|

|

|

|

|||||

|

|

Credo Technology Group Holding Ltd CRDO and Marvell Technology, Inc. MRVL are chipmakers that offer high-speed connectivity solutions for the data infrastructure market.

The data center market is rapidly evolving as organizations across the globe speed up digital transformation efforts, including the adoption of hybrid/multi-cloud strategies and cutting-edge tech like AI and ML. This has led to an exponential growth in data generation and is stressing existing data center infrastructure, resulting in increased demand for innovative data processing and storage solutions. As per a Grand View Research report, the global data center market is expected to witness a CAGR of 11.2% between 2025 and 2030.

This bodes well for both Credo and Marvell, which specialize in delivering interconnect and networking technologies that support the growing demands of AI workloads.

So, now the question arises: Which stock makes a better investment pick at present? Let’s dive into the fundamentals, valuations, growth outlook and risks for each company.

Credo is gaining a strong market presence in both Ethernet and Active Electrical Cables (AECs) solutions specialized for data centers. AEC products experienced triple-digit sequential growth in the third quarter of fiscal 2025, driven by their increasing adoption in the data center market. The demand for AECs is increasing as ZeroFlap AECs offer more than 100 times improved reliability than laser-based optical solutions. This made AECs an increasingly attractive option for data center applications, contributing to the new expansion of AEC usage and further solidifying Credo Technology’s position in the market.

Credo is also focused on expanding its product portfolio to include PCIe solutions, which will address the growing demand for AI scale-out and scale-up networks. The company expects the PCIe products to considerably expand its total addressable market. This expansion into PCIe connectivity further solidifies the company's competitive positioning in the high-performance computing and AI markets.

CRDO’s PCIe and Ethernet retimers saw strong customer interest, especially for scale-out networks in AI servers. This growing demand underscores the increasing importance of high-performance solutions in the rapidly expanding AI server market. PCIe retimer demand is expected to exceed $1 billion by 2027, positioning Credo for significant future revenue growth.

Momentum in the optical business, particularly Optical Digital Signal Processors (DSPs), bodes well. It recently unveiled the innovative Lark Optical DSP family, engineered to transform 800G optical transceivers. The Lark portfolio has two distinct optical DSP products. The Lark 800 is a high-performance, low-power DSP optimized for fully retimed 800G transceivers, designed to meet the stringent power and cooling requirements of hyperscale AI data centers. The Lark 850 is an ultra-low-power 800G Linear Receive Optics DSP, consuming under 10W, making it an ideal solution for AI-driven data environments where power efficiency is exceptional.

For the third quarter of fiscal 2025, CRDO reported 154% year-over-year growth in revenues, driven by its largest hyperscale customer, which significantly scaled the production of AI platforms, reflecting the growing demand for AI-powered connectivity solutions. For the fourth quarter of fiscal 2025, CRDO expects revenues between $155 million and $165 million. The Zacks Consensus Estimate for fiscal fourth-quarter revenues is pegged at $160 million, suggesting growth of 163.2% from the year-ago quarter’s reported figure.

While CRDO is a small and upcoming player, Marvell is a giant in the data center space. Marvell Technology is well-positioned to gain from the fast-growing data center market, offering solutions like pulse amplitude modulation (PAM) chips, digital signal processors and silicon photonics that are vital for AI infrastructure.

Custom AI silicon and electro-optics products are driving the top-line expansion for MRVL. In the last reported quarter, data center end market revenues of $1.37 billion surged 78% year over year and 24% sequentially. The segment accounted for 75% of the quarter’s total revenues, representing its largest end market.

Revenues from Electro-Optics products and Teralynx Ethernet switches grew double-digits sequentially on a percentage basis. Within Electro-Optics, heavy demand for 800-gig PAM products and 400ZR DCI products remains the main catalyst.

Marvell’s advanced optical interconnects (like the 1.6T PAM DSP) are aiding the data centers move faster while consuming less energy, a crucial advantage as AI infrastructure scales. Marvell’s Co-Packaged Optics (CPO) technology and development of the industry's first 2nm silicon IP for cloud and AI workloads boost its position in next-generation networking solutions’ space. In the last earnings call, management noted that CPOs can boost the size and scale of AI servers. Now these rely on passive copper interconnects, but the transition to optical interconnects will expand interconnect revenue and market opportunities for the company.

Management expects revenues from its custom XPU (accelerated computing) solutions to continue expanding in fiscal 2027 and beyond. MRVL expects the cloud and AI portion of the data center end market to witness sequential double-digit revenue growth for the first quarter of fiscal 2026. It ended last fiscal year with AI revenues exceeding $1.5 billion and now expects to “very significantly” exceed its $2.5 billion goal in fiscal 2026.

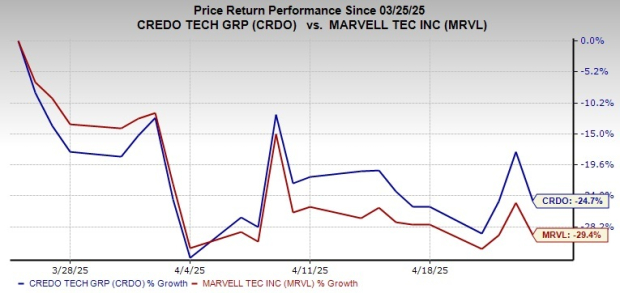

Over the past month, CRDO and MRVL have registered heavy declines of 24.7% and 29.4%, respectively, amid the escalating trade tensions and tariff troubles, particularly with China. The tech sector as a whole was hit hard by these developments. However, yesterday, CRDO jumped 9.4% and MRVL was up 6.2% as President Trump hinted at a probable de-escalation with China regarding tariffs.

In terms of the forward 12-month Price/sales ratio, CRDO is trading at 10.30X, higher than MRVL’s 5.39X.

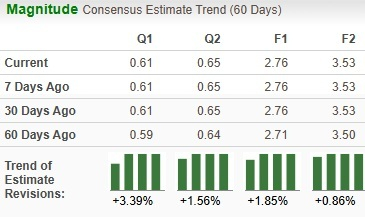

Analysts have significantly revised their earnings estimates upwards for CRDO’s bottom line.

Meanwhile, for MRVL, there is a relatively subdued estimate revision.

Both CRDO and MRVL are well-positioned to gain from the rapidly growing data center market. CRDO at present flaunts a Zacks Rank #1 (Strong Buy) while Marvell carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Consequently, in terms of Zacks Rank, CRDO seems to be a better pick at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite