|

|

|

|

|||||

|

|

Healthcare insurance company Molina Healthcare (NYSE:MOH) announced better-than-expected revenue in Q1 CY2025, with sales up 12.2% year on year to $11.15 billion. Its non-GAAP profit of $6.08 per share was 2.1% above analysts’ consensus estimates.

Is now the time to buy Molina Healthcare? Find out by accessing our full research report, it’s free.

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE:MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

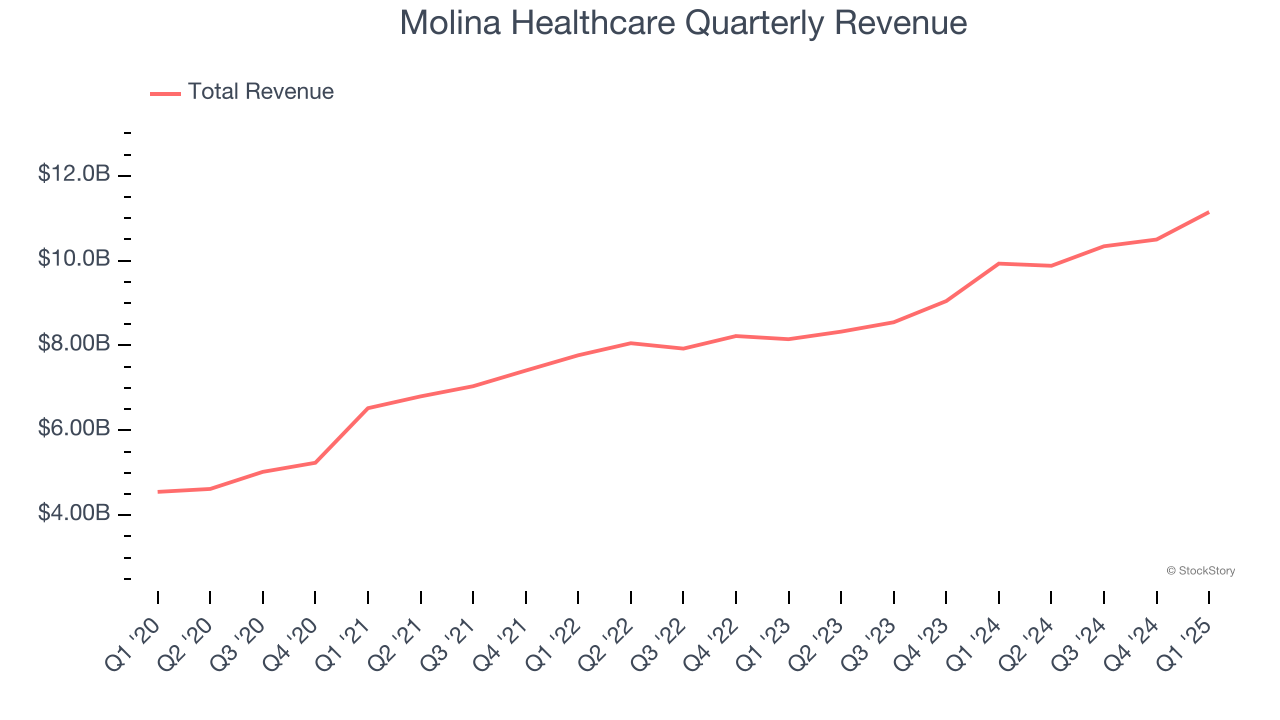

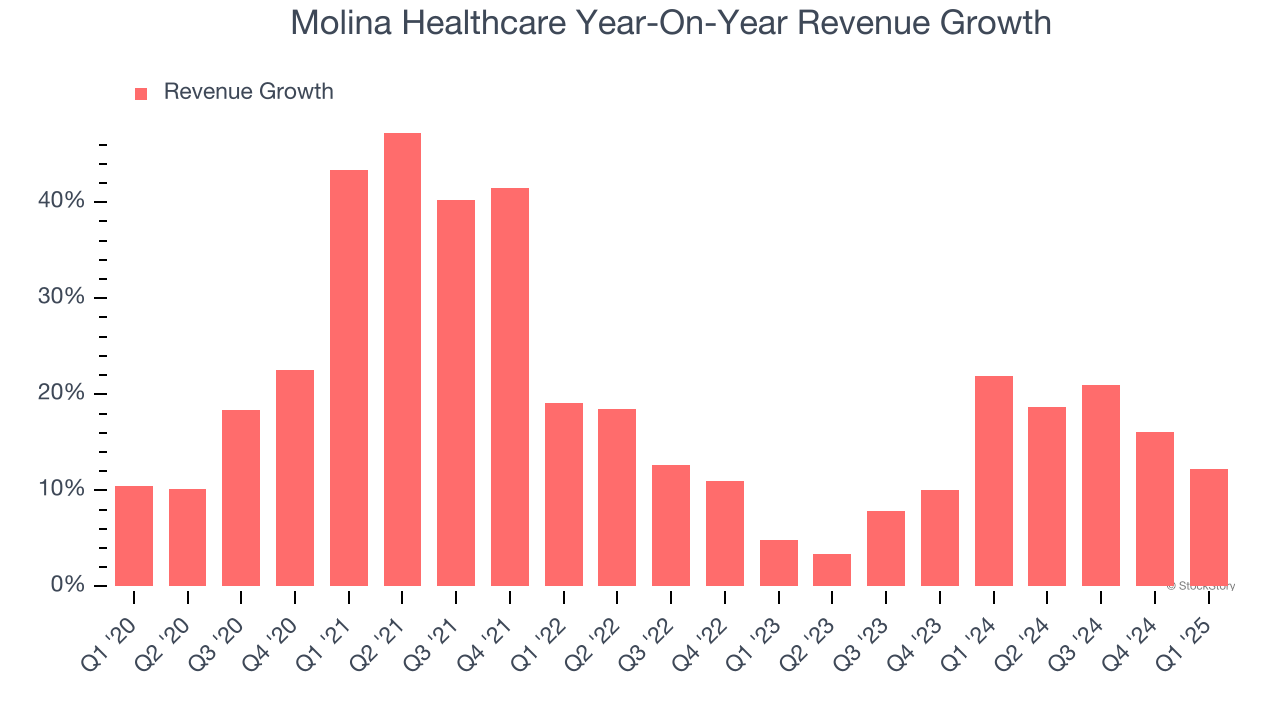

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Molina Healthcare’s sales grew at an impressive 19.4% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Molina Healthcare’s annualized revenue growth of 13.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

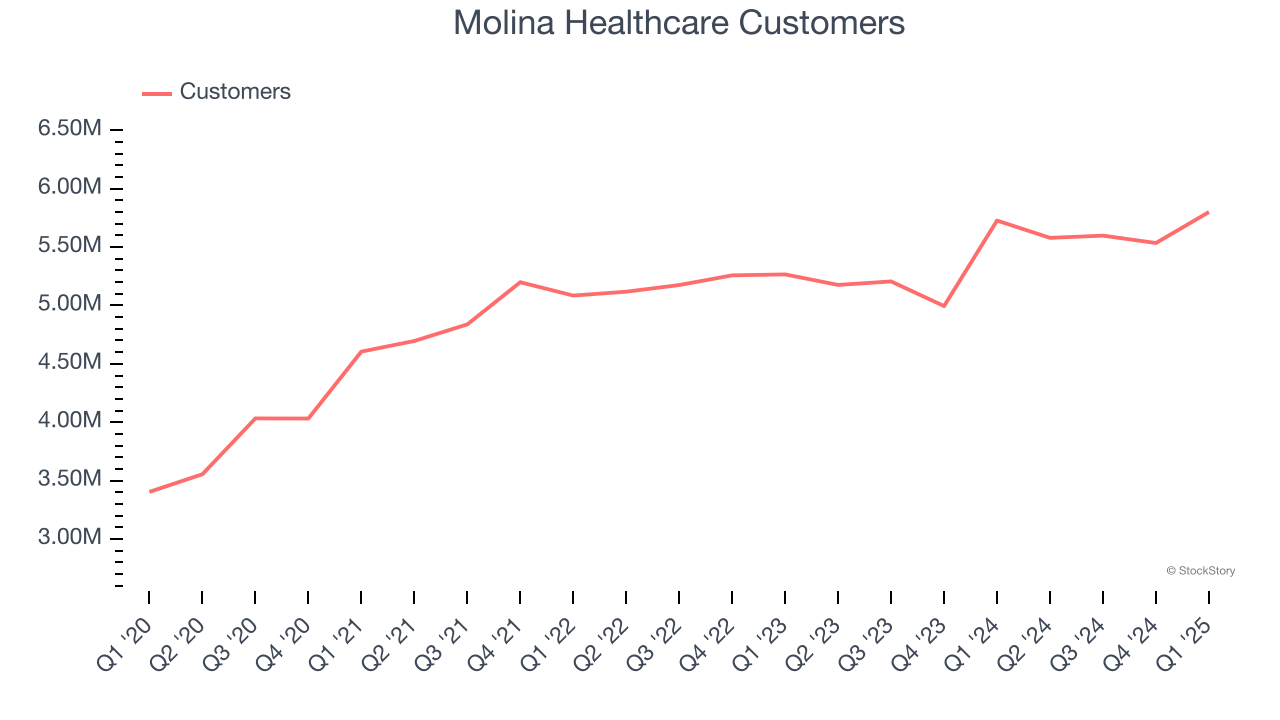

We can dig further into the company’s revenue dynamics by analyzing its number of customers, which reached 5.8 million in the latest quarter. Over the last two years, Molina Healthcare’s customer base averaged 4.1% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Molina Healthcare reported year-on-year revenue growth of 12.2%, and its $11.15 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

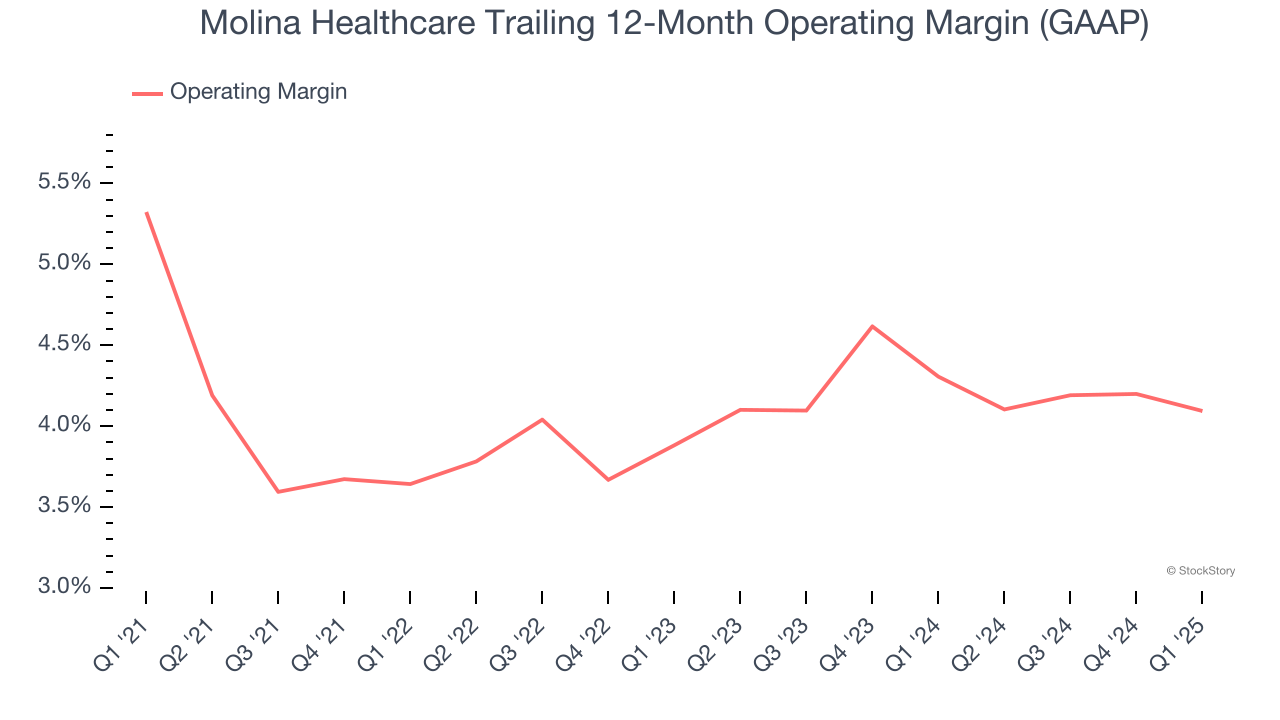

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Molina Healthcare was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for a healthcare business.

Analyzing the trend in its profitability, Molina Healthcare’s operating margin decreased by 1.2 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. We like Molina Healthcare and hope it can right the ship.

In Q1, Molina Healthcare generated an operating profit margin of 3.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

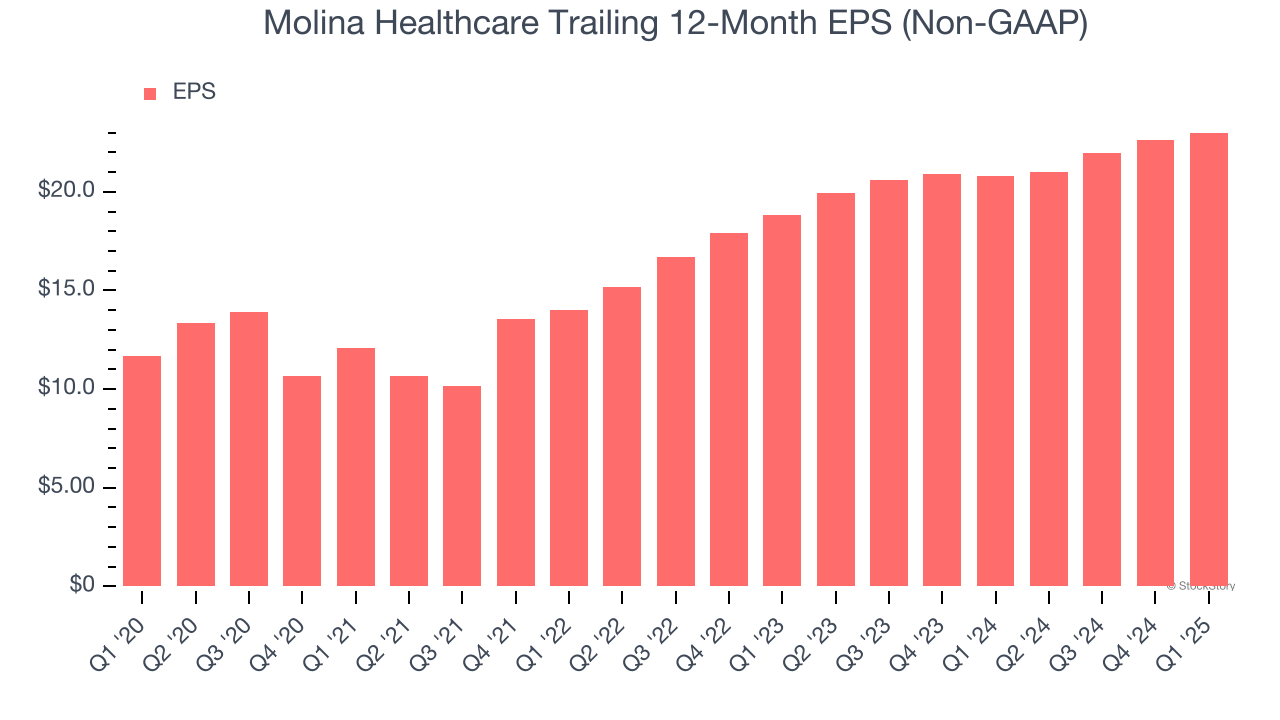

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Molina Healthcare’s EPS grew at a spectacular 14.6% compounded annual growth rate over the last five years. However, this performance was lower than its 19.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Molina Healthcare’s earnings can give us a better understanding of its performance. As we mentioned earlier, Molina Healthcare’s operating margin was flat this quarter but declined by 1.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Molina Healthcare reported EPS at $6.08, up from $5.73 in the same quarter last year. This print beat analysts’ estimates by 2.1%. Over the next 12 months, Wall Street expects Molina Healthcare’s full-year EPS of $23 to grow 11.4%.

We enjoyed seeing Molina Healthcare beat analysts’ revenue and EPS expectations this quarter. We were also happy its customer base narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Still, this quarter had some key positives. The stock remained flat at $332 immediately after reporting.

Indeed, Molina Healthcare had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-26 | |

| Feb-25 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-14 | |

| Feb-12 | |

| Feb-11 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite