|

|

|

|

|||||

|

|

Wall Street has maintained its northward journey after an impressive bull run of the past two and a half years. The technology sector, driven by the astonishing adoption of generative artificial intelligence (AI) across the world, was the primary driver of this rally. The sector suffered some hurdles in the first half of 2025 but regained strong momentum in the past two months.

We have selected three technology bigwigs that witnessed solid earnings estimate revisions in the last 60 days. This indicates that market participants are expecting these companies to do good business in the near future.

Moreover, each of our picks currently sports a Zacks Rank #1 (Strong Buy), reflecting strong price upside potential in the near future. You can see the complete list of today’s Zacks #1 Rank stocks here.

These stocks are: Dell Technologies Inc. DELL, Jabil Inc. JBL and Credo Technology Group Holding Ltd. CRDO.

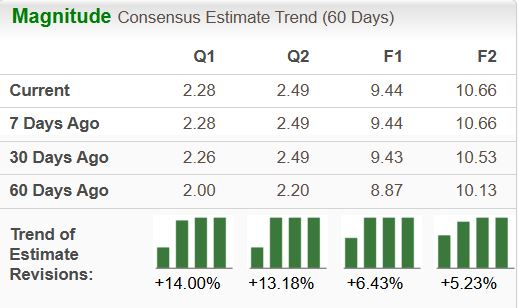

Dell Technologies has been benefiting from strong demand for AI servers driven by ongoing digital transformation and heightened interest in generative AI applications. In the last reported quarter, DELL secured $12.1 billion in AI server orders, surpassing shipments and building a strong backlog.

DELL’s PowerEdge XE9680L AI-optimized server is in high demand. Strong enterprise demand for AI-optimized servers is aiding the company. A robust partner base, which includes the likes of NVIDIA, Google and Microsoft has been a major growth driver.

DELL is expanding its cloud services through its infrastructure solutions and rich partner base that provides essential hardware and services that support cloud environments. Through its APEX platform, DELL provides multi-cloud solutions and advanced AI infrastructure, which have become key highlights of its offerings.

Dell Technologies has an expected revenue and earnings growth rate of 8.7% and 16%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

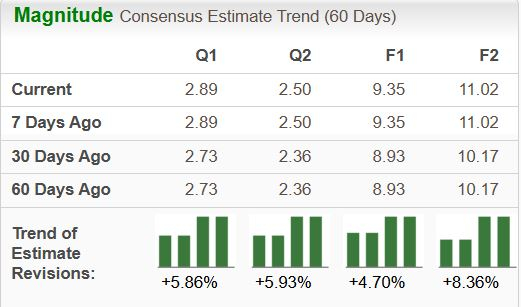

Jabil has been benefiting immensely from healthy momentum in capital equipment, AI-powered data center infrastructure, cloud, and digital commerce business verticals. Its focus on end-market and product diversification is a key catalyst. Jabil’s target that “no product or product family should be greater than 5% operating income or cash flows in any fiscal year” is commendable.

JBL’s high free cash flow indicates efficient financial management practices, optimum utilization of assets, and improved operational efficiency. Massive application of generative AI is set to drastically increase the efficiency of JBL’s automated optical inspection machines for the automation industry. A large-scale portfolio of business sectors offers JBL a high degree of resiliency during times of macroeconomic and geopolitical disruption.

Jabil has an expected revenue and earnings growth rate of 5.8% and 17.8%, respectively, for next year (ending August 2026). The Zacks Consensus Estimate for next-year earnings has improved 8.4% over the last 30 days.

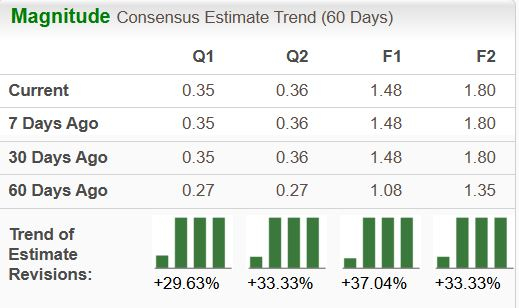

Credo Technology is a provider of high-performance serial connectivity solutions for the hyperscale datacenter, 5G carrier, enterprise networking, artificial intelligence and high-performance computing markets.

CRDO’s main business is its Active Electrical Cables (AEC) product line. AEC is gaining traction owing to its increasing adoption in the data center market. The demand for AECs is increasing as ZeroFlap AECs offer more than 100 times improved reliability than laser-based optical solutions.

This made AECs an increasingly attractive option for data center applications. With the demonstration of PCIe Gen6 AECs and increasing hyperscaler interest, this product line is expected to remain a growth engine.

Strength in the optical business, particularly Optical Digital Signal Processors (DSPs), is another key catalyst. CRDO expects an expansion of customer diversity across lane rates, port speeds and applications to accelerate revenue growth going forward.

CRDO announced that it achieved a key 800-gig transceiver DSP design win and unveiled ultra-low-power 100-gig per lane optical DSPs built on 5-nanometer technology. CRDO expects its 3-nanometer 200-gig-per-lane optical DSP to boost the industry’s transition to 200-gig lane speeds.

Supplementing these businesses is CRDO’s PCIe retimers and Ethernet retimers business. This particular product line continues to witness customer interest, especially for scale-out networks in AI servers. CRDO highlighted that the retimer business delivered “robust” performance driven by 50 gig and 100 gig per lane Ethernet solutions.

This growing demand underscores the increasing importance of high-performance solutions in the rapidly expanding AI server market. Shift to 100 gig per lane solutions and higher demand for system-level expertise and software capabilities for dealing with AI-optimized architectures bode well for CRDO’s retimer business.

Credo Technology has an expected revenue and earnings growth rate of 85.8% and more than 100%, respectively, for the current year (ending April 2026). The Zacks Consensus Estimate for current-year earnings has improved 37% in the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

A Memory-Chip Shortage Is Squeezing Consumer Techand Its Set to Get Worse

DELL -9.13%

The Wall Street Journal

|

| Feb-12 | |

| Feb-12 |

Cisco Memory Chip Warning Sends Down Dell, HPE, Arista, NetApp Shares

DELL -9.13%

Investor's Business Daily

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Cisco Profit Margin Outlook Sends Down Dell, HPE, Arista, NetApp Shares

DELL -9.13%

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite