 2026, including expected shifts in consumer spending patterns, regulatory oversight and evolving fintech competition, makes it timely to reassess which company’s competitive advantages run deeper.

With earnings momentum diverging and operating models facing different risk exposures, investors are increasingly focused on durability rather than just growth. Let’s take a closer look at the fundamentals to determine which company commands the stronger moat today.

Mastercard’s moat is rooted in its asset-light network model, and it has a market cap of $465.5 billion. The company does not take on credit risk; instead, it earns fees from transaction processing and cross-border activity. This structure provides resilience during economic slowdowns, as it avoids loan losses that can pressure integrated lenders. Its global acceptance footprint spans more than 200 countries and territories, reinforcing network effects that are difficult for competitors to replicate.

In the fourth quarter of 2025, Mastercard delivered 18% net revenue growth, supported by healthy cross-border volume (up 14% YoY), steady consumer spending and robust value-added services (VAS). Cross-border transactions, a high-margin driver, continued to recover, reflecting sustained travel demand. Adjusted operating margin improved 140 basis points YoY to 57.7%.

Mastercard invests aggressively in value-added services, including cybersecurity, data analytics and open banking solutions. These adjacencies diversify revenue beyond traditional swipe fees and deepen relationships with merchants and financial institutions. Fourth quarter VAS revenues totaled $3.9 billion, up 26% year over year. Compared with AmEx, which relies more heavily on cardmember spending within its own system, Mastercard’s open network allows it to partner broadly with banks and fintech firms.

Risks remain, including regulatory scrutiny of interchange fees and competition from alternative payment rails. However, Mastercard’s diversified geographic exposure and strong free cash flow generation provide flexibility to navigate such pressures. Its balance sheet strength and capital-light model reinforce earnings durability.

American Express operates a differentiated closed-loop model, issuing cards directly to consumers and merchants while extending credit. This structure allows it to capture both transaction fees and interest income, which can boost revenue during periods of strong spending. The company continues to attract affluent customers, a demographic that tends to be more resilient in economic downturns.

AmEx has a market cap of $231.7 billion and leans heavily on its premium positioning to drive growth, reinforcing its pricing power. Unlike Mastercard’s bank-partnered network spanning thousands of issuers globally, AmEx’s expansion relies primarily on growing its proprietary card base, deepening engagement within its closed-loop platform and selective partnering with issuers overseas.

In the fourth quarter of 2025, AmEx posted 10% revenue growth, driven by higher cardmember spending and net interest income. Loan balances expanded, reflecting healthy demand from its premium customer base. However, this same lending exposure introduces credit risk that Mastercard avoids. Rising delinquencies or economic softness could weigh more heavily on American Express’ profitability.

While AmEx generates strong returns on capital (12.1%) and maintains a loyal customer base, its business is more concentrated geographically, with significant exposure to the U.S. market. In contrast, Mastercard’s broader international diversification offers additional growth levers, particularly in emerging markets, and it has a return on capital of 58.2%.

The Zacks Consensus Estimate for Mastercard’s 2026 and 2027 revenues is pinned at $36.97 billion and $41.34 billion, respectively, signaling 12.7% and 11.8% year over year growth. The consensus mark for 2026 and 2027 EPS is pegged at $19.38 and $22.40, indicating 13.9% and 15.6% growth, respectively. The 2026 earnings estimate witnessed 13 upward revisions and one downward movement. Mastercard beat earnings in each of the past four quarters, with an average surprise of 5.5%.

Mastercard Incorporated price-consensus-eps-surprise-chart | Mastercard Incorporated Quote

Meanwhile, the consensus estimate for AXP’s 2026 and 2027 revenues is pinned at $78.76 billion and $84.98 billion, respectively, signaling 9% and 7.9% year over year growth. The consensus mark for 2026 and 2027 EPS is pegged at $17.51 and $20.09, indicating 13.9% and 14.7% growth, respectively. The 2026 earnings estimate witnessed four upward revisions and two movement in the opposite direction. AmEx beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 3.9%.

American Express Company price-consensus-eps-surprise-chart | American Express Company Quote

Mastercard trades at a premium forward price-to-earnings multiple relative to AmEx, reflecting its capital-light structure and lower risk profile. MA currently trades at a forward P/E of 26.38X, higher than AXP’s 19.29X. The valuation gap underscores the market’s preference for Mastercard’s stability and diversified growth drivers.

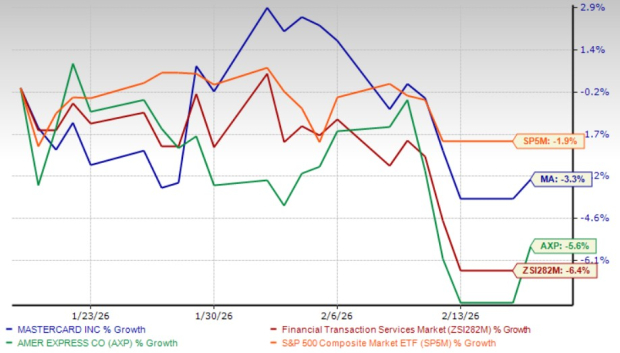

Over the past month, Mastercard shares have shed less value than AXP. It fell 3.3%, while AmEx and the industry have declined 5.6% and 6.4%, respectively. The S&P 500 has decreased 1.9% during this time.

Both Mastercard and AmEx remain high-quality payment companies positioned to benefit from the global digitization efforts. AmEx offers premium brand strength and interest income upside, but its lending exposure introduces cyclical risk.

Mastercard’s deeper moat lies in its asset-light, globally diversified network model, strong margins and expanding value-added services ecosystem. With strong earnings estimate revisions and sustained cross-border momentum, Mastercard appears better positioned to deliver durable upside in 2026, even though the companies currently carry a Zacks Rank #3 (Hold) each.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 48 min |

Stock Market Today: Dow Drops Amid U.S.-Iran Tensions; Etsy Soars On Deal News (Live Coverage)

AXP

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 10 hours | |

| 11 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Digital payments sovereignty: Industry responds to UK domestic card payments alternative

MA

Retail Banker International

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite