|

|

|

|

|||||

|

|

Rocket Lab USA, Inc. RKLB has recently been selected by Kratos to execute a full-scale hypersonic test flight under the Department of Defense’s MACH-TB 2.0 program, further cementing its role as a critical player in the national defense tech landscape. The $1.45-billion MACH-TB 2.0 initiative is aimed at significantly accelerating hypersonic testing capabilities. This mission will be launched from Rocket Lab’s Complex 2 in Virginia using its HASTE rocket.

The company’s increasing launch cadence and integration with major defense partners like Kratos underscore its strategic relevance and potential for long-term government contracts. With more HASTE launches lined up for 2025-26, this latest win might attract investors to add RKLB to their portfolio, seeking exposure to cutting-edge defense and aerospace innovation.

However, before making any hasty decision, it would be prudent to take a look at Rocket Lab’s share price performance over the past year, the stock’s growth prospects as well as risks (if any) to investing in the same. The idea is to help investors make a more insightful decision.

Rocket Lab’s shares have skyrocketed 455.9% in the past year, outperforming the Zacks aerospace-defense industry’s decline of 0.5%. It has also outpaced the broader Zacks Aerospace sector’s rise of 3.8% as well as the S&P 500’s gain of 5.2% in the same time frame.

A similar stellar performance has been delivered by other industry players, such as Embraer ERJ and Intuitive Machines LUNR, whose shares have surged 77% and 18.3%, respectively, over the past year.

Over the past decade, the commercial space technology market — covering communication, Earth observation and navigation — has seen robust growth. At the same time, rising geopolitical tensions have led governments to strengthen national security through increased military satellite deployments. This dual demand has been significantly boosting interest in Rocket Lab’s launch services, satellite manufacturing and on-orbit operations. The latest contract win is a bright example of that.

Impressively, Rocket Lab’s space systems have supported more than 1,700 missions worldwide, including high-profile projects such as components for the James Webb Space Telescope and key infrastructure for global communications constellations.

The company’s HASTE is a suborbital testbed launch vehicle, derived from Rocket Lab’s heritage Electron rocket, and provides reliable, high-cadence flight test opportunities required for hypersonic missions. Rocket Lab has successfully launched HASTE three times to date, including two launches within 21 days.

Successful mission launches and contract wins, like the latest one, bolster Rocket Lab’s revenues, which surged 78.3% year over year in 2024. Such strong financial performance is likely to have been boosting investor confidence in this stock, which was duly reflected in its share price performance over the past year.

According to a World Economic Forum report from April 2024, the space economy may reach $1.8 trillion by 2035, driven by the increasing adoption of satellite and rocket-enabled technologies. This outlook strengthens the long-run growth prospects of space stocks like LUNR and RKLB. Notably, RKLB’s Electron launch vehicle ranks as the second most frequently launched orbital rocket by U.S. companies.

However, in February 2025, Bleecker Street Research published a report accusing Rocket Lab of misleading investors regarding the development timeline of its Neutron rocket, suggesting potential delays and financial concerns. Later in a press release, it was announced that a securities class action lawsuit has been filed against Rocket Lab USA, citing that the company failed to disclose the aforementioned delays to its investors and that the only contract for its Neutron launch vehicle was made at a discount with an unreliable partner.

RKLB's failure to issue a formal press release or public statement directly addressing the aforementioned allegations might thus remain a cause for concern for its investors.

In fact, if the company faces a delay in launching its new products like Neutron, its future financial performance might suffer, and so will the market sentiment for this stock, thereby affecting its share price.

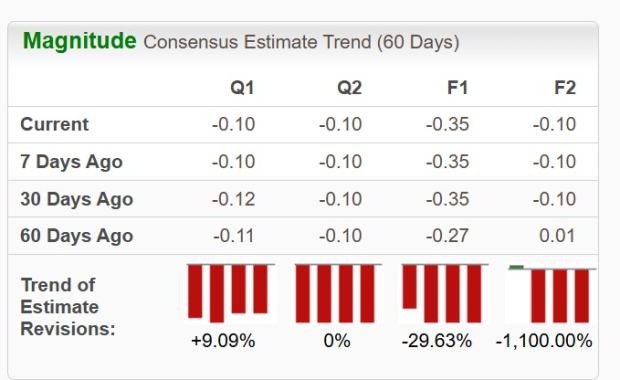

Let’s take a sneak peek at its near-term estimates to see what analysts expect from RKLB in the next few quarters.

The Zacks Consensus Estimate for RKLB’s 2025 and 2026 sales suggests an improvement of 32% and 48.2%, respectively, year over year. A look at its 2024 and 2025 earnings estimates suggests a similar year-over-year improvement.

However, its first and second-quarter 2025 earnings estimates reflect a year-over-year decline, most probably due to the litigation costs and other operating expenses RKLB might incur in connection to the aforementioned delay in its vital programs. The downward revision of its 2025 and 2026 estimates further indicates investors’ declining confidence in the stock.

While Rocket Lab presents significant long-run growth opportunities, it faces notable challenges. A key risk lies in its high operating expenses, caused by investments in innovations like the Neutron launch vehicle, Electron’s first-stage recovery, advanced spacecraft capabilities and an expanded portfolio of components. These expenses often offset revenue gains, leading to losses, as evident from its recent quarterly reports.

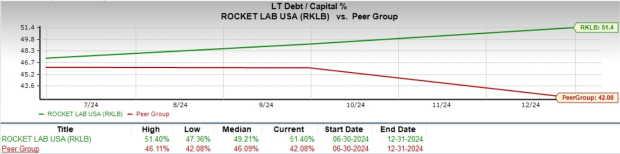

Moreover, the company is highly debt-ridden at this moment compared to its peer group (as is evident from the image for its long-term debt-to-capital ratio, available below) as it is investing heftily in designing, manufacturing, and commercializing new technologies. If the company fails to deliver the new products in time, such high debt burdens might weigh on its future financial performance.

RKLB’s Long-term Debt-to-Capital

In terms of valuation, RKLB’s forward 12-month price-to-sales (P/S) is 13.89X, a premium to its industry’s average of 1.82X. This suggests that investors will be paying a higher price than the company's expected sales growth compared to that of its industry.

Another space stock, LUNR, is also trading at a premium to the industry average in terms of its forward P/S ratio. LUNR has a forward sales multiple of 4.54X.

However, another industry player, ERJ, is trading at a discount, with its forward sales multiple of 1.05X.

To conclude, investors interested in Rocket Lab should wait for a better entry point, considering its premium valuation, high leverage and the challenges it is facing in terms of lawsuits related to program delays. The stock holds a VGM score of F, which is also not a very favorable parameter for investing in a stock.

RKLB’s Zacks Rank #4 (Sell) further supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite