|

|

|

|

|||||

|

|

Swimming pool distributor Pool (NASDAQ:POOL) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 4.4% year on year to $1.07 billion. Its GAAP profit of $1.42 per share was 4.1% below analysts’ consensus estimates.

Is now the time to buy Pool? Find out by accessing our full research report, it’s free.

“Execution of our long-term strategic initiatives and organic growth investments contributed positively to our performance this quarter, and our team generated over $1.0 billion in net sales, highlighting the strength and resiliency of our business. During the quarter, we continued to expand our sales center network by adding two greenfield locations, optimizing our supply chain capabilities and further expanding our suite of premium product offerings. Combined with further integration of our digital platform, these initiatives position us to capture available demand that allows us to outperform the market while providing a best-in-class customer experience,” commented Peter D. Arvan, president and CEO.

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

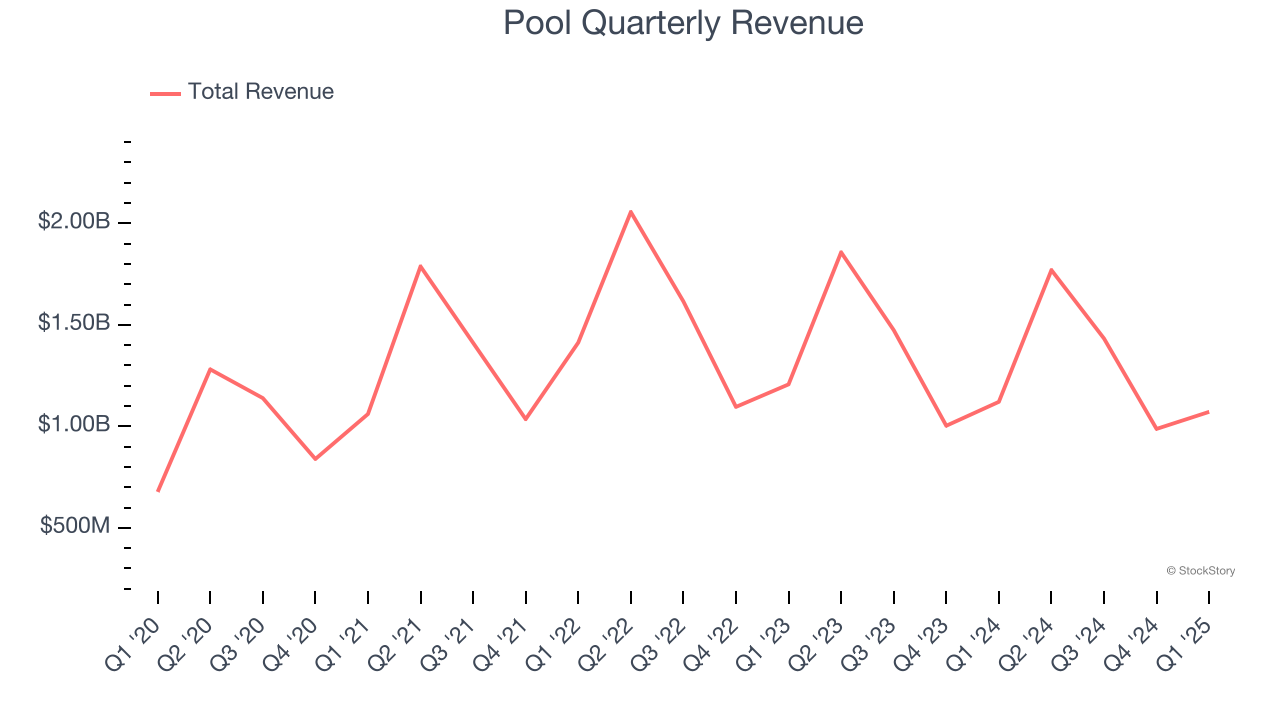

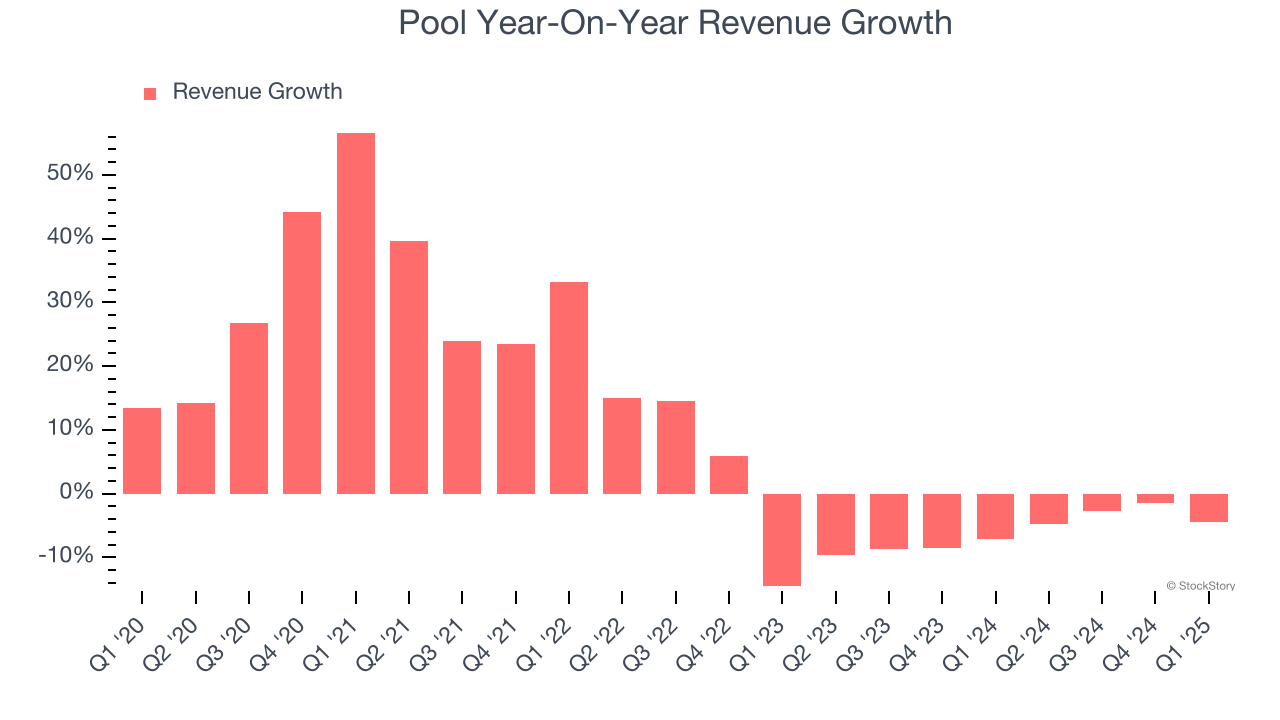

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Pool’s sales grew at a tepid 9.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Pool’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.1% annually.

This quarter, Pool missed Wall Street’s estimates and reported a rather uninspiring 4.4% year-on-year revenue decline, generating $1.07 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

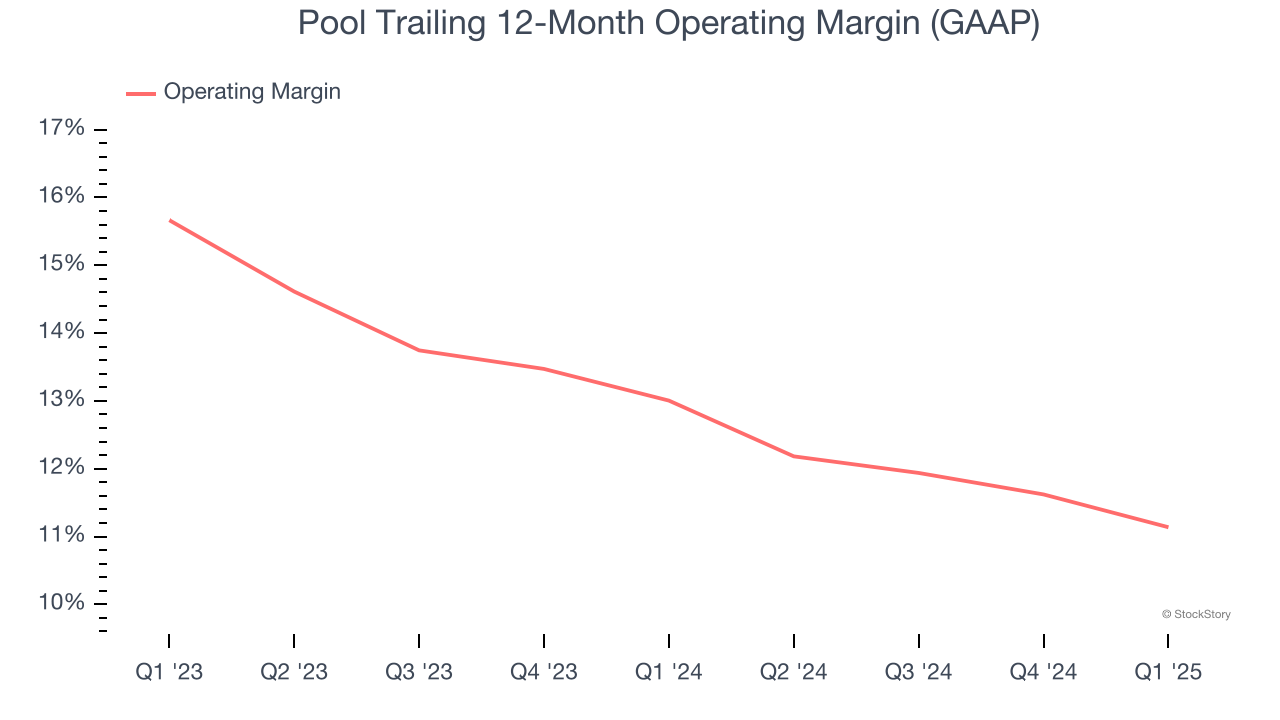

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Pool’s operating margin has been trending down over the last 12 months, but it still averaged 12.1% over the last two years, decent for a consumer discretionary business. This shows it generally does a decent job managing its expenses.

In Q1, Pool generated an operating profit margin of 7.2%, down 2.5 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

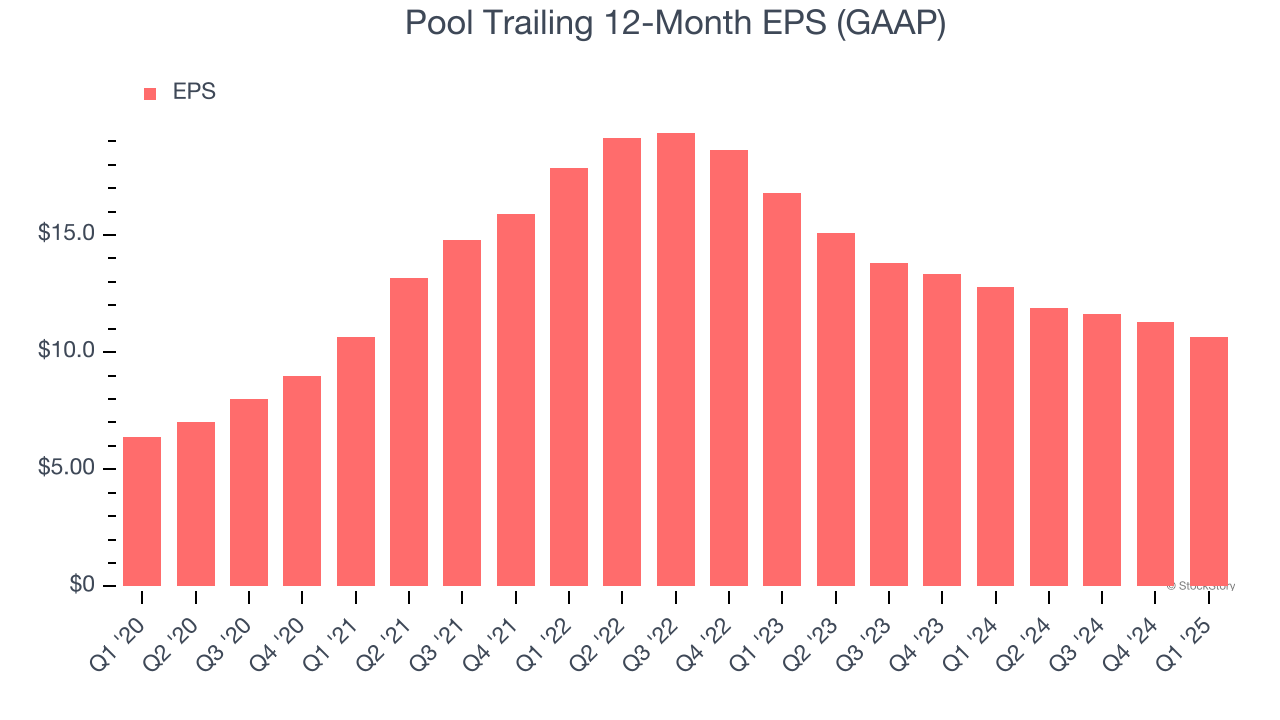

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Pool’s decent 10.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q1, Pool reported EPS at $1.42, down from $2.04 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Pool’s full-year EPS of $10.66 to grow 6.8%.

Pool's revenue missed and its EPS fell short of Wall Street’s estimates. On a more positive note, full-year EPS guidance met expectations. Overall, this quarter was mixed, but the full-year EPS outlook seems to be sparking some optimism. The stock traded up 2.5% to $316.99 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-10 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 | |

| Jan-30 | |

| Jan-29 | |

| Jan-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite